- Crude oil prices on the Brent benchmark are trading lower for a 2nd day as concerns over 2022 demand and Omicron weigh on sentiment.

Crude oil prices fell steeply on Monday, as the markets went into risk aversion mode over the rise in cases of the Omicron COVID-19 variant. Concerns over lower consumption in 2022 also weighed on investor sentiment, allowing Friday’s selloff to spill over into Monday’s New York session.

There are concerns that the UK and Europe, which are seeing the highest spread rates of the Omicron variant, could initiate restrictions for the holiday season. The situation allowed the bears to push down prices on the Brent benchmark by 3.26% on Monday. Brent crude is now trading at $70.53. It had traded as low as $69.64 earlier in the day.

Crude Oil Price Outlook

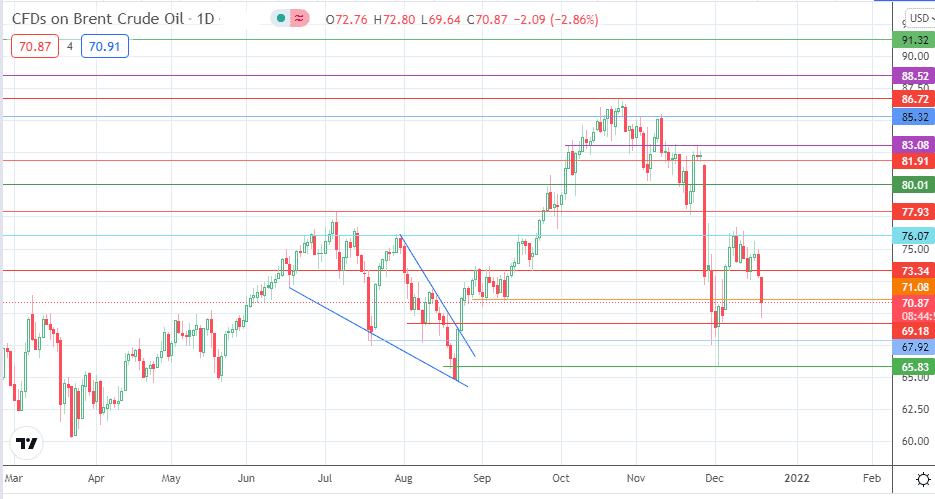

The active candle on the Brent benchmark bounced just above the 69.18 support line. However, renewed bearish pressure puts this support under pressure. If the bulls fail to defend the support level, 67.92 and 65.83 will become additional price targets to the south.

On the other hand, an extension of the bounce allows the bulls to mount a challenge at the 71.08 price mark. If this barrier buckles under challenge, the 73.34 price mark becomes the new target to the north. 76.07 and 77.93 are additional resistance barriers that will become visible with a more extensive price recovery.

Brent Crude: Daily Chart

Follow Eno on Twitter.