- Bitcoin rebounds after an 18% November drop as ETFs recover and analysts eye a potential December rally. Fed signals will guide the next move.

Bitcoin is trying to stabilise after a painful November that wiped out 18% of its value and triggered one of the sharpest liquidations of the year. The move crushed sentiment across digital assets, sending several altcoins to multi-week lows and forcing traders to reassess near-term risk appetite.

The encouraging news is that early December is already showing a different tone, and the Top Crypto Prediction narrative is shifting toward whether BTC can sustain this bounce and avoid deeper downside.

Nic Puckrin, investment analyst and co-founder of Coin Bureau, summed up the renewed optimism, saying,

We’re not out of the woods yet, but December may be shaping up to be a far better month than its predecessor, and a Santa rally is certainly not off the cards”

Meanwhile, Bitcoin ETFs are finally seeing inflows again after suffering their second-largest monthly outflows on record in November. That shift alone is easing the pressure that had been weighing on prices for several weeks.

Bank of America added even more confidence to the long-term narrative after its CIO team told clients that a 1%-4% crypto allocation “could be appropriate” depending on investor risk tolerance.

For investors with a strong interest in thematic innovation and comfort with elevated volatility, a modest allocation of 1% to 4% in digital assets could be appropriate”

said Chris Hyzy, CIO at Bank of America Private Bank.

This marks a major change from the bank’s previously conservative stance.

Why Did Bitcoin Fall So Sharply in November?

Bitcoin’s November decline was driven by three main factors:

• Aggressive profit-taking after BTC failed to reclaim $105,000

• Heavy ETF outflows that drained market liquidity

• A broad risk-off shift in global markets as traders priced in slower economic momentum

The drop briefly accelerated toward the end of the month when BTC slid under $88,000 on high leverage unwinds, but so far, December is showing stronger buying interest near the lows.

Bitcoin Price Analysis: Can BTC Extend This Early December Rebound?

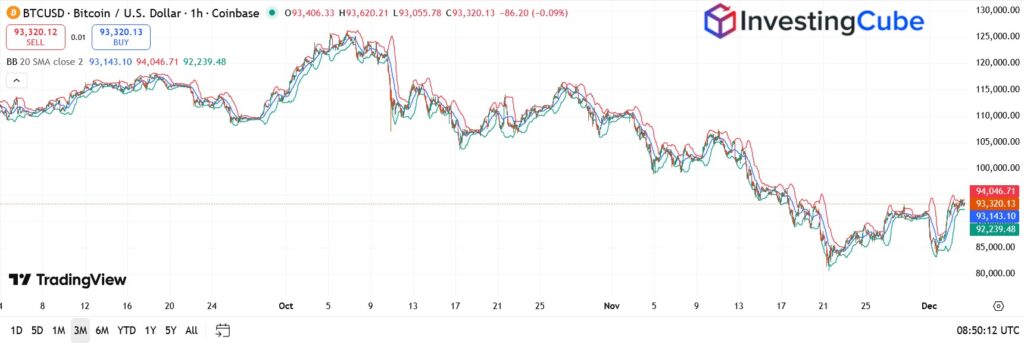

The BTC/USD 1-hour chart shows Bitcoin trading around $93,320, recovering from the early-December bounce after dipping toward $85,000 late last week. Prices remain trapped below the 20-period Bollinger mid-band, which sits around $94,000, a level BTC must reclaim to confirm bullish momentum.

• Immediate resistance: $94,500 – $96,000

• Key support: $90,000 – $88,000

• Downside risk line: A drop below $88,000 could open the door to $85,000 again

Bitcoin continues to show higher intraday lows since the December 1st flush, and volatility is tightening, often a precursor to a breakout.

From my perspective, BTC still needs a decisive push above $96,000 to convincingly flip momentum in its favour. Until then, this rebound is promising but not confirmed.

What to Watch in Bitcoin This Week

Here is what the market is focused on:

1. Fed Chair Powell’s Policy Tone

Analyst Engel noted that Powell has been “less hawkish on crypto than other FOMC members,” adding that a more pro-crypto stance could accelerate digital-asset integration within the banking system.

2. ETF Flow Direction

If inflows continue this week, BTC could find enough fuel to revisit $100,000. Outflows would put immediate pressure on the bounce.

3. Broader Risk Sentiment

Equities are stabilising, volatility is cooling, and December seasonality tends to favour risk assets. If macro conditions remain stable, BTC could extend its recovery.

Outlook: Is Bitcoin Setting Up for a December Rally?

Bitcoin is entering December with better momentum than the market expected after last month’s severe drop. Support is holding, ETF flows are improving, and institutional commentary is gradually turning more positive. A clean break above $96,000 would likely shift sentiment quickly and position BTC for a stronger finish to the year.

The coming days will determine whether this rebound becomes the start of a broader recovery, or just another pause in a larger correction. Either way, the Bitcoin price prediction narrative for December hinges entirely on Bitcoin’s ability to hold above critical support and reclaim lost momentum.