Suzlon Energy (NSE: SUZLON) stock used to be a favorite in India’s renewable energy boom, but now it’s been falling hard in recent months. The stock is trading at ₹54.20 as of this writing, which is more than 33% down from its peak of ₹86.04 in September 2024.

Its downtrend started in June 2025, and it has been losing money for the last four months, leaving investors with scars. This streak is currently fueled by people taking profits after a great run-up and concerns about India’s midcap market as a whole.

What is Pressuring Suzlon Stock Price?

In the three months leading up to mid-2025, Suzlon stock price rose by almost 20%. This was due to strong results in Q4 FY25 and multiple new orders in the wind turbine generator segment. But, as is typically the case during bull runs, excitement turned into exhaustion.

By September, the stock had lost 4% on the monthly chart and was down by about 15% year-to-date. Global headwinds, such falling commodity prices and delays in getting permissions for renewable projects, made things worse. Furthermore, profit-taking pressure added to the drop.

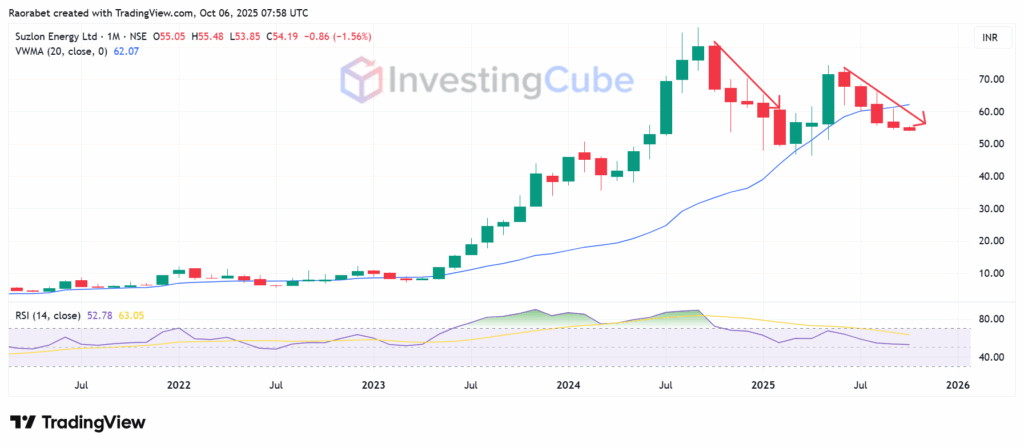

Suzlon Stock price is on a four-month losing streak, the worst run since Oct 2024-Feb 2025. It is below the Volume Weighted Moving Average (VWMA). Source: TradingView

Can Suzlon Stock Bounce Back?

For those who are willing to wait, the scales on Suzlon stock price edge toward opportunity. It’s important to tell the difference between a trend that is caused by temporary variables and one that is caused by structural weakness. Suzlon’s decline seems to be caused in part by too much selling pressure, concerns about interest rates, and a general volatility in the renewable and power industries. Most of these factors are not company-specific.

Notably, the company has recently reported a number of substantial order wins, which could balance things out. Midway through 2025, it reached 4 GW, the highest level in years, thanks to new investments from top clients like NTPC.

Most importantly, debt, which has been a problem in the past, has been brought under control. As of June 2025, Suzlon Energy had borrowed only ₹3.21 billion, which gave it a debt-to-equity ratio of only 0.05. This is a substantial decline from the ₹12,000 crore debt mountain of the past, which freed up capital for research and development and growth. The return on equity (ROE) is 41%, which shows that the company is using its capital wisely.

At the same time, major financial institutions and mutual funds came through for Suzlon by buying a 1.45% stake in the company through a block offer worth ₹1,309 crore at an average price of ₹66.05 per share. Interest from institutions like these can help ease concerns about liquidity, add credibility, and boost investor confidence.

Additionally, Suzlon has benefited from India’s push for more renewable energy, supportive government policies, and the growing need for cleaner energy. These tailwinds could give the company an opportunity to flourish in a big way.

What Are the Risks?

Amidst the great promise it holds, significant risks lie ahead for Suzlon stock. If there are four months of losses, it could bring technical problems or make retail and institutional investors less likely to reinvest.

Delays in the execution of mega-projects could hurt revenues, while competition from big Chinese companies like Goldwind puts pressure on margins. Regulatory issues, including the Gujarat Electricity Regulatory Commission’s rejection of Suzlon’s request for better connectivity, make things harder.

Additionally, there are cost constraints on turbine components such as steel, electronics, and rare-earth magnets. Margins could get smaller if Suzlon is unable to fully pass on costs.

In Conclusion

In summary, Suzlon’s four-month drop is a caution, but it doesn’t mean the losses are irreversible. The broader story is in its order book, ability to fill out orders, and ability to ride India’s renewable energy wave.

Based on the information discussed above, Suzlon stock seems more like a moderate-risk, high-upside investment than a low-risk company. A smart investor would wait for indicators of a reversal, such as volume confirmation, better margins, and new orders, before making a big investment.

Suzlon’s recent losses are attributed to market volatility, profit booking, and sector-wide weakness. However, its fundamentals remain strong with new renewable energy orders supporting long-term growth potential.

Suzlon’s debt-free balance sheet, 41% ROE, and competitive wind energy technology position it for India’s ambitious renewables goal.

Yes. The stock remains a moderate-risk buy, backed by strong order inflows, institutional interest, and India’s renewable expansion, despite recent weakness.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.