Bitcoin slipped toward $113,500 on Thursday as traders moved to the sidelines ahead of Jerome Powell’s final Jackson Hole address. The token has pulled back from recent highs near $124,000, with futures showing nervous positioning around the $113,000 pivot. The mood is cautious, not panicked, as markets brace for Powell’s signal on how quickly the Fed might ease policy into year-end.

Why Is Bitcoin Under Pressure Now?

The weakness is less about crypto fundamentals and more about macro positioning. Powell’s Jackson Hole remarks have become a ritual for global markets, often setting the tone for policy into the fall. With inflation cooling but not yet anchored, investors are hedging for the possibility that Powell pushes back against aggressive rate-cut bets. That’s kept risk appetite in check across equities and digital assets alike.

For Bitcoin, the timing is tricky. Institutional inflows have slowed after a torrid July, and volumes on major exchanges are running lighter. Derivatives data shows a tilt toward put hedging, reflecting caution rather than conviction. The narrative hasn’t broken, long-term bulls are still anchored on ETF demand and halving tailwinds, but in the short term, the market wants Powell’s clarity before making its next move.

Bitcoin Technical Analysis

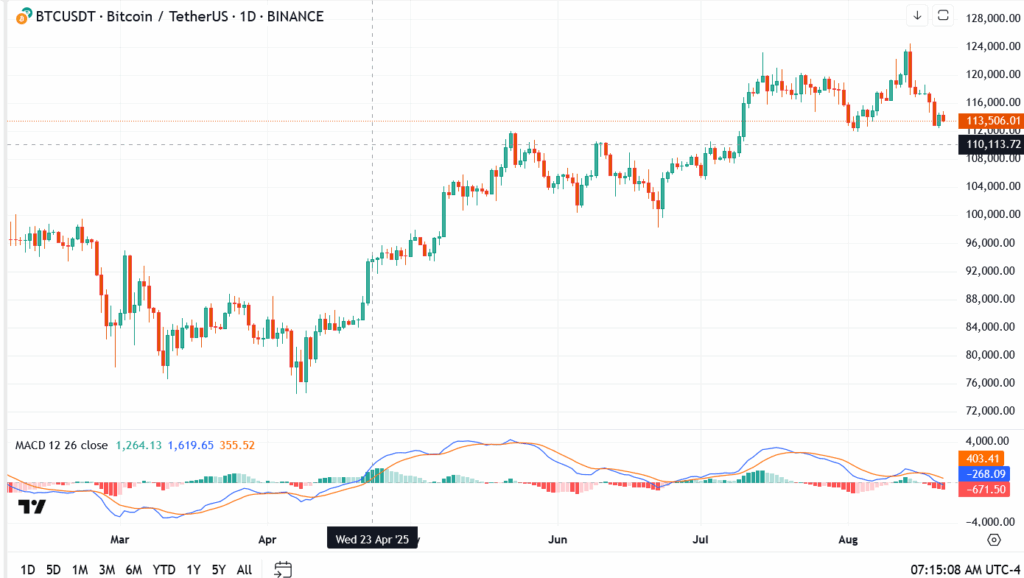

- Current price: $113,506

- Pivot level: $113,000

- Immediate resistance: $116,000, then $120,000

- Support: $112,000, then $110,000; deeper cushion at $105,000

BTC is parked just above its $113,000 pivot. A close above $116,000 would relieve immediate pressure and open the path back to $120,000. Lose $113,000, however, and the market will quickly probe $112,000, with $110,000 as the next line of defense. The MACD remains soft, signaling consolidation rather than momentum.

Bitcoin Outlook: Jackson Hole Decides the Next Move

For bulls, the setup is straightforward: defend $113,000 into Powell’s speech and look for a rebound toward $116,000 and $120,000. Bears, meanwhile, are eyeing a clean break under $113,000 to force a slide toward $110,000. With the Fed back in focus, Bitcoin’s next leg will be dictated less by charts and more by Powell’s tone.