- XRP surges on a $500M Ripple funding round, Bitcoin steadies above $100K amid global jitters, and Cardano eyes a rebound from oversold levels.

In a week marked by shifting regulation, macro pressure, and fresh institutional headlines, the top three cryptocurrencies, XRP, Bitcoin, and Cardano, are setting the tone for the broader digital-asset market.

XRP’s blockbuster funding round and Mastercard partnership pushed it to the top of investor watchlists, Bitcoin steadied above the $100,000 level after heavy liquidations, and Cardano tested key support as traders eyed an oversold rebound. Together, these three assets reflect the market’s attempt to reset after weeks of volatility and policy uncertainty.

XRP Price Today: Ripple’s $500 Million Raise Reignites Institutional Optimism

XRP started Thursday on a stronger footing after Ripple announced a $500 million strategic investment round that values the company at $40 billion. The raise, led by Fortress Investment Group and Citadel Securities, reinforces the perception that institutional capital is returning to crypto infrastructure plays.

Ripple also confirmed a settlement pilot with Mastercard, using its RLUSD stablecoin in collaboration with WebBank and Gemini. The initiative will test faster, compliant settlement for card transactions via the XRP Ledger (XRPL). For context, this is not theoretical adoption, it positions XRP directly within operational payment pipelines where settlement times and auditability are critical.

The announcement followed a 22 percent monthly slide for XRP, meaning the coin entered the news cycle from oversold conditions. The twin catalysts, funding and a real-world use case, gave traders reason to reprice its short-term outlook.

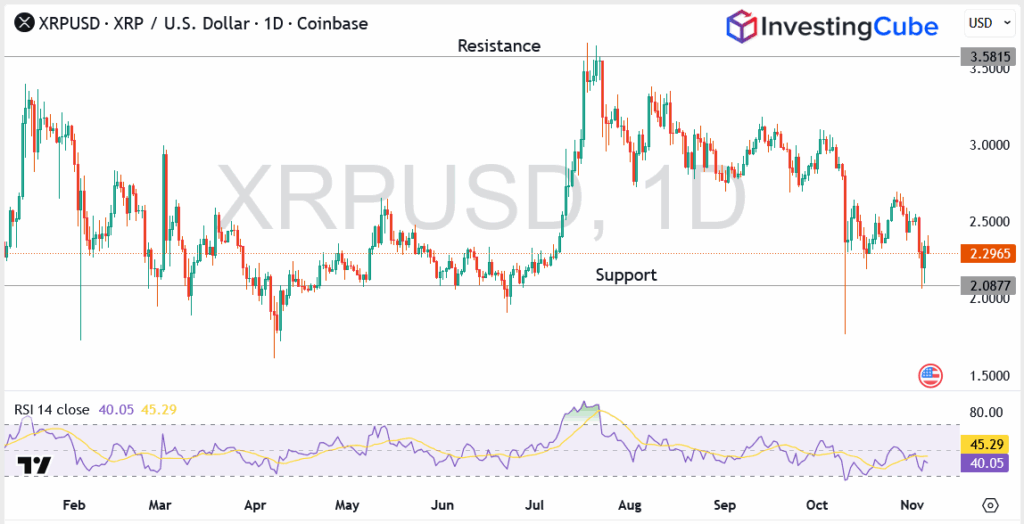

XRP Technical Analysis

XRP trades near $2.30, up roughly 3 percent in 24 hours. Intraday moves briefly tested $2.38, with support now seen at $2.08 and resistance at $2.40 – $2.44, aligning with the 38.2 percent Fibonacci retracement of the September-October range.

The RSI (14) sits near 40, showing room for recovery, while the structure remains constructive above $2.10. A close above $2.44 would signal renewed upside momentum toward $2.80.

Bitcoin Price Today: Recovers to $104 K But Market Still Cautious

Bitcoin (BTC) climbed back above $104 000 in Thursday’s pre-market session after briefly dipping under $100 000 earlier this week. The move followed heavy liquidations that flushed excess leverage from the system, clearing room for a potential rebound.

Sentiment remains fragile, weighed by concerns over global growth and a cautious stance from the Federal Reserve. Still, the President’s recent “America First in Crypto” comments and stronger-than-expected retail inflows into U.S. spot ETFs have steadied nerves among traders.

World Economic Forum President Børge Brende also warned of potential “valuation bubbles” in both AI and crypto, remarks that briefly spooked markets mid-week. Yet historical patterns suggest that such corrections often create accumulation zones for long-term investors.

