MicroStrategy (NASDAQ: MSTR) is back in the spotlight. The software firm-turned-Bitcoin vault has come under renewed criticism following its aggressive crypto expansion, and the stock is reflecting that tension. MSTR is now hovering below the $405 ceiling, struggling to maintain momentum even as Bitcoin trades steady near $107,000.

Despite Bitcoin holding firm, MicroStrategy hasn’t followed through. The company isn’t just a software name anymore; it’s a Bitcoin tracker in disguise. And the stock’s recent lack of movement is drawing heat from both bulls and skeptics alike.

Pakistan’s Bitcoin Reserve Plan Gets Saylor’s Endorsement

Michael Saylor’s Bitcoin ambitions are going global, literally. As MicroStrategy stock hovers below $405, the firm’s co-founder is now advising Pakistan on a bold $5 billion national Bitcoin reserve plan, signalling a fresh chapter in global crypto adoption.

Despite Bitcoin holding firm near $107,000, MicroStrategy continues to face resistance below $405. But this week, the conversation has shifted.

Michael Saylor has offered advisory support to Pakistan’s government as it formalises a national Bitcoin reserve strategy, one that could turn the country into a serious player in digital finance. The move adds fresh visibility to MicroStrategy’s Bitcoin-first ethos, even as investors weigh the risks of its heavily leveraged crypto exposure.

MemeStrategy, Critics, and the Leverage Debate

Over the weekend, a Hong Kong startup dubbed “MemeStrategy” poked fun at MicroStrategy’s treasury model, mirroring its aggressive BTC accumulation to troll the original. While meant as satire, the clone project has fueled a very real discussion: how sustainable is MSTR’s business model when 90% of its valuation depends on one volatile asset?

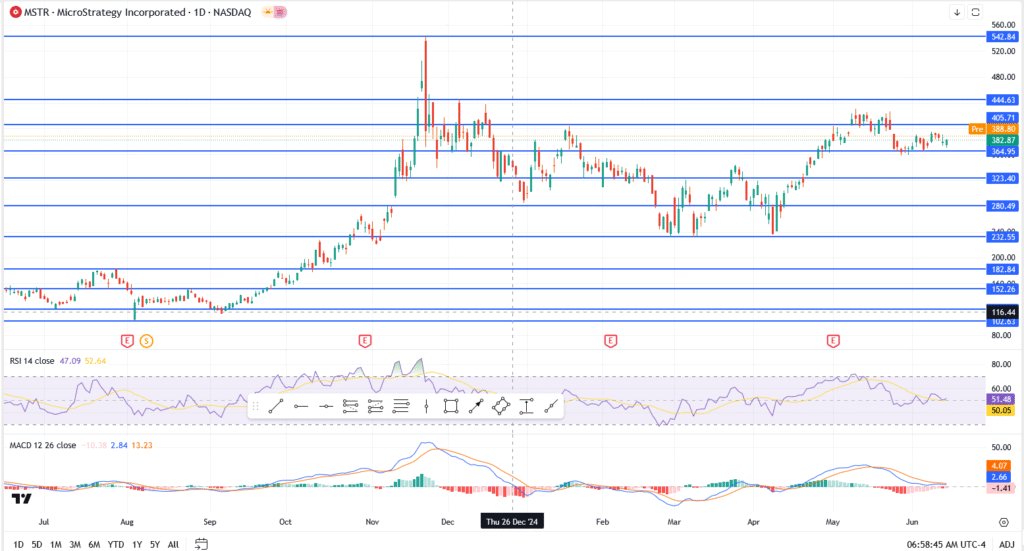

MSTR Technical Analysis: Bulls Need to Break $405

- Current price: $388.80

- Resistance: $405, then $444

- Support: $365, followed by $323

- RSI hovering around 51

- MACD fading into neutrality

The chart shows indecision. MSTR has been coiling for weeks, and with Bitcoin rangebound, the breakout traders are losing patience. A break above $405 could reignite upside toward $444, but a slip below $365 opens the door for a steeper correction.

Should Investors Choose MicroStrategy or Just Buy Bitcoin?

For investors looking to gain exposure to Bitcoin, MicroStrategy is not the smartest route. With spot Bitcoin ETFs widely available, it’s now easier to invest directly in BTC, without the need for cold wallets, private keys, or exposure to corporate debt.

MicroStrategy’s share price comes with added baggage. It doesn’t just track Bitcoin, it amplifies its volatility. As more public companies adopt BTC holdings of their own, MSTR’s first-mover edge is wearing thin. For some investors, it may be time to bypass the middleman and take a direct position in Bitcoin itself.