- Crude oil prices are up by nearly 2% on Friday as expectations of extended OPEC+ cuts outweigh concerns over demand.

Crude oil prices traded near 2% gains on Friday, as the market bet on potential extention of OPEC+ cuts. Brent crude futures were up 1.97% and trading at $79.80 per barrel at 13.35 GMT. Similarly, WTI was up by 1.92% and trading at $79.72. The commodity has effectively recorded the highest price since November 15th , and weak dollar fundamentals could help it rise further.

Members of oil cartel OