- Vodafone idea stock is on an upbeat momentum above key moving averages amidst improved sentiment around its 5G rollout.

Since mid-October 2025, Vodafone Idea stock has been steadily rising, going from about ₹8.50 to over ₹10.50 in just a few weeks. That’s a rise of more than 20%. On October 27, it shot up by 13% in one day after some huge news came out. That’s exciting news, especially for a company that has been struggling with debt and competition for years.

Vodafone Idea AGR Case and Price Surge

The Supreme Court gave the government the go-ahead to take another look at Vodafone Idea’s huge Adjusted Gross Revenue (AGR) dues again. Since 2019, the corporation has had to deal with around ₹70,000 crore in debts. This decision could lead to cuts, maybe even by half. If that happens, it could free up money for important 5G investments and network upgrades. This apparent easing of regulations has been the main driver for Vodafone Idea stock and suggests a lower risk profile.

On top of that, there are rumors of better subscriber retention, since losses have been getting narrower in recent months. In addition, there is anticipation of tariff hikes across the board that could bring in more money. Vodafone Idea’s drive into homegrown 4G and 5G technology is also making investors more hopeful. The resulting sentiment and momentum has helped it get its market valuation back above ₹1 trillion.

Beware of the Risks

Even if things have been going really well lately, let’s not get too excited. The company’s debt is still quite high, at more than ₹2.1 lakh crore, and its debt-to-EBITDA ratio is roughly 9.6x. If funding delays persist, this could make it hard for the company to run its business.

Meanwhile, subscriber loss continues, with 2 million less in Q2, and severe competition could limit the increase of Average Revenue Per User (ARPU). Subscription churn and flat ARPU are ongoing consequences of the industry’s sluggish 5G network growth in comparison to Jio and Airtel.

Vodafone Idea Share Price Chart

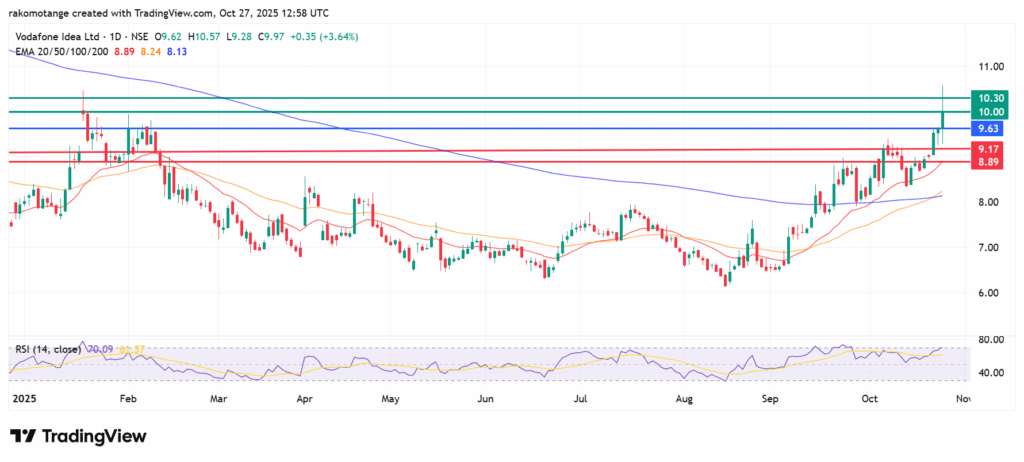

After the surge on October 27 broke through the 200-day Exponential Moving Average (EMA) at ₹8.13, indicating significant upward momentum. With that, Vodafone Idea stock price suggests a bullish breakout. Key support is at the ₹9.63 pivot and the sellers could take charge if action tests the 20-day EMA of ₹8.89 . On the other hand, there are resistances at psychological ₹10.00 and ₹10.30. The RSI is at 70, which means there is strength to buy, but it is also within an overbought territory, which brings risk of profit taking.

Vodafone Idea daily stock price chart 10/27/2025. Source: TradingView

Vodafone Idea stock is rising due to a favourable ruling by India’s Supreme Court on AGR dues. That could potentially ease ₹70,000 crore liabilities and has boosted investor hopes.

The main risks facing the company include high debt of about ₹2.1 lakh crore, subscriber losses, and competition, all of which add downward pressure.

A return above the 200-EMA above ₹8.13 and RSI at 70 signals bullishness. Its first support at ₹9.631, initial resistance likely at ₹10.00.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.