- Crude oil price has eased after rising for two consecutive sessions. The expected slowing of shale drilling in North America has boosted prices.

Crude oil price has eased after a two-day surge. Earlier in the week, uncertainties surrounding the demand and supply dynamics exerted pressure on the commodity. Investors were concerned about increased supply after OPEC+ member states agreed to increase monthly output by 400,000 bpd from August.

The decision comes at a time when the Delta coronavirus strain has been spreading aggressively in different parts of the world. Notably, the unexpected increase in US oil stockpiles further triggered worries over the status of the global oil demand.

However, an improvement in risk sentiment has boosted crude oil price. Besides, the expected reduction of shale drilling within North America has acted as a bullish catalyst for the financial asset. According to Baker Hughes Inc., shale activity in the region is set to slow down in the year’s second half. Investors have called for the distribution of profits to shareholders as opposed to increasing oil rigs and production.

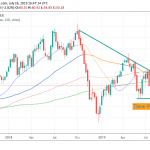

Brent oil technical analysis

Crude oil price has eased after rising for two consecutive sessions. On Monday, Brent oil dropped from an intraday high of 73.35 to a two-month low of 67.43 on Tuesday. Since then, it has rebounded by about 9.60%. Subsequently, it has managed to erase its losses from earlier in the week.

At the time of writing, Brent oil was up by 0.24% at 73.80. On a two-hour chart, it is above the 25 and 50-day exponential moving averages.

In the near term, I expect crude oil price to trade within a tight range of between 73.00 and 74.00. A move above the resistance level of 74.00 will have the bears targeting 75.00. On the flip side, a move below 73.00 will place the support level along the 50-day EMA at 72.01.

Crude oil price chart

Follow Faith on Twitter.