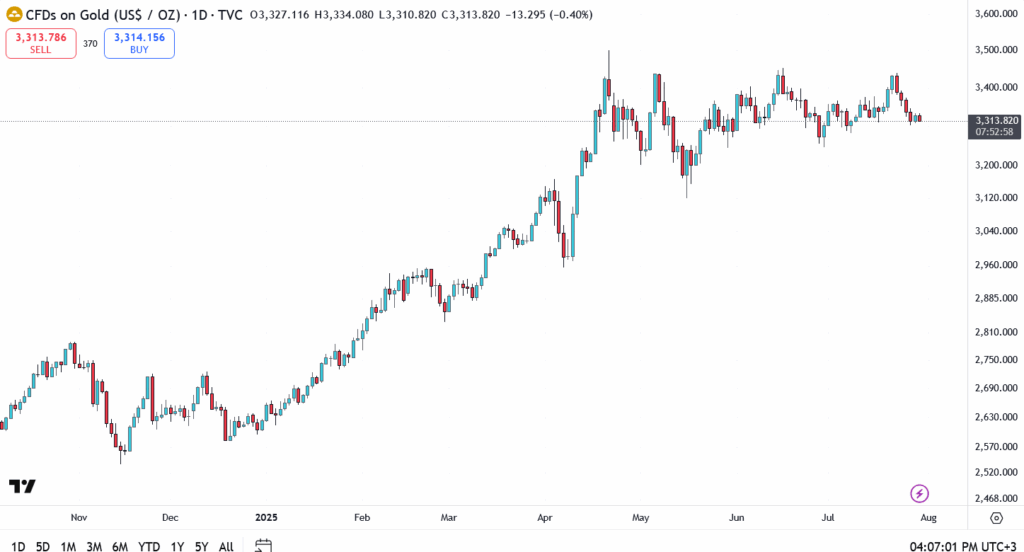

Gold prices edged lower on Wednesday, dipping to $3,313.82 per ounce as investors turned cautious ahead of this week’s Federal Reserve interest rate announcement. The yellow metal shed $13.29 on the day, breaking below a key intraday support level and raising fresh doubts over the short-term trend.

The move comes as the broader commodities complex shows signs of hesitation. With the Fed’s language under the microscope and US GDP and inflation data due in the next 48 hours, traders are bracing for potential volatility. The big question: is this latest pullback a brief pause, or the start of something deeper?

Fed Decision, Dollar Strength, and Geopolitics in Focus

Markets are widely expecting the Fed to hold rates steady, but the focus will be on forward guidance. If policymakers hint at tighter conditions ahead, it could lift the US dollar and pressure gold further. On the flip side, any dovish tilt could reopen the path back toward all-time highs.

Meanwhile, geopolitical tensions in Eastern Europe and trade uncertainty between the US and China are providing a steady undercurrent of safe-haven demand. But with real yields still positive and the bond market firming, gold’s upside momentum has stalled, at least for now.

Gold Chart Outlook

- Current price: $3,313.82

- Resistance levels: $3,345 and $3,380

- Support zones: $3,297, then $3,260

Is This a Buying Opportunity?

That depends on your time horizon. For long-term bulls, gold remains well above its March breakout point and continues to benefit from global macro uncertainty. But for short-term traders, caution is warranted.

Unless the price reclaims $3,345 in the next few sessions, momentum will likely remain with the sellers. Any bounce that stalls below that level may turn into a classic bull trap.

Final Take: All Eyes on the Fed and the $3,297 Line

What happens next in gold really depends on what the Fed says this week. If their tone leans hawkish, we could see gold drop further as the dollar gains strength. But if the central bank strikes a more cautious or dovish note, or if upcoming US data underwhelms, gold could find a fresh wave of support.

Right now, the mood is cautious. Price action near $3,297 will be crucial. A clean break below that could trigger a sharper selloff going into August. On the flip side, if gold steadies and pushes back above $3,345, bulls might regain control and set the tone for a stronger rebound.