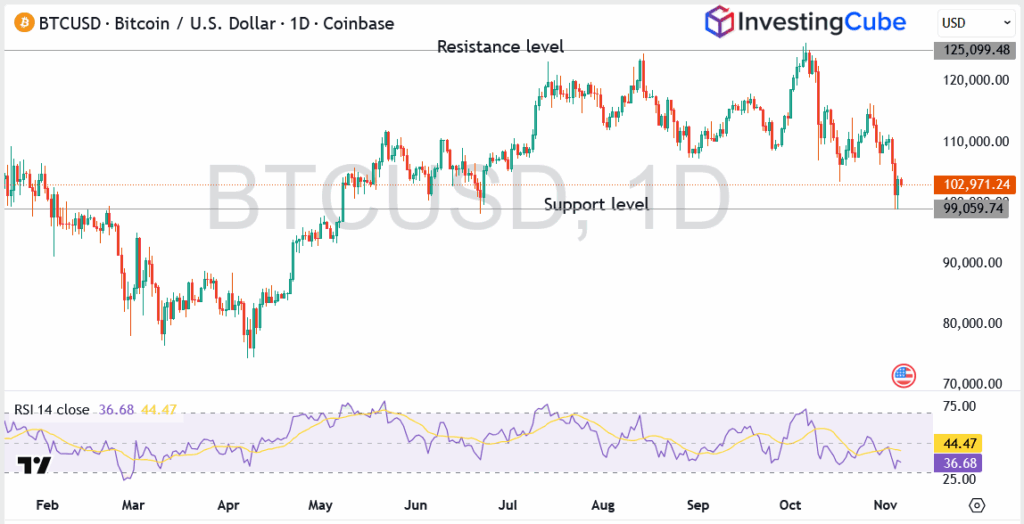

Bitcoin Technical Analysis

BTC/USD shows early signs of base-building near $100 000 – $99 000, a key horizontal support area that coincides with the June pivot. Resistance stands near $110 000 – $112 000. The RSI (14) at 44 indicates neutral momentum, while the ADX around 35 signals a maturing downtrend.

A confirmed daily close above $106 000 would strengthen the recovery narrative. Failure to hold $99 000 could expose $95 000.

Cardano Price Today: ADA Eyes Rebound From Oversold Levels

Cardano (ADA) is trading near $0.53, down 9 percent on the week after testing multi-month support at $0.52 – $0.51. The token’s recent underperformance has been largely technical rather than fundamental, with traders rotating into more liquid majors following last week’s volatility.

Developers continue to expand Cardano’s Hydra scaling framework and Mithril node upgrade, both aimed at improving throughput and reducing sync times, key prerequisites for network adoption. While on-chain activity remains moderate, long-term metrics such as wallet growth and staking participation have stayed resilient.

The setup now resembles prior periods of exhaustion that preceded medium-term recoveries. Market watchers are treating this region as a potential accumulation zone if broader sentiment stabilizes.

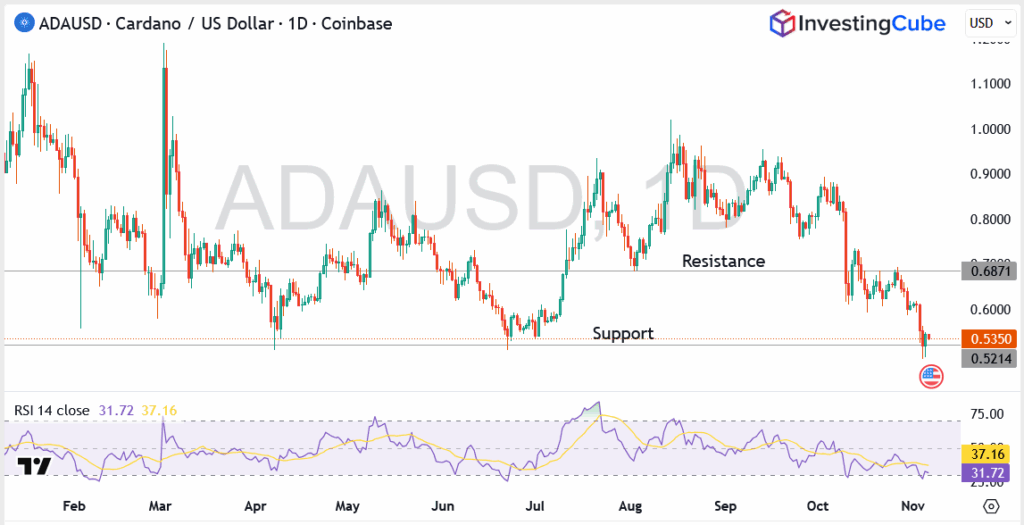

Cardano Technical Analysis

ADA/USD faces resistance at $0.68 – $0.70 and support at $0.52 – $0.50. The RSI (14) near 31 shows oversold conditions, while the ADX at 33 hints at trend weakening. A rebound above $0.60 would validate early bullish divergence. Failure to defend $0.50 could open the door to $0.45 before buyers return.

Crypto Market Outlook: Institutional Flows and Policy Shape the Next Move

After weeks of headline risk, the crypto market appears to be stabilizing. The XRP-Mastercard pilot underscores a practical use case in traditional payments, while Bitcoin’s recovery from the $100 k area shows that long-term buyers remain active.

Cardano’s positioning near multi-month lows adds a tactical setup for short-term traders watching RSI extremes. Together, these moves suggest that volatility may begin to normalize as macro pressure eases and liquidity rotates back into large-cap tokens.

The narrative is shifting from speculation to integration, from trading to actual use. If that theme continues, the second half of November could see more defined leadership across assets with clear utility, institutional support, or regulatory visibility.

Final Take

The crypto market’s pullback this week feels less like a collapse and more like a deep breath before the next move. From where I stand, XRP’s real-world progress, Bitcoin’s resilience, and Cardano’s oversold exhaustion suggest a market that’s resetting, not retreating.

The emotion is shifting from fear back to curiosity, investors are no longer asking “Is this over?” but “What’s next?” That shift in tone, quiet as it seems, often marks the start of a new phase in every cycle.