HDFC Bank share price has been doing quite well, going up 9.7% this year and 19% in the last year. As of this writing, the bank’s share price is ₹973.40, with the markets closed for the Ganesh Chaturthi holiday. Foreign Institutional Investors (FIIs) have not been very active lately, which is affecting the momentum of equities that FIIs like, such as HDFC Bank.

However, another factor contributing to the HDFC Bank share price drop was the bank’s recent 1:1 bonus share offering. With this move, every shareholder got one extra share for each share they already owned. This doubled the number of shares and automatically lowered the stock price to maintain market capitalization and shareholder value.

HDFC Financials Underscore Strong Standing

HDFC Bank (NSE:HDFCBANK) is a giant in India’s financial services sector, with a market cap of ₹13,34,148.12 crore. It has built impressive financial strength, with its recent profit margin of 25.05% and quarterly revenue increase of 63%. Its debt-to-equity ratio of 1.35, on the other hand, suggests a careful approach to borrowing that balances ambition with caution.

The HDFC share price is also helped by strong financial results. In Q4 FY25, the company’s net profit grew by 6.7% year over year, hitting ₹17,616 crore. The bank’s net interest income (NII) also went up significantly, rising by 10.3% year over year, to ₹32,070 crore. The net interest margin (NIM) was 3.54% of total assets and 3.73% of interest-yielding assets.

Recent Action Urge Caution Around HDFC Stock

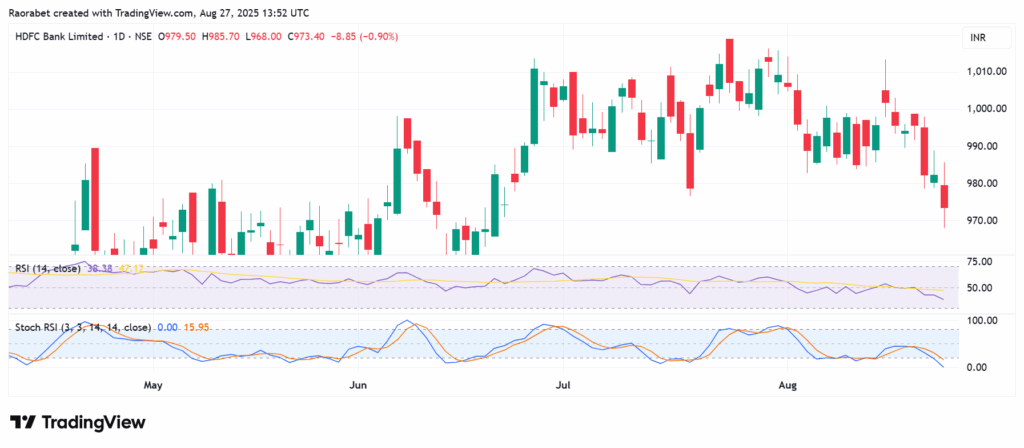

However, the recent shifts by HDFC Bank share price don’t look as good. The stock is currently below its key moving averages, which signals bearish conditions. The 20-day moving average is ₹993.49, the 50-day moving average is ₹988.56, and the 200-day moving average is ₹929.98. These numbers point to a general downtrend in both the short and long term.

The daily Relative Strength Index (RSI) for the stock is still at 38, which adds weight to the downside narrative. In addition, the Stochastic RSI, which has dropped to 0, shows a strong negative momentum, and calls for an extended downside in the near term.

Q4 Outlook Holds Much Promise

While the outlook is weak from a technical point of view, the story changes when we look at the medium-term. Analysts are optimistic about HDFC Bank share price performance in Q4 2025 because its finances are likely to improve alongside its asset quality. They anticipate there will be a big recovery, with target prices ranging from ₹2,195 by Nuvama Institutional Equities to ₹2,340 by Jefferies.

Meanwhile, CLSA has its target at ₹2,200 from and Macquarie’s is at ₹2,300. This consensus shows that the market trusts the bank to use its strengths to generate income and combat emerging macroeconomic challenges.

The technical outlook is negative in the short term, with a high sell recommendation based on moving averages. However, it turns positive over a longer time frame. With the one-month rating showing an emerging buy signal, HDFC Bank’s recent decline could be just a temporary setback. At this point, the bank’s strong fundamentals are at odds with its short-term technical weaknesses, and that could lead to a rebound in the last quarter of 2025.

In Conclusion

In conclusion, HDFC Bank’s share price performance will depend on its asset quality and how well its third quarter results turn out. Although there is a negative technical outlook for the near-term, things are looking up for the coming months. Investors should watch the bank’s financial performance and technical indicators to make educated investment decisions.

The bank’s guidance for the full-year says that the outlook for Q4 2025 is good. It projects that underlying net interest income will be around £13.5 billion for 2025, thanks to strong asset quality and mortgage and lending momentum. However, uncertainty remains in the broader macroeconomic environment, especially in the wake of escalating trade tariff standoff between India and the United States.

HDFC share price fell in August primarily due to a 1:1 bonus issue, which increased the number of shares available to trade without altering the market capitalisation.

The bank has reported a 11.3% YoY growth in net interest margin, maintained a robust deposit growth and asset quality has been stable.

The bank gave a strong guidance indicating revenue growth in the October-December quarter, and analysts expect its loan book to outpace industry average, due to wider strong deposits and larger margins

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.