The Nifty 50 clawed back early losses to close at ₹23,742.90 on Monday, up 98 points, after Motilal Oswal raised its FY26 earnings-per-share (EPS) forecast for Nifty companies by 10%. The revision helped offset lingering concerns over global tariffs and weak monsoon cues, with traders now eyeing stronger corporate growth ahead.

The updated outlook, pegging FY26 Nifty EPS at ₹1,359, marks a meaningful upgrade from ₹1,234 in FY25, a signal that India Inc. may remain resilient despite external volatility. The brokerage cited strong profitability across banks, autos, and capital goods, with financials expected to drive nearly 40% of the overall earnings jump.

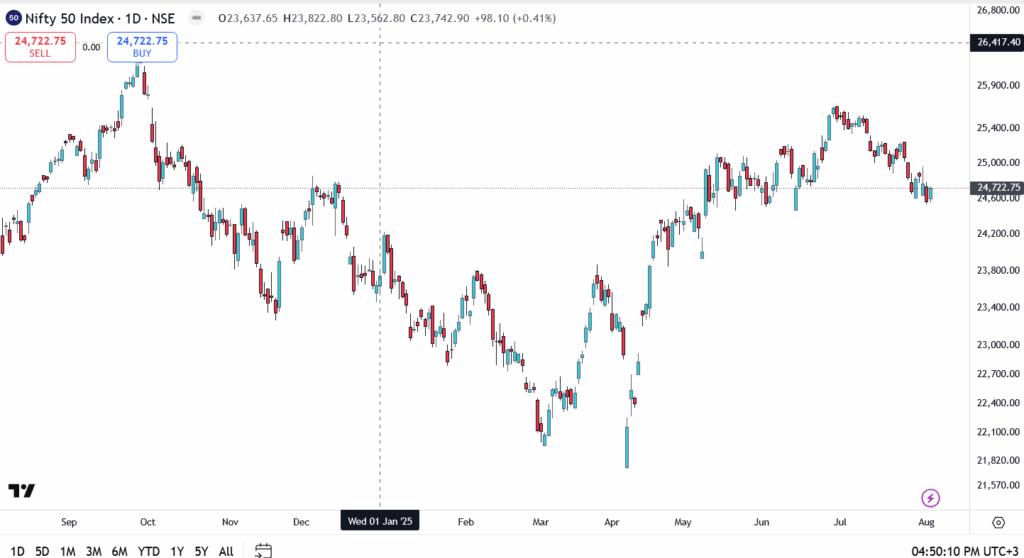

Nifty 50 Chart Analysis

- Current Price: ₹23,742.90

- Resistance: ₹24,200, then ₹24,690

- Support: ₹23,400, then ₹22,800

Today’s rebound came after Nifty briefly dipped near the lower end of its July range. A recovery in banks and index heavyweights like L&T and ICICI Bank helped flip sentiment intraday. However, the index is still stuck in a tight coil under ₹24,700, a level that has acted as a wall for over two weeks.

With earnings optimism back on the table, bulls may attempt another push higher this week. But a clean breakout will likely depend on RBI’s rate commentary and global risk flows. For now, the index remains sideways, with a bearish bias unless ₹24,200 is reclaimed on strong breadth.

Outlook

If Nifty 50 clears ₹24,200 on a closing basis, momentum could extend toward ₹24,690 and ₹25,000. But failure to hold above ₹23,700 this week may open the door to ₹23,400 retests. Keep an eye on bank stocks; they hold the key to whether this bounce sticks.