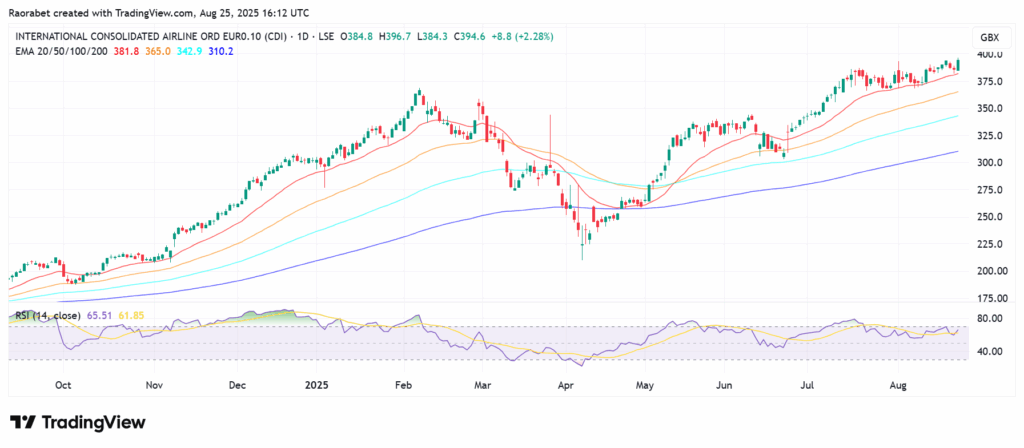

International Consolidated Airlines Group (IAG) share price rose strongly on Monday hitting a five-year high of 396p and ended the day up 2.28%. The most recent gains show that the aviation industry is recovering well. The propulsion is linked to multiple factors including rising demand for air travel, changing oil prices, and technical momentum indications that suggest the market will stay bullish. The underlying fundamentals of IAG’s share price have been very strong, even though some underlying problems persist.

IAG Share Price Position Supported by Strong Financials

IAG owns a number of airlines, including British Airways, Iberia, Vueling, and Aer Lingus. It posted sales of €33.28 billion and earnings per share (EPS) of €0.56 for the trailing twelve months, giving it a price-to-earnings (P/E) ratio of 7.05. These figures show that the stock has a relatively stronger standing compared to its competitors.

The group’s debt levels are high, with a debt-to-equity ratio of 248.48%, but they are manageable, thanks to strong return on equity of 58.30%. This shows that they are using their capital efficiently in an industry which requires a lot of efficiency. But the real reason IAG’s value is going up is because air travel trends are coming back, and they are far better than what was expected for 2025.

What Passenger Figures Tell Us

This year, global passenger traffic is expected to grow by 5.8%, measured in revenue passenger kilometers (RPKs). This is on top of a 6.5% growth in 2024. A lot of people want to travel for fun, and that’s providing strong propulsion.

For IAG, this means better connections and higher load factors, especially on transatlantic routes where demand for luxury cabins has come back strong, mainly from business travelers. The airline has made around €2 billion in profit in the last year, and that has allowed it to invest in expanding its fleet and optimizing its routes. That has allowed it to impact tourism by making air travel easier to get to new markets in Asia and Latin America.

However, the airline conglomerate still faces problems. Corporate travel, which has a high profit margin, is not likely to fully rebound to pre-pandemic levels. IAG forecasts that group-wide capacity will only expand by 3% this year. Delays in the supply chain for new planes and rising labor costs make things less optimistic, but overall, the rise in air travel has helped IAG weather the downturn in the economy. However, the positive forecast from U.S. airlines shows that the sector is still strong.

What’s Behind Current IAG Share Price Momentum

Oil price is a key element that affects IAG’s share price today since it may make up as much as 30% of an airline’s operating budget. As of this writing Brent crude oil price, which is used as a benchmark for jet fuel, was at to $68.38 a barrel. This was a 0.8% gain on the daily chart and a 16.83% drop over the preceding year.

However, crude oil faces uncertain times as weak demand from top buyers like China takes it toll, and that has given IAG a big boost. Lower oil prices lower hedging risks and make costs more stable, which could raise margins in an industry where even small changes can affect profits. For example, in early 2025, tensions between Israel and Iran prompted oil prices to fluctuate, with Brent prices rising 7% in June during airstrikes. This made investors worry about delayed Middle Eastern supply, which caused airline stocks like IAG to fall.

But as worries about the situation around the world faded and prices started to rise, the relief rally began. IAG’s results for the first quarter of 2025 already showed this. They had a pretax profit of €239 million, which was better than expected, but some of that was because of higher costs outside of the airline business and some of it was a result of ffavorable fuel dynamics.

On the other hand, if oil prices go back up because of fresh conflicts or OPEC cuts, these profits could be lost. For now, the favorable oil market makes the good air travel story even better, which is good for IAG share price because of this opposite relationship.

Along with these basic factors, a technical picture that supports upward momentum is also present. The 50-day exponential moving average (EMA) for IAG share price is at 381p, which means that the stock is strong in the short term as the price stays around 394.60p. The stock’s 126% one-year return suggests that the 200-day moving average, which measures long-term trends, is lower. This puts IAG in a bullish channel where crossings above these levels frequently lead to more gains.

In Conclusion

In summary, IAG share price movement is a reflection of how healthy the aviation industry is. This is because strong air travel trends guarantee continued demand growth, and the prevailing low oil prices will likely help keep costs down. Fundamentals like revenue growth and efficiency measures give a strong base.

In addition, technical indicators confirm the momentum, with moving averages and oscillators lining up for possible gains. Analysts’ one-year forecast target of about 435p shows that the stock could go up, but there are risks from geopolitical tensions or a slowing economy.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.