- Top crypto predictions for Bitcoin, ETH and XRP as prices approach major breakout levels during Christmas week and year-end trading thins.

The cryptocurrency market is attempting to stabilise as we start the Christmas week after a sharp correction, top 3 crypto price prediction Bitcoin, Ethereum and XRP all hovering near technically important zones. Price action over the coming sessions will be critical in determining whether the recent pullback marks a pause within a broader bull cycle or the start of a deeper consolidation phase.

Market sentiment has cooled alongside falling momentum indicators, but higher-timeframe structures remain intact for now, placing increased focus on support holds and daily closes rather than intraday volatility.

Bitcoin Price Analysis: Long-Term Support Holds as Momentum Softens

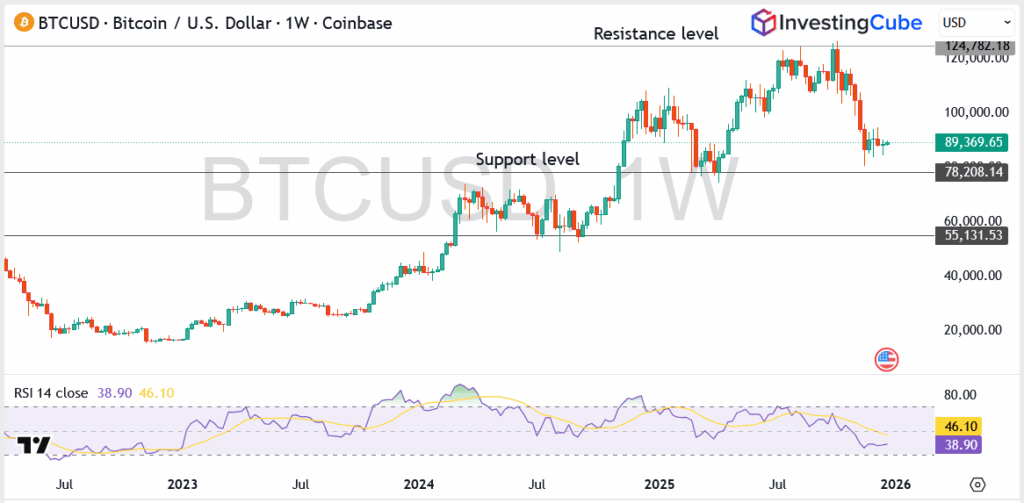

Bitcoin is currently trading near $89,000, having retraced sharply from its October peak close to $125,000. On the weekly chart, BTC remains above the $78,200–$80,000 support band, a zone that aligns with prior breakout structure and historical consolidation from early 2024.

The RSI on the weekly timeframe sits below 40, reflecting a clear cooling in momentum but not yet a breakdown into sustained bearish territory. Historically, similar RSI resets during prior cycles have preceded extended range-building phases rather than immediate trend reversals.

A sustained hold above $78,000 keeps the broader bullish structure intact, while a weekly close back above $95,000 would be the first signal that buyers are regaining control. Failure to defend this support region would expose BTC to a deeper retracement toward $65,000–$70,000, where longer-term demand previously emerged.

Ethereum Price Outlook: Range Formation Signals Indecision

Ethereum is consolidating around $3,000, trapped between firm support near $2,770 and overhead resistance at $3,360. Unlike Bitcoin, ETH has yet to show a decisive recovery attempt, reflecting weaker relative strength versus BTC.

The daily RSI remains below 50, signalling neutral-to-bearish momentum, while price action suggests ETH is transitioning into a range-bound environment rather than an impulsive move. A daily close above $3,360 would reopen the path toward $3,800–$4,000, while a loss of $2,770 risks a deeper pullback toward the $2,400–$2,500 zone.

Ethereum’s structure suggests patience rather than urgency, with directional clarity likely to follow broader market confirmation.

XRP Price Analysis: Support Under Pressure as Downtrend Persists

XRP continues to underperform, trading near $1.92 after failing to reclaim resistance around $2.70. The token remains locked in a broader downtrend, with lower highs intact and RSI readings stuck below neutral.

The $1.90–$2.00 support area is now critical. A daily close below this level would likely trigger further downside toward $1.60, while any meaningful recovery requires a reclaim of $2.13 followed by a break above $2.70 to alter the prevailing structure.

Until then, XRP remains technically vulnerable compared to BTC and ETH.

What Traders Should Watch Next in the Crypto Market

As markets move through Christmas week and into the final trading days of the year, price behaviour around these support and resistance levels is likely to set the tone for early-January positioning. Thin liquidity can exaggerate moves, but sustained closes rather than intraday spikes will matter most as traders assess whether this pullback is consolidation or a deeper reset.

Institutional positioning via spot ETFs continues to provide longer-term support for Bitcoin, even as momentum indicators reset. According to commentary from Standard Chartered and Bernstein, long-term adoption trends remain intact despite near-term volatility.

Historically, Bitcoin has tended to perform better around the Christmas period than many traders expect. Over the past 11 years, Bitcoin has posted gains in 8 pre-Christmas weeks (December 19–25) and rallied 6 times in the days immediately after Christmas. This pattern makes Bitcoin’s holiday behaviour slightly different from the wider crypto market, which has historically shown stronger momentum in the post-Christmas period rather than before it.

Christmas often leads to lighter trading volumes in Western financial markets as institutions and traders step back for the holidays. However, global markets do not slow uniformly.

In regions such as Asia, where Christmas is not widely observed, trading activity often continues as normal and can even pick up. This imbalance in participation can create unusual price movements and short-term opportunities for traders monitoring global markets.

Cryptocurrency markets often see lower liquidity on Christmas Day as Western traders step away, which can amplify price swings. Historically, crypto has shown a slight bullish bias around Christmas, but moves are inconsistent and driven more by thin trading conditions than seasonal guarantees.