- Crude oil prices took a softer tone on Monday as Russia-Ukraine tensions mount, prompting evacuation of non-essential embassy staff.

Crude oil prices were a tad softer on Monday as geopolitical tensions sparked a mild safety flight. Brent crude oil price shed 1.45% after the US embassy said it would ask all non-essential embassy staff in Ukraine and their families to leave the country. The US is also considering shoring up its military presence in Eastern Europe and the Baltic states to stem any potential Russian aggression.

However, the fall in crude oil prices on Monday is seen largely as a temporary blip along the path to a $100/barrel. Commerzbank’s analysts see prices rising, even as the UAE says it fended off another drone attack by the Houthi rebels. The bank feels that the situation in the Middle East constitutes a risk premium for oil prices. Data from OPEC shows that compliance level of production cuts exceeded 100%, while the IEA said OPEC + production was 790,000 barrels per day lower than the agreed production quota. Brent crude is down 2.03% as of writing.

Crude Oil Price Outlook

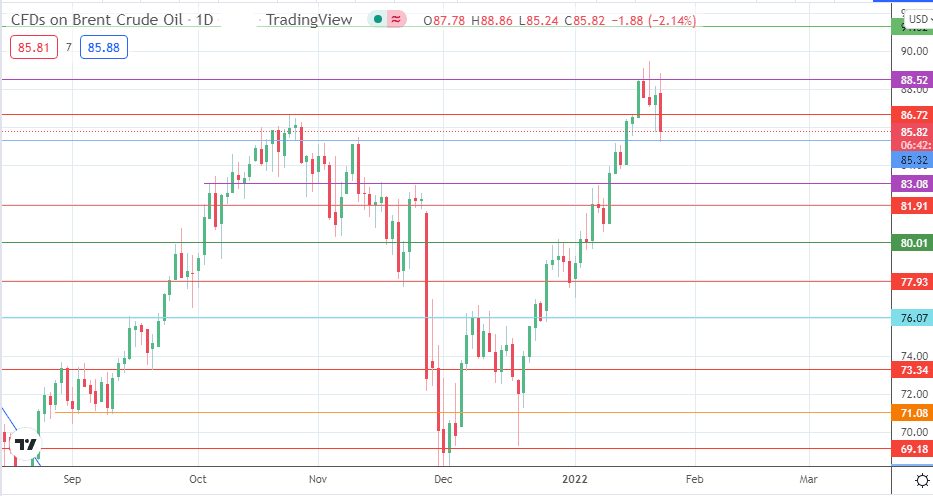

The intraday decline is testing support at the 85.32 price mark. If the bears take out this support, 83.08 and 81.91 become the additional downside targets. 80.01 and 77.93 enter the picture if the price decline is more extensive.

On the flip side, a breach of 88.52 sends oil prices towards 91.32 (6 October 2014 high). Above this level, 96.58 and 100.00 are additional price targets to the north, the multi-year highs from September 2014.

Brent Crude: Daily Chart

Follow Eno on Twitter.