Shiba Inu is leaning lower on Thursday, with price flirting around $0.00001275 after another slow bleed into support. Traders appear to be backing off meme coins this week as momentum fades and with Bitcoin holding just above $105K, there’s not much risk appetite spilling into altcoins.

SHIB’s attempts to reclaim ground above $0.00001391 have failed multiple times since mid-May. Today’s move isn’t dramatic, but the tone has clearly shifted. Buyers are hesitant, and the chart is starting to show cracks around the edges.

Over 2 Trillion SHIB Tokens Moved to Coinbase: Whale Activity Adds Pressure

Adding to the tension, Whale Alert flagged a massive 2 trillion SHIB token transfer to Coinbase Institutional on June 5. The transaction, worth nearly $36.6 million, came from the wallet address 0x2E2…4AaEf, which had also moved an additional 524 billion SHIB earlier.

This type of activity rarely goes unnoticed. Large-scale exchange transfers often precede sell-side events or institutional rebalancing. While the tokens haven’t yet been offloaded, traders are watching closely, and some may already be front-running the move.

SHIB Chart Analysis: Key Levels to Watch

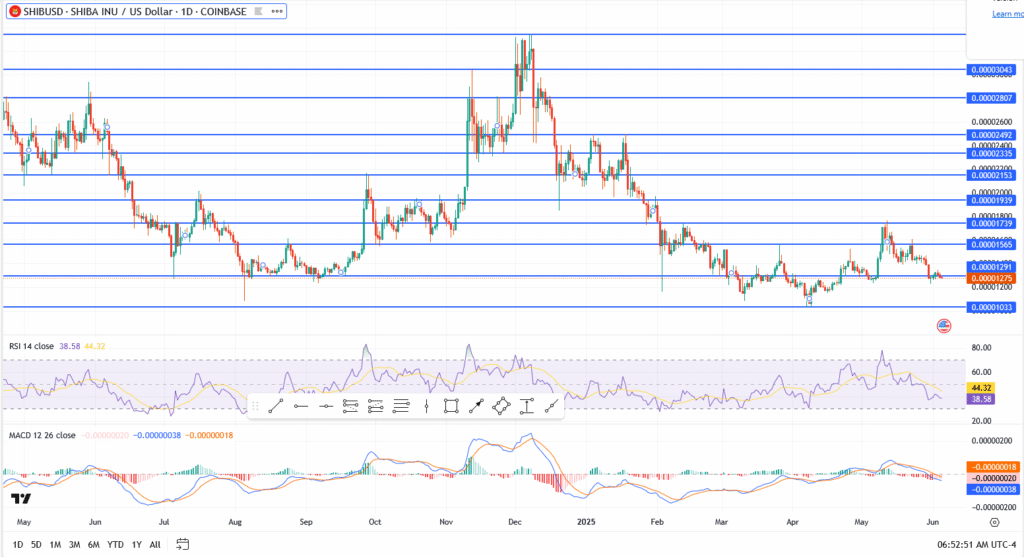

- Immediate support at $0.00001200, currently being tested

- If broken, next demand zone is $0.00001033 – the March low

- Resistance stands at $0.00001291, then $0.00001391

- RSI at 38.58 – nearing oversold, but no reversal signal yet

- MACD bearish, both signal lines trending down with flat histogram

Price structure is turning soft, with lower highs developing across the daily chart. Unless bulls defend the $0.00001200 zone with volume, SHIB risks slipping back into the lower consolidation range from Q1.

Can SHIB Rebound in June?

SHIB’s long-term trend is still holding above its early-year base, but short-term sentiment has clearly cooled. Without fresh catalysts from the Shibarium project or ecosystem burns, the token may struggle to attract new buyers.

That said, SHIB tends to move in bursts, and a flush below support could trigger a bounce, especially if meme coin sentiment returns on social media. For now, though, the bears are in control.