From September 22nd through the 26th, 2025, the Dow Jones Industrial Average (INDEXDJX: .DJI) exhibited very little movement, closing the period with very low volatility. This flat performance comes at a time when the market as a whole is very unstable. This has led to concerns about whether the bullish momentum that pushed the index to record highs earlier this year is now fading.

The Dow’s Mixed Signals

At first sight, it seems likely that bulls are becoming tired. September has always been a weak month for U.S. stocks, with seasonal sell-offs and higher volatility. The PCE inflation figure, which came in at 2.7%, as expected, has eased some anxiety but the economy has failed to inspire fresh spending just yet. Also, the fact that tech-heavy indices like the Nasdaq are falling behind other sectors suggests that the broad-based surge that happened earlier in the year might be running out of steam.

On the other hand, market cycle analysis shows that the long-term upswing is still in place, even though September’s historical drag is still in effect. This is because the U.S. economy’s fundamentals are strong, with GDP growth predicted to be stable at 2.3% for 2025 and a solid job market.

Investors are quite interested in whether the Federal Reserve will stay dovish as far as interest rates go. The rate cut in September and expectations of another one in Q4 keep providing tailwinds, making equities elevating risk premiums and helping growth sectors.

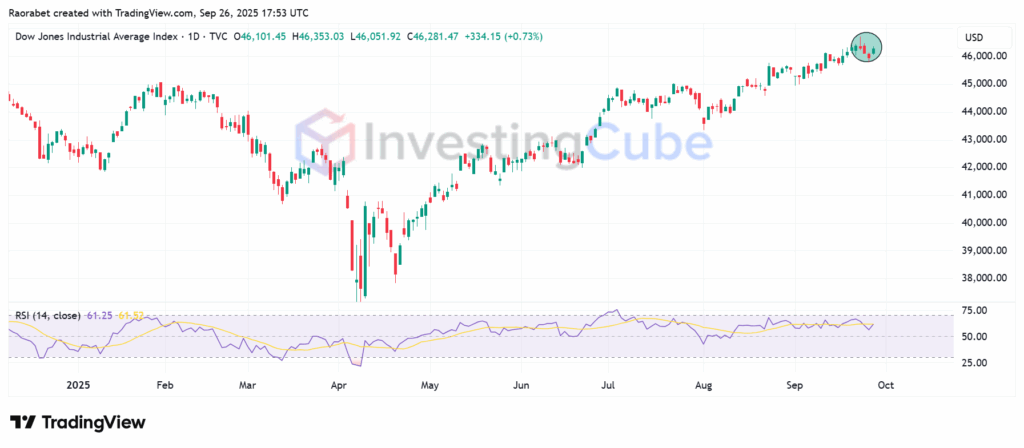

While the Dow Jones Index has its RSI at 61, it has registered three loss-making sessions out of five this week-the first such run since late July. Chart Source: TradingView

Will the Index Regain Momentum in October?

Looking ahead October seems likely to have the Dow on the uptrend, but there are still some concerns. Analysts expect a rebound from seasonal weakness, thanks to a likely rise in economic activity in the fourth quarter. That said, concerns like the possibility of a U.S. government shutdown or the persistent effects of trade tensions, could limit investors’ risk-taking and could add downward pressure on the market.

October is also the beginning of the third quarter results season for corporations. Strong results will back up the current high valuations and could ease concerns over a slowing economy. On the other hand, big cuts to corporate guidance will probably back up the bearish case.

In Summary

After a succession of record or near-record highs, the recent drops and flat performance by the Dow Jones Index signal that the market is going through a natural phase of readjustment. After a major rise, markets rarely move up in a straight line because investors take their profits. October is likely going to be a month of increased volatility. However, for investors who are willing to sit out the first swings, a positive outcome to the Fed and earnings uncertainty could still lead to a seasonal bounce and a great end to the year.

Weak breadth, valuation concerns, and investor caution ahead of Fed decision have kept the Dow Jones range-bound despite earlier bullish momentum

No, the Dow’s recent weakening of momentum suggests consolidation, not exhaustion. Strong fundamentals and Fed support indicate the bull market remains intact for now.

Expect cautious trading with possible volatility, driven by Fed policy, inflation data, and earnings surprises.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.