XRP is turning heads again. After months of legal noise and lukewarm price action, the token is back in the spotlight as odds of a U.S.-listed XRP ETF approval hit 92%. Layer that with fresh whale accumulation and strategic corporate reserves, and the setup looks anything but ordinary. XRP’s market cap is now hovering near $137 billion, and traders are watching for what could be the coin’s next defining moment.

XRP ETF Approval Odds Hit 92%, Here’s Why That Matters

Momentum has shifted. For the first time, odds of a spot XRP exchange-traded fund being approved by U.S. regulators have reached the low 90s, a huge leap from just weeks ago.

Nasdaq-Listed Firms Quietly Building XRP Reserves

Two notable companies are making aggressive moves. Webus International, a Nasdaq-listed mobility and booking platform, is planning to allocate $300 million into XRP reserves. VivoPower, another listed firm, is positioning $121 million into similar XRP-backed programs for cross-border operational use.

This isn’t theoretical adoption. It’s real capital, flowing into real positions driven by long-term utility rather than hype. It’s also a sign that XRP may finally be shedding its speculative image in favor of enterprise integration.

Whale Activity Suggests the Smart Money Is Moving In

Recent blockchain data shows wallets holding between one and ten million XRP have added more than two billion tokens over the past 60 days.

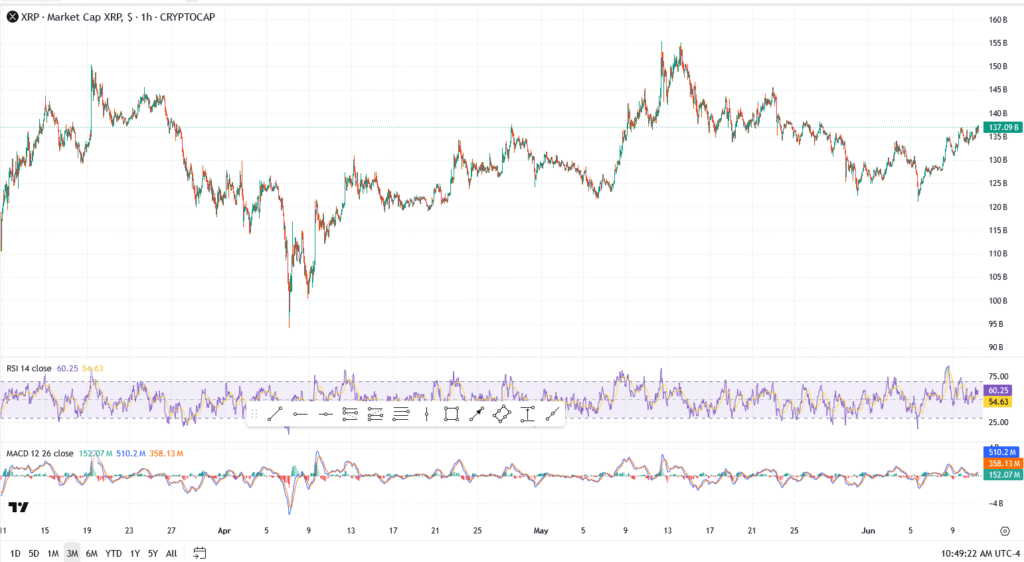

XRP Market Cap Analysis

- Current market cap: $137.09 billion

- Resistance zone: $140 billion, previously rejected in late April

- Support levels: $130 billion, followed by $125 billion

- RSI: 60.25 – trending bullish, but not overheated

- MACD: Holding a mild upward bias, suggesting continuation potential

Is XRP a Buy Right Now?

That depends on what kind of trader you are. For long-term holders, the case for XRP has strengthened dramatically. With ETF odds rising, corporate demand surfacing, and large wallets quietly building positions, the token is entering new territory.

But like all crypto stories, execution matters. ETF approval isn’t guaranteed. Reserve programs must deliver real-world impact. And if whale accumulation turns into distribution, momentum could vanish just as quickly.

For now, though, XRP has the attention of both institutions and the market, and in crypto, that’s often where breakout stories begin.