- The Fed cut interest rates by 25 basis points on December 10, raising hope of increased risk uptake, which favours cryptocurrencies

- Institutional appetite for XRP-powered payments has declined in recent weeks

- A rebound is still possible, especially if the Fed indicates intention to slash rates further in 2026

XRP, the digital asset associated with Ripple Labs, has recently experienced intense volatility, with its price consolidating precariously close to the significant $2 psychological support level throughout December 2025. Below, we discuss how this could play out, especially in view of the latest interest rate decision.

The Impact of the Fed’s December 10 Rate Cut

On December 10, the Federal Open Market Committee (FOMC) voted to lower its main interest rate by 0.25%, bringing it to between 3.5% and 3.75%. For cryptocurrencies, the impact has been a mixed bag. Historically, rate cuts juice risk assets by lowering borrowing costs and encouraging investment. Yet, post-announcement, XRP price slid nearly 5% to $2.06, underperforming Bitcoin’s milder dip.

For XRP, which often behaves as a liquidity-driven asset, this shift should fundamentally support a move higher in the medium term, helping to buttress the $2 support. The key, however, lies in the forward guidance provided by the Fed. If the central bank signals a clear path for future cuts, it could act as a significant tailwind for the entire crypto market, potentially overshadowing the current technical weakness in XRP price.

On-Chain Metrics Signal Weakness

XRP activity data from XRPSCAN shows that fewer XRP tokens are being burned as fees, which means there’s less activity on the network overall. Even if the burn rate doesn’t directly control the price, a big drop suggests that fewer institutions and regular people are using XRP for payments.

Will XRP Price Break Below $2?

The $2 level is more than just a number. It’s a point where the price has found support several times in the past. Now, traders and investors are wondering if XRP price will fall below it. There’s a good chance it could go down. Since falling from its highest point this year, XRP has been on a clear downward path.

When a key support level is tested repeatedly, it usually means that sellers are pushing hard and buyers are getting tired. If the price breaks through this level, it could fall quickly to a multi-month lower support level.

XRP Price Prediction

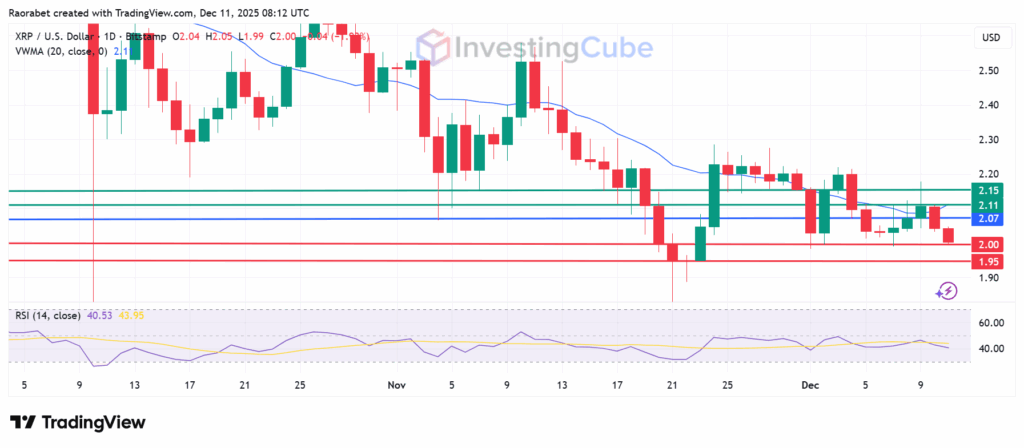

The technical outlook for XRP is marked by a clear struggle at the psychological $2 level. The Relative Strength Index (RSI) is around 40, which means there aren’t many buyers and the market is likely to continue trending downwards if resistance persists at $2.07. Key support areas are at the psychological $2.00 and $1.95.

On the other hand, if the price goes above the pivot point, it could build traction to target the Volume Weighted Moving Average (VWMA) at $2.11. A break above that level will invalidate the downside narrative and potentially serve as a springboard to test the second resistance at $2.15.

XRPUSD daily chart with key support and resistance levels on December 11, 2025. Created on TradingView

The main concern is the repeated testing of the crucial $2 psychological support level. If this level fails, technical analysts warn of a potential rapid decline towards lower price targets.

One more 2026 cut projection boosts risk appetite, potentially lifting XRP to $2.50 if inflation eases; yet, a pause could extend consolidation, balancing on-chain strength against volatility.

Strong institutional appetite, evidenced by continuous and substantial net inflows into U.S.-listed spot XRP Exchange-Traded Funds (ETFs), is providing structural support and tightening the long-term available supply.