Suzlon Energy stock price has been oscillating in tight range for the past month, mostly between ₹55 and ₹60. After a period of intense volatility, which included a steep decline from its 52-week peak, the market has entered a consolidation phase. The most important thing for investors and market observers right now is not if this range will be broken, but when and in what direction.

The answer consists in a mix of the company’s internal fundamentals, developments in the industry as a whole, and technical signals from the market. We need to look into each of these factors to figure out which way the next big shift is likely to go.

Technical and Fundamental Factors Affirm Range-Bound Trading

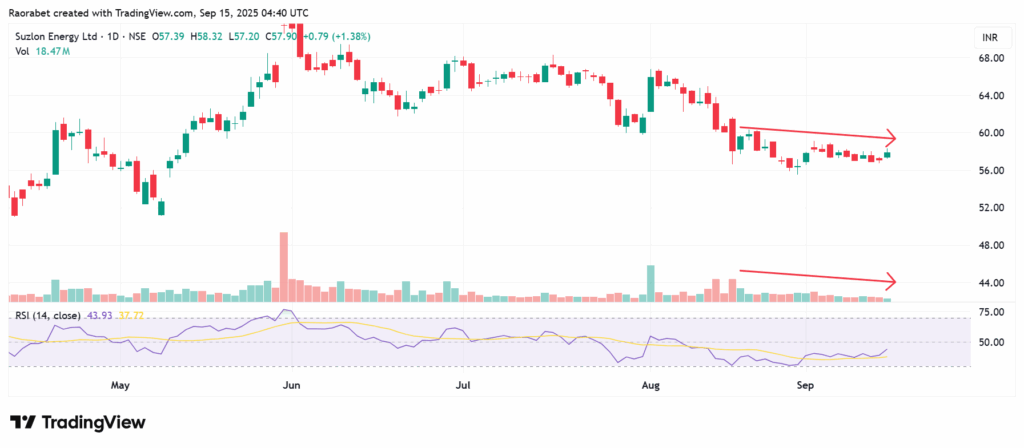

To break out of a tight range, you need both technical momentum and fundamental drivers to come together. On medium-term charts, Suzlon Energy stock price is stuck in a descend trend channel. In addition, a break below key simple moving averages (SMAs) signals short-term bearishness.

That said, Relative Strength Index (RSI) is below 30 on daily timeframes, which means it is oversold and could be a sign of exhaustion selling. On the other hand, the Moving Average Convergence Divergence (MACD) displays bearish crossovers, which adds supports to a “strong sell” outlook.

Why Is Suzlon Stock Stuck In Range?

A solid fundamental catalyst is the first and most important thing that needs to happen for any breakout, especially towards the upside. An industry leader in wind power in India, Suzlon Energy (NSE: SUZLON) has just undergone a remarkable time of transformation. The company has successfully paid off its debts and is currently in a net cash position after years of financial trouble. This, along with a strong order book, has been the main reason behind its stock price surge over the past few years.

What Will It Take To Break Out?

Suzlon must showcase ongoing operational and financial resilience to break out of the current range. A significant set of quarterly results that surpasses market expectations would be one such crucial catalyst. This would need to be not only a great top line number, but also solid profit margins, which would make the company’s finances even stronger. Investors and traders will closely track its ability to turn its record order book of 5.6 GW into revenue and profit.

Meanwhile, trade volume has been low, hovering below 50-day norms, which makes it hard to make big moves. For a breakout to be triggered, trading volume needs to go up by at least 50% to 100% over recent averages, and it should be on positive price action to confirm the reliability of such a breakout. The psychological floor of the range is 55 rupees, and support stays there. Currently, Suzlon Energy stock price resistance level is at ₹60–62, which is close to the 50-day SMA.

Suzlon Energy stock price has been trading downwards with a significant drop in trading volume as seen on the daily chart. Source: TradingView

The macroeconomic and sectoral climate will be quite important, in addition to news about specific companies. The sector as a whole benefits greatly from the ambitious renewable energy targets set by the Indian government. Companies like Suzlon have a clear and long-term demand for their services because of the country’s push to reach 500 GW of non-fossil fuel capacity by 2030, with a large part of that coming from wind energy.

But the market has probably already taken some of this prospective increase into account. There have to be new, good policy announcements or a clear speeding up of project implementation for a breakout to materialize.

September has multiple catalysts in the works. Suzlon’s aggressive outreach to investors, which includes meetings with J.P. Morgan, ICICI Securities, and Motilal Oswal, could bring attention to order inflows and FY26 guidance, which could shift the current market sentiment about the company. In addition, the 30th AGM on September 25 could feature dividend proposals or updates on expansion.

In Conclusion

Finally, Suzlon Energy stock price will need a mix of favorable government policies, a rise in institutional buying, and ongoing solid financial performance to achieve a lasting upward breakout. The current consolidation period shows how well bulls and bears are balanced. There are still some short-term risks of going down because of overvaluation and weak trends.

However, the renewable tailwind and clean balance sheet suggest that patient investors will likely see their holdings grow in value. This wind giant has the potential to ride the green momentum gusts to new heights, so keep an eye out for conviction trades as September progresses.

Suzlon stock price is range-bound due to low trading volume, bearish technicals, and investor indecision, despite strong fundamentals and renewable energy tailwinds.

High trading volume, positive AGM updates, new orders, or government renewable incentives could help Suzlon to break out of the 55-60 rupee range, potentially sparking upward momentum.

Because the company has proven that its turnaround strategy works and the government is making it easier for renewable energy to grow, an upward breakout is more likely. But if the market is too volatile, it could break towards the downside.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.