- Stocks switch back to risk-on mode, pushing Asian markets to new highs and helping EU and US stocks to opening gains.

Global tone: risk-on rebound after late-January volatility

Stock markets are trading higher today as traders shift back to risk-on positioning. This positioning is also manifesting in the precious metals and commodity markets, where volatility is starting to cool after January’s wild ride.

Against this backdrop, equity markets turn to macro data and earnings. In terms of macro data, markets are warming up ahead of key US employment data, which could set the tone for Fed rate expectations in the first quarter.

1) Asia: Japan and South Korea surge to records on tech/AI leadership

Asian stocks set the tone for today’s risk-on positioning as the Nikkei 225 index and South Korea’s KOSPI hit new records. Demand for tech/AI stocks continues to drive the upside push. The Japanese benchmark nicked a record lose as investors poured into notable tech names. The KOSPI surged 7% to a new record, as Samsung and SK Hypix led other chipmaker and AI-related stocks on the gainers’ chart.

2) Europe: STOXX 600 hits a record as miners + defence lead

Shares in European markets surged to new highs, driven by defence and industrials, as well as mining stocks. The recent metals slump seen at the tail end of last week has reversed, as gold and other precious metals get some lift-off from key support levels. This bounce has also supported mining stocks today.

Furthermore, reports of a large-scale military investment plan by Germany buoyed defence stocks, as expectations of higher defence spending continue to drive the sector’s recent uptick. Also boosting sentiment in the European equities market is the passage of the 2026 budget by the French parliament, after a no-confidence vote was defeated, fending off political uncertainty in that country.

3) U.S.: futures higher, AI/tech earnings in focus

US markets are also higher as investors rotate back into tech stocks ahead of key earnings reports. Palantir shares surged after its latest earnings report smashed expectations. Its guidance also impressed investors, helping to push a renewed drive into tech stocks. A major item to watch for the day is Advanced Micro Devices (AMD) shares, as the company’s earnings report is due after the close. This earnings report could shape investors’ views on US-listed AI stocks.

Correlated Markets

Other markets seeing some action include metals and oil markets, which have implications for mining and oil company stocks. Gold staged a 6% recovery, while silver surged by double digits, as the metals market recovered from Friday’s selloff. Gold and silver, which had seen sharp surges in recent weeks, were brought back to earth after US President Trump nominated Kevin Warsh as the next Fed chair to replace Jerome Powell, who has a few months left on his tenure. Many brokers adjusted margin requirements on gold and silver, which discouraged further long positioning in the asset and led to the steep selloff that closed out January.

Brent crude also fell as US President Trump hinted at potential de-escalation with Iran. This position eased geopolitical tensions and scaled back oil demand, leading to attendant selling of oil stocks.

Chart of the Day

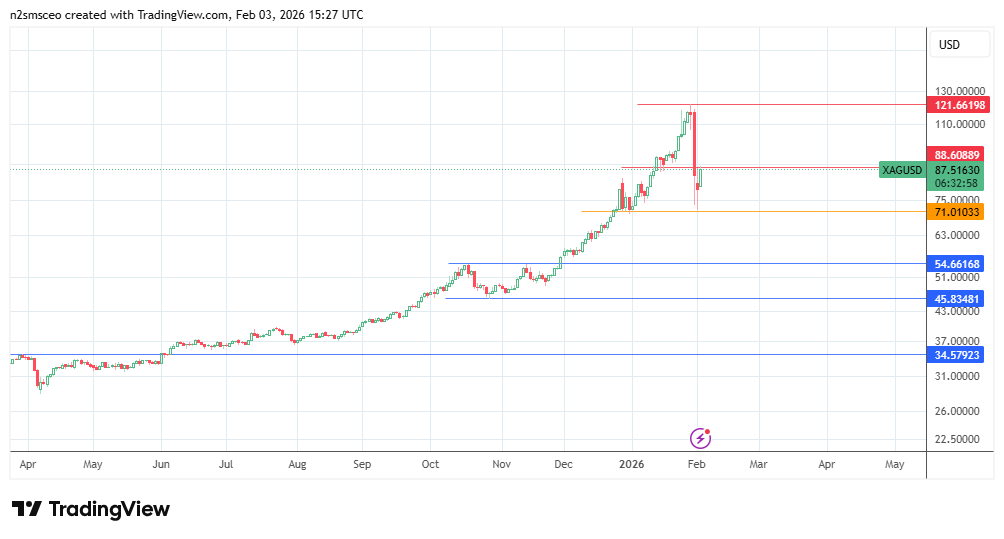

The 10.66% rise in silver has brought the XAG/USD asset to the 88.60 resistance level. If this key barrier is breached, the bulls will have clear skies to retest the all-time high of 21 January at 121.67.

However, a rejection at 88.60 could make for a retest of the 2 February low at 71.00. If this pivot collapses under bearish pressure, a further correction towards the 54.66 support could be in the works. The mid-December 2025 lows at 61.36 could be a pitstop in this scenario.