- Pi Coin is struggling for momentum and has been trading sideways in recent days but there are signs that the bulls could be taking over.

Pi Coin (PI), Pi Network’s native cryptocurrency, has found itself trapped in a narrow trading range in November, noticeably struggling to establish sustained momentum above the $0.250. The mobile mining app got over 35 million users, making for a big community, but it’s struggling to prove its utility in the real world, and it’s hard to trade. PI’s absence from major centralized exchanges like Binance keeps trading volumes thin make it vulnerable to whale-driven swings.

Plus, they are to unlock 120-139 million PI tokens in November, which is like adding a ton of new supply. This puts pressure on the price as early miners might want to cash out. The market isn’t helping either. Bitcoin’s price is shaky below $107k as of this writing, and that’s hurting market sentiment and altcoins like PI.

Near-Term Catalysts And Signs of a Turnaround

Looking ahead, the near-term trajectory for Pi Coin hinges on the long-awaited transition to a fully Open Network (Open Mainnet). This final phase will remove the remaining external firewall, allowing unrestricted external transfers and, crucially, enabling official listings on top-tier global exchanges such as Binance or Coinbase.

A reversal isn’t out of reach for Pi. The coin’s trajectory could pivot on upcoming milestones that bridge its accessibility with tangible value. The V23 Mainnet upgrade, planned for Q4, should increase scalability and allow smart contracts, letting developers create tokens and apps. This could spark organic demand, especially alongside the PI DEX rollout, which would decentralize trading and boost liquidity without relying on external listings.

A wildcard is the November 22 ISO 20022 integration, aligning Pi with global banking standards for cross-border payments. If it happens, PI could become a popular currency for cross-border payments, similar to XRP.

Pi Coin Technical Analysis

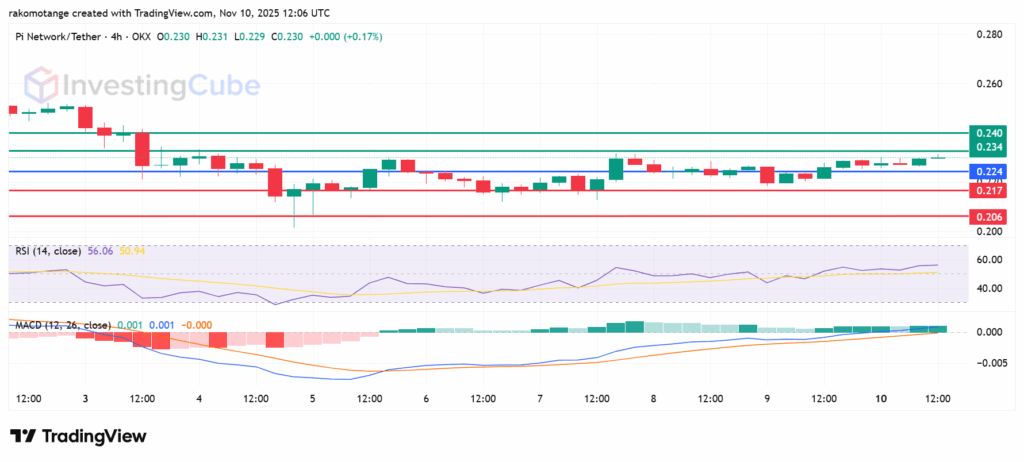

Pi coin’s 4-hour chart reflects its current upbeat outlook. Indicators suggest caution but also show signs of strength. The RSI sits at 56.06, which is bullish-leaning and on the rising trajectory. Therefore, we are likely to see a rebound if buying volume spikes. MACD shows at 0.001, adds weight to this outlook, and divergence from price lows suggests weakening downside momentum. Support holds at $0.217-$0.206. A breach here could eye psychological $0.200. Resistance will likely be in the $0.234-$0.240 range, but Pi coin price needs to stay above the $0.224 pivot to test these levels.

PIUSDT Exchange on November 10, 2025. Source: TradingView

Pi Coin is operating within an “Enclosed Mainnet” phase. This is like a firewall that severely restricts external transfers and connectivity, thus starving the token of the liquidity needed to absorb selling pressure. Also, delayed listing by major exchanges like Binance is a limiting factor.

The V23 upgrade and PI DEX will enable developers to build useful services directly on Pi. That will turn a mining reward into a currency people actually spend.

The single most potent catalyst would be the transition to a fully Open Network (Open Mainnet). This would enable unrestricted external transfers and allow for official listings of Pi Coin on major, top-tier cryptocurrency exchanges.