Bitcoin, Ethereum and XRP inched higher in early Asian and London trading on Monday, extending last week’s fragile rebound as traders brace for a crucial Federal Reserve rate decision and fresh US jobs data.

Bitcoin is hovering around 91,700 dollars, up about 1.5 percent on the day, Ethereum is holding above 3,120 dollars, and XRP trades near 2.09 dollars, all recovering modestly from their late-November lows.

The broader tone remains cautious. Liquidity is thin, funding markets are tight, and risk appetite is still healing from October’s leverage wipeout, but traders are beginning to position for a potential policy shift later this week.

Bitcoin Price Today: BTC Edges Back Above $91,000 as Traders Reset for Fed Week

Bitcoin has climbed steadily from the 85,000 dollar floor it tested earlier this month, supported by a calmer derivatives market and renewed expectations that the Fed could deliver a rate cut before year-end.

A sharp drop in early November wiped out nearly 18 percent of BTC’s value for the month, plus tens of billions in leveraged positions, leaving market makers cautious across Asia and Europe. That hangover is still visible in today’s trading range.

Nic Puckrin, co-founder of Coin Bureau, summed up sentiment in a note:

We’re not out of the woods yet, but December may be shaping up to be a far better month than its predecessor, and a Santa rally is certainly not off the cards.”

Noted Nic Puckrin, co-founder of Coin Bureau.

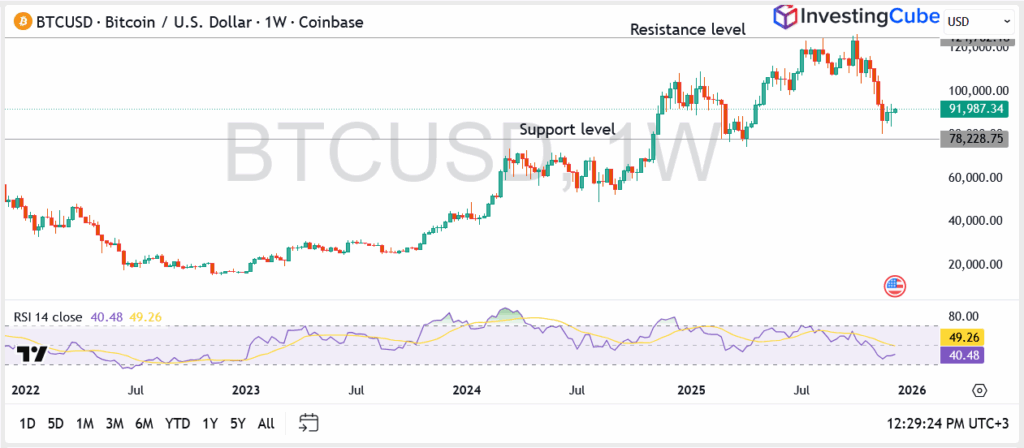

Bitcoin Chart Analysis

BTC/USD is trading near 91,700 dollars, trying to stabilise above the lower boundary of its recent weekly range. Immediate support sits near 90,000 dollars, which has acted as a short-term floor after last week’s drop.

On the upside, the first resistance zone appears around 94,000–95,000 dollars, where price previously stalled. A clean break above 98,000 dollars would confirm stronger recovery momentum ahead of Wednesday’s Fed decision, potentially opening the door for a move back toward the psychological 100,000 zone.

In my view, Bitcoin is behaving like a market waiting for permission. If the Fed signals confidence in the disinflation trend, BTC could finally break out of its tight range.

Ethereum Price Today: ETH Outperforms Majors but Still Faces Resistance

Ethereum is showing relatively stronger momentum, up more than 2 percent on the day near 3,130 dollars. The asset has now risen over 10 percent in the past week, narrowing the gap created by October’s downturn.

ETH sentiment was supported last week as developers completed the Fusaka hard fork, introducing upgrades aimed at improving scalability and validator performance. That technical progress has helped cushion volatility ahead of the Fed meeting.

