- Ethereum price has shown in Q3 2025 how things can change quickly when fundamentals, institutional inflows, and sentiment line up.

Ethereum holders may have suffered in the first quarter of 2025, but the third quarter has been the perfect rebound story. The coin’s performance in the third quarter has revived bullish enthusiasm across the cryptocurrency market. The propulsion fuel has been primarily from rising institutional interest, accommodative regulatory developments, and a growing decentralized finance (DeFi) ecosystem.

By the beginning of August, ETHUSD had finally risen back above $4,000, a figure that seemed out of reach in Q1. From there, it kept going up, reaching previous cycle highs and trading above $3,700 for the last week

Following the recent bullish run, it has seen its year-to-date returns rise to 41%, beating Bitcoin’s 30% gain. The latest upsurge is helped along by softer U.S. inflation data and growing bets that the Federal Reserve will cut rates in September. However, while a strong macro environment helps, most of the work was done by crypto-specific factors.

This report takes a closer look at how ETH pulled off this turnaround, comparing the bruising first quarter to today’s bullish Q3, and diving into the trends driving DeFi growth, ETF demand, and staking participation.

Q1 vs. Q3: A Tale of Two Markets

In the first quarter, ETH lost 45% of its value, going from over $4,100 to lows at $1,400. Most analysts were talking more about survival than upward projections. With the market down, there was a lot of volatility, and even an element of Fear Uncertainty and Doubt (FUD) sentiment. However, Q3 has been earmarked by a strong turnaround, with Ethereum price having broken out strongly to the upside after it had spent weeks consolidating between $3,600 and $4,500. Consequently, many analysts are now confidently floating year-end targets of $5,000 to $7,000.

This is one of the biggest shifts in market sentiment seen in years. It shows how quickly stories can change in crypto when the fundamentals start to line up.

Institutional Uptake of ETH Propels Gains

The sharp rise in interest from exchange-traded funds (ETFs) was the central narrative of Ethereum’s third quarter. In the first quarter, just a little amount of money came in, with about $2.49 billion getting into Ethereum spot ETFs. Most of this money came from hedge firms who were doing basis trading. However, the closing of those trades actually added pressure to the downside.

That story had changed completely by the third quarter. In the second quarter, $14.6 billion went into Bitcoin and Ethereum ETFs, which hinted at a resurgence. But the third quarter was when the real fireworks started. In August, ETH spot ETFs brought in wave after wave of capital, with a record single-day net inflows of $1.02 billion registered on August 11.

The nine US-traded Ethereum spot ETFs have registered net positive returns in six of the first eight trading sessions in August. This isn’t just opportunistic trading; big investors are now putting Ethereum at the center of their digital asset portfolios. Consistent buying pressure has kept ETH prices high and sustained the momentum. ETFs are no longer merely a way to get extra liquidity; they are becoming a key part of the structure of ETH demand.

DeFi Gets Its Groove Back

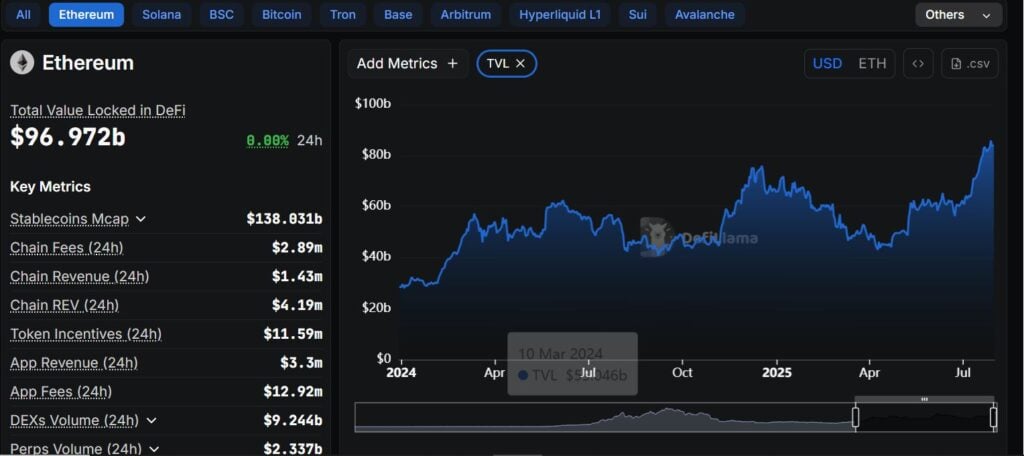

Ethereum also saw its performance in the DeFi segment spark back to life in the third quarter. In July, Ethereum chain’s Total Value Locked (TVL) reached a record high of nearly $270 billion. Unlike some earlier rises this one wasn’t just about token values going up; it was about real activity. Decentralized exchanges were busy, there was a lot of liquidity in stablecoins, and lending protocols saw an uptick in utility.

Ethereum is still the biggest single-chain TVL holder. However, Layer 2 chains (L2s) and some Layer 1 chains have joined the mix, making the market bigger and healthier. According to DefiLlama data, liquidity is not only expanding, but also moving through key pathways for on-chain price discovery. The atmosphere in Q3 feels much more solid and growth-oriented than it did in Q1, when prices were choppy and unclear and DeFi token valuations often seemed out of place.

Ethereum’s DeFi performance since 2024. Source: DeFiLlama

Staking Swells

Staking has also been a quiet but strong force in the third quarter. About 30% of the ETH supply is now staked, which is almost a record high. In the first quarter, liquid staking yields were shaky, but in the third quarter, they stabilized around 3.00–3.10%.

Ethereum chain implemented the Pectra upgrade in May, and that has enhanced network scalability and flexibility and also raised the validator staking cap. However, an arguably more impactful development came in August, when the U.S. SEC clarified that protocol staking, especially liquid staking, would not be considered a security.

That green light from regulators gave the market a lot of confidence and made staking a long-term plan for many investors. The medium-term and long-term impact of that announcement will favour Ethereum price upside.

ETH Price Forecast Q3 2025

Ethereum’s medium-term trajectory will likely remain in place as long as it holds above the $3,900 mark which aligns with the middle Bollinger Band on the daily chart. Immediate resistance is at $4,800, but a stronger buying appetite could push it to test the psychological $5,000.

On the other hand, the coin’s RSI is at 79 and the price has sent it outside the upper Bollinger Band. These readings signal overbought conditions, and that could result to a reversal. A break below $3,900 could usher the sellers to take control, with the next significant support at $3,900, just at the start of the recent uptrend level. Breaking below that level will signal a stronger downside momentum, with the next critical support at $2,790. Action below that level will shift the sentiment to full-blown bearishness.

What Could Go Wrong?

Despite the current strong positive sentiment around Ethereum, things won’t always be perfect. A few factors could shift the momentum to the downside:

- Federal Reserve interest rate decision: The current “risk-on” trade could turn around quickly if the rate cut that everyone was looking forward to in September doesn’t happen.

- ETF Reversal: The current surge of ETF inflows has been amazing. However, the buying impulse could start fading in the absence of new and creative ETFs or outflows start to rise.

In Conclusion

Ethereum price has shown in Q3 2025 that the crypto market can change quickly when fundamentals, institutional inflows, and sentiment line up. Currently, institutional money is coming in through ETFs at a rate that has never been seen before. Also, DeFi is bigger and works better than before. In addition, staking is steadily growing and now it has the support of clear rules from regulators. If the current factors remain in play, Ethereum price could rise past its all-time highs before the end of the year, especially if the US economy stays strong.