As markets open Thursday pre-market, Bitcoin hovers near $113K after an overnight bounce from its early-week low. BTC reversed sharply from just under $110K, a technical pivot point, and now trades within the $113,000–$114,000 range, testing Monday’s intraday high. Analysts say $109K remains the make-or-break line; a hold above would strengthen the case for another leg higher. Meanwhile, investors are digesting signals from Washington, Trump-backed crypto moves and macro whispers are steering sentiment as much as technical levels.

Why Did Bitcoin Ease Off $120K?

The rejection at $120K arrived after a powerful multi-month run, so profit-taking was natural. Risk assets also paused as traders reassessed the path for global interest rates and liquidity. Bitcoin remains highly sensitive to those macro currents because cheaper funding and stronger risk appetite tend to fuel flows into spot BTC and crypto funds. In plain terms, a softer policy tone and improving liquidity usually help the bid, while a firmer stance can stall rallies.

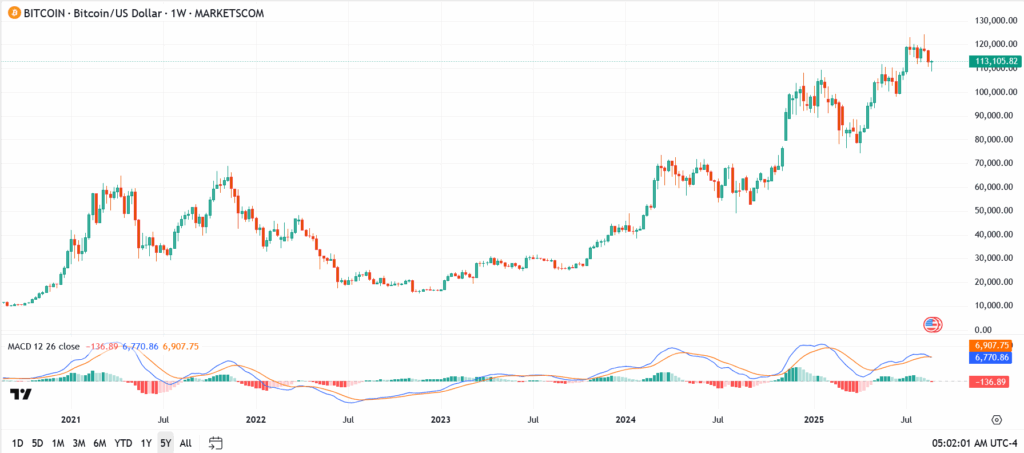

Bitcoin Weekly Chart Analysis

On the weekly timeframe, BTC is still printing higher highs and higher lows compared with the spring trough. Price is holding above the prior breakout area near $110K, which now acts as first support, with a deeper shelf around $105K and the psychological $100K level below that. Resistance is stacked at $120K, then $125K, followed by the year-to-date peak just shy of $130K. The MACD has eased from extreme readings, and the histogram has begun to contract, which often signals waning downside pressure rather than a fresh bearish leg. If buyers can keep weekly closes above $110K, the path back toward $120K reopens.

Is The Bitcoin Bull Cycle Intact?

Structurally, yes. This cycle has been driven by continued institutional participation, a broader build-out around custody and payment rails, and the narrative that BTC serves as a portfolio diversifier when traditional assets chop. None of those supports have disappeared. The open question is pace, not direction. A steady base above $110K would imply digestion after a long run, while a weekly close under $105K would warn of a deeper shakeout toward $100K where longer-term money typically re-evaluates.

What Should Traders And Investors Watch Next?

Short-term traders will key off the $113K to $110K zone as the immediate battlefield. A clean push through $120K with rising volume would confirm trend resumption and put $125K to $130K back in play. Longer-term investors can focus on whether funding conditions ease, whether spot demand absorbs dips near $110K, and whether volatility compresses after the recent spike. Calm bases tend to precede directional moves, so evidence of quiet accumulation would be a constructive tell.

Conclusion

Bitcoin has handed back some altitude, yet the weekly structure remains constructive. Hold $110K, rebuild energy, and the market can stage another attempt at the highs. Lose $105K, and the conversation shifts to defense around $100K.

Bitcoin at $113K is still in an uptrend, but timing matters. If $110K holds as support, it could set up another push toward $120K. Waiting for a dip closer to that level is what cautious traders prefer, while long-term holders argue staying invested pays off.

The decline was prompted by profit-taking and elevated funding rates. As BTC approached that round number, leveraged positions were liquidated, resulting in a rapid decline to $110K before buyers re-entered the market

Volatility is the biggest risk, with daily swings of 10-15%. Regulation and ETF outflows add uncertainty, while high leverage in futures can accelerate both rallies and crashes. Long-term value is tied to adoption, but the path is never smooth.