The Nifty 50 index bounced back on Wednesday, closing higher after two days of selling. But while the broader market outperformed, the benchmark index is still hitting resistance, and the 25,000 level is starting to feel like a wall.

The index finished just under 24,900, posting a mild recovery led by banking and auto stocks. Midcaps and small caps also saw renewed strength, signalling underlying optimism. But large-cap momentum remains spotty, and without leadership from heavyweight sectors like IT, the rally feels incomplete.

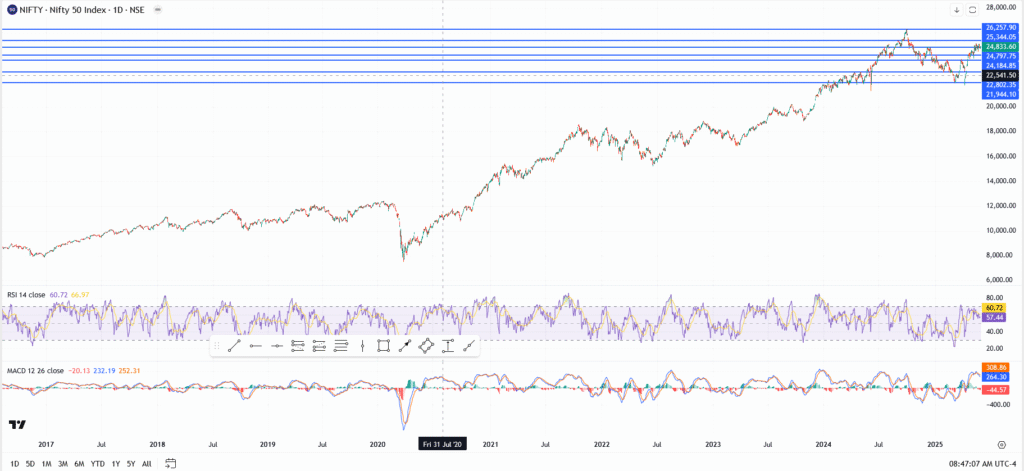

Nifty 50 Technical Outlook: Resistance Still Pressing at 25,344

Nifty is caught in a range. Bulls reclaimed short-term support at 24,797, but they’ve yet to convincingly push past 25,344, a resistance level that has held firm through multiple tests.

- Immediate resistance stands at 25,344, followed by 26,257 if broken

- Key support zones sit at 24,797, 24,384, and 24,144

- RSI is at 60.72, showing bullish control, but losing upward slope

- MACD remains positive, though the histogram has flattened, signs of cooling momentum

There’s no reversal here, but there’s no breakout either. Nifty is in a wait-and-see phase, coiling just below a major psychological level.

Nifty 50 Forecast: Bulls Need a Catalyst to Break Higher

The short-term forecast remains sideways to mildly bullish, but a breakout needs fuel. With Indian election updates on the horizon and global risk appetite shifting, the next move may depend on macro data or a surprise in earnings from index heavyweights.

If Nifty clears 25,344 with volume, expect a move toward 26,000–26,250. Until then, range-bound action between 24,400 and 25,300 looks likely.

Traders should stay nimble. The structure still favours buyers, but momentum is thinning, and a failure to break higher could invite quick profit-taking ahead of next week’s macro calendar.