- Bitcoin price traction above the psychological $110k mark could raise the prospect of hitting a new all-time high in the next few days.

Bitcoin price retested the $109k mark for the third session in a row on Tuesday, signaling an impending breakout. The crypto market bellwether has struggled to find traction above the psychological $110 barrier since late May and was recently rejected at that mark. Therefore, a break above that level could potentially usher a strong sentiment that could validate a move towards all-time highs of $112k.

The coin’s upside potential has strong support from institutional demand, underpinned by ETF resilience and rising BTC accumulation. US-traded Bitcoin spot ETFs resumed trading with a massive $216 millions worth of net inflows on Monday and have only returned a net outflow once in the last twenty sessions.

Meanwhile, the Michael Saylor-led Strategy, the poster child of institutional BTC accumulation intends to raise $4.2 billion to purchase more coins. The company’s holdings currently stand at about $65 billion. BlackRock remains the largest institutional holder with 700,306 coins valued at over $75.8 billion in its possession via its iShares Bitcoin Trust. Other institutions that have recently revealed substantial acquisitions include MetaPlanet and ReserveOne.

Elsewhere, blockchain data aggregation site, IntoTheBlock reports that BTC netflows (the difference between the value of inflows and outflows) in exchanges declined substantially to -$586 million in the last seven days. That signals a sharp decline in selling pressure, which is supportive of Bitcoin price upside.

Bitcoin Price Prediction

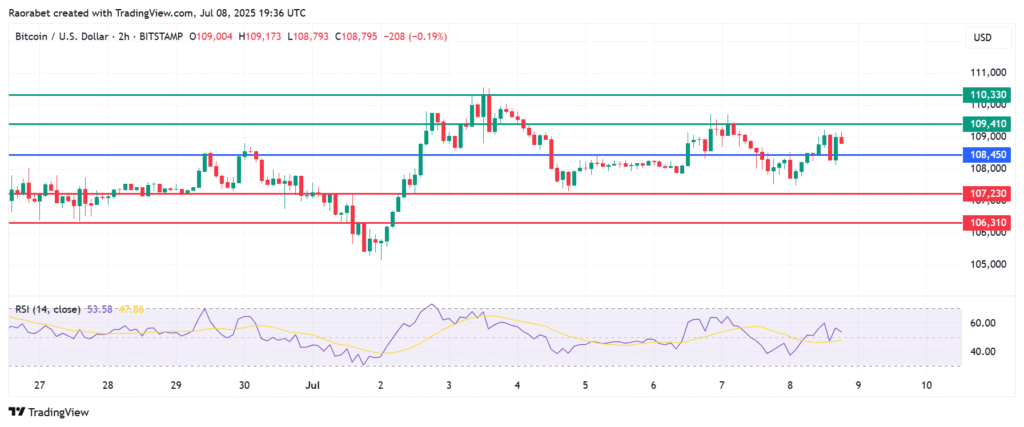

Bitcoin price pivots at $108,450 and the RSI indicator calls for further upside above that level. That momentum will likely meet initial resistance at $109,410. A stronger momentum will break above that level and could push the action higher to test $110,330.

Conversely, action below $108,450 will shift the momentum to the downside. With that, the first support will likely be at $107,230. The upside narrative will be invalid if the price breaks below that level. Also, such an action could clear the path to test $106,310.