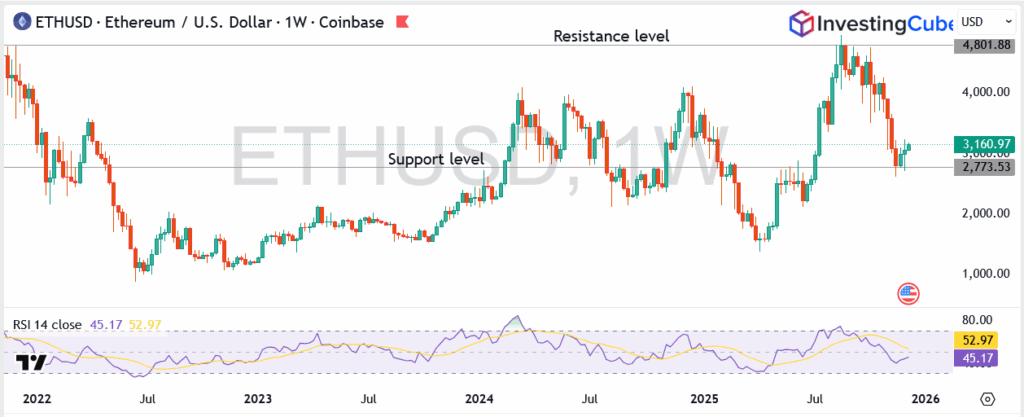

Ethereum (ETH) Weekly Chart Analysis

Ethereum is showing a steadier structure than BTC, trading around 3,160, after reclaiming its major 2,770 support zone. The weekly RSI near 53 suggests improving momentum, hinting that buyers are cautiously returning after November’s broad market pullback.

Upside resistance is clustered near 4,800, where ETH was rejected multiple times in 2025. If bulls maintain control above 3,000, ETH could target a move toward 3,500–3,800 in the short term. A breakdown below 2,770 would invalidate the recovery and expose ETH to lower supports.

XRP Price Today: XRP Climbs Above 2 Dollars as Traders Rotate Back Into Majors

XRP is up 2.14 percent today at 2.09 dollars, benefiting from the broader market’s stabilisation and lighter weekend liquidity. The token continues to hold firm above 2 dollars, an area that previously acted as a pivot during market pullbacks.

While flows into XRP remain modest compared to earlier this quarter, the asset is tracking Bitcoin’s recovery and showing signs of steady accumulation.

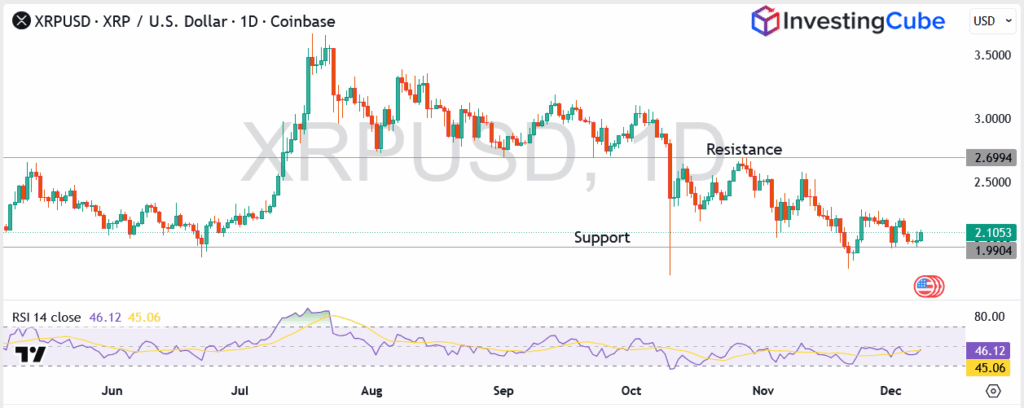

XRP (XRP/USD) Chart Analysis Today

XRP trading around 2.10 dollars, hovering just above the 1.99 dollar support level that has repeatedly kept the downside in check. For now, the structure stays neutral, with the first resistance zone near 2.70 dollars, which capped every rebound attempt through November.

A daily close above that area would signal improving momentum and open the way towards the 3.00 dollar psychological barrier. Losing the 1.99 dollar floor, however, could expose a deeper dip as liquidity remains thin across altcoins this week.

What Crypto Traders Should Watch This Week

The next 72 hours are macro-heavy and could dictate the path for all three top crypto assets.

Key catalysts:

- Final Federal Reserve rate decision of the year

- US non-farm payrolls and jobless-claims data

- Market liquidity conditions as year-end approaches

- Ongoing rotation between gold, silver and Bitcoin as macro hedges

A decisive rate signal from the Fed could finally kick crypto out of its narrow consolidation and determine whether December becomes a recovery month or another sideways grind.

Top Crypto Prediction: Bitcoin, Ethereum and XRP Outlook

The Top Crypto Prediction for Bitcoin, Ethereum and XRP remains cautiously optimistic as markets head into a data-heavy week. Bitcoin is attempting to hold above the 91,000 zone, Ethereum is stabilising near 3,100, and XRP is gaining modestly from its recent lows.

If macro conditions improve and liquidity returns, all three could extend their rebound into mid-December. But if support levels fail, the market may slip back into a defensive phase, keeping traders focused on the Fed decision, US jobs data and volatility signals before committing to fresh positions.

Bitcoin is climbing as traders position ahead of the Fed rate decision and jobs data, with improving liquidity and steadier sentiment lifting BTC above $92,000.

BTC is pushing toward the key resistance band, but a breakout will likely depend on ETF inflows and whether the Fed signals a clear path toward rate cuts.

Ethereum is outperforming majors due to strong network activity, while XRP is stabilising near support, with both expected to follow Bitcoin’s direction around major macro events.