- XRP price prediction ahead of Fed meeting, Ripple trades near $2. Will XRP rally or crash? Key levels, market risks and targets explained

XRP is stuck in a tight consolidation zone once again, hovering near the 2 dollar level as traders brace for one of the most market-moving events of the month, the December 9–10 Federal Reserve meeting. The altcoin dipped to 2 dollars earlier today before bouncing back toward 2.07 dollars, but momentum remains muted as investor activity continues to shrink across the XRP Ledger. With uncertainty rising and liquidity staying thin, markets are now asking the same question: is XRP preparing for a breakout or a deeper correction?

XRP Market Overview: Sentiment Turns Nervous Ahead of Fed Decision

XRP price is holding near 2.07 dollars despite broader market volatility, suggesting demand remains intact but fragile. The latest network data shows a sharp drop in on-chain participation, active XRP Ledger addresses fell to just 35,931, marking their lowest level in over three months.

This contraction signals that investors are becoming cautious, particularly as the Fed’s decision approaches. The market has already priced in the possibility of a policy shift, and the tone of the announcement could set the pace for crypto volatility into year-end.

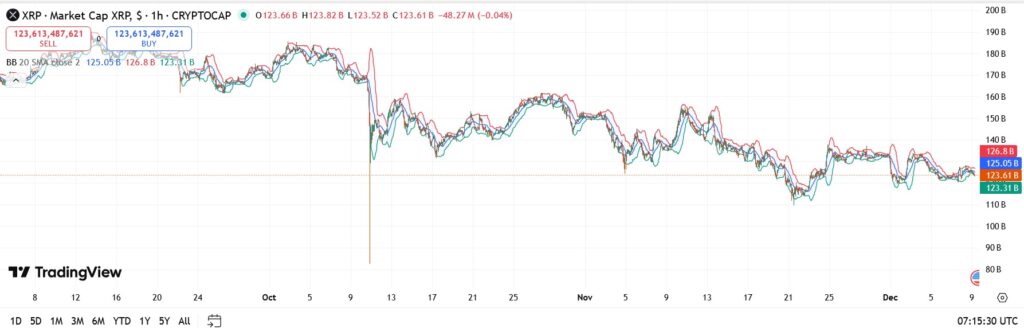

XRP’s market cap continues to drift sideways, reflecting stalled momentum and indecisive traders. The altcoin remains closely correlated with Bitcoin’s behaviour, which has also battled thin liquidity conditions over the past week.

XRP Technical Analysis Today

XRP is trading near 123.6 billion dollars in market cap terms with a clear downtrend since early October, followed by a flattening pattern throughout late November and early December.

Key levels to watch:

- Support: 2.00 dollars remains the line in the sand. A breakdown exposes 1.80 dollars and possibly 1.70 dollars.

- Resistance: The immediate ceiling sits at 2.20 dollars. A close above that level would open a path toward 2.40 dollars.

- Momentum: Traders are waiting for volume confirmation, and without it, the rangebound structure is likely to persist.

XRP Outlook Bullish Case

If the Fed signals a softer outlook or hints at easing financial conditions, XRP could finally break out of its narrow range. ETF-driven institutional demand has quietly improved liquidity, and a dovish tone could accelerate a push toward:

- 2.20 dollars,

- and then 2.40 dollars if momentum strengthens.

XRP Outlook Bearish Case

A more hawkish Fed may tighten conditions, pressuring risk assets.

If XRP loses the 2.00 dollar zone, traders will likely target:

- 1.80 dollars,

- and 1.70 dollars as the deeper support area.

XRP price prediction based on current levels

Considering the broader economy, fresh ETF demand, and how XRP is behaving technically, the near-term XRP price prediction still leans bullish as long as the price holds above $2, even if volatility persists. A dovish Fed today could ignite a stronger push toward $2.20 and beyond, while a hawkish tone may delay any breakout.

From my perspective, XRP remains well-positioned as long as buyers continue to defend the $2 zone, and I believe any dips into $1.80–$1.90 may still attract opportunistic accumulation rather than trigger a deeper breakdown. In general, the medium-term XRP forecast stays constructive thanks to ongoing ETF momentum and improving liquidity.