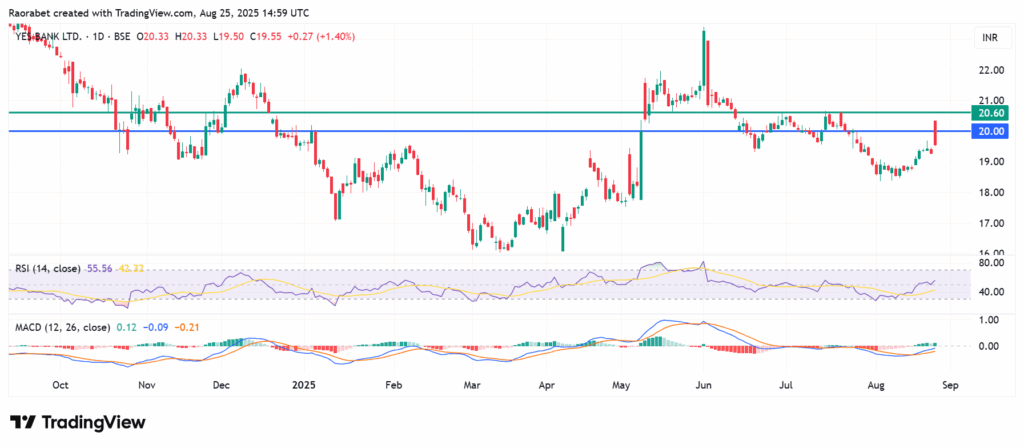

Yes Bank share price rose significantly on Monday, climbing as much as 5.44% to an intraday high of ₹20.33 and closing at ₹19.55, a 1.42% gain from the previous close of ₹19. 55. Investors are weighing the bank’s ongoing comeback story, and this price action reflects a broader sense of cautious optimism. There are also mixed indications coming from the current state of the economy and the technical indicators.

Yes Bank Fundamentals Largely Healthy

Investors have been paying a lot of attention to Yes Bank’s performance since it started a restoration plan- and it has made a lot of progress on its path to recovery. For the trailing twelve months, the bank’s Earnings Per Share (EPS) was ₹0.80, which means that the Price to Earnings (P/E) ratio was about 30.31.

Yes Bank (BSE: YESBANK) reported growth in post-tax profit up for the seventh quarter in a row in the April-June quarter. This was due to cost controls, higher other revenue, and steady asset quality. Overall, the bank’s finances demonstrate that it is slowly getting back on track after facing difficulties in the past.

Yes Bank has primarily been able to keep profit growing due to better cost management. The quality of the assets seems good because there are fewer provisions and steady metrics. However, revenue growth for the quarter was only 4.81% year over year, and Net Interest Margin (NIM) is still low, which makes it hard to grow quickly.

The Reserve Bank of India (RBI)’s move to approve 25% stake acquisition by Sumitomo Mitsui Banking Corporation (SMBC) to is likely to improve Yes Bank’s capital and strategic capabilities. Also, that could help speed up deposit mobilization and loan growth in FY26.

The continual increase in Yes Bank’s asset quality is a key part of its fundamental story. Recovery, improvement, and transfer to asset reconstruction firms have all contributed to the bank’s concerted effort to lower its non-performing assets (NPAs). This coordinated effort has resulted in a better loan book and has been a major element in restoring investor trust.

The Influence of the Macroeconomic Environment

In general, the performance of the Indian banking sector would also affect Yes Bank share price. This is because the health of the Indian economy is closely related to the health of the banking sector. The banking industry is getting a big boost from India’s strong Gross Domestic Product (GDP) growth predictions for this fiscal year.

When the economy is flourishing, both businesses and consumers usually want more credit. This gives banks more opportunities to grow their loan books. Investors are keeping a close eye on two important factors: inflationary pressures and the RBI’s response to them through monetary policy. A higher interest rate environment can help banks’ net interest margins (NIMs), but it can also slow down credit growth and make it more likely for people to default on their loans.

Therefore, the RBI’s future decisions about interest rates will have a strong bearing on the banks’ capacity to generate income. The role of regulatory oversight is still substantial. In order to guarantee the stability of the financial system, the RBI has established severe regulations concerning capital adequacy, provisioning, and corporate governance. For Yes Bank to keep growing, it will need to keep following these regulations and be able to handle any new policy changes that come up.

Technicals Call for Caution

When looking at the Yes Bank share price from a technical point of view, it is a mix of good and bad signals. The momentum indicators show that consolidation could soon set in after a prolonged period of gains.

The Relative Strength Index (RSI) reading on the daily chart is 55, which is generally bullish to neutral. It also shows that there may be a balance between buying and selling forces building up, and it doesn’t mean that the market is overbought or oversold. The Moving Average Convergence Divergence (MACD) indicator, which helps is also exhibiting symptoms of decreasing momentum. This means that the recent rise might not be as strong.

A look at the moving averages tells a more complicated scenario. The stock has had trouble staying above ₹20 in the past few weeks, and its recent rejection at that level might be seen as a warning of short-term weakness. Conversely, a break above ₹20.60 could strengthen the upside and build a stronger upward traction.

In Conclusion

In summary, Yes Bank share price action is the result of a lot of different things working together. The bank’s improved fundamentals and the positive outlook for the Indian banking sector as a whole are providing support. However, technical indicators are sending inconsistent signals, so investors need to tread carefully. The stock’s future will likely depend on how well the bank can stick to its turnaround plan and how the rest of the market interprets the changing economic data.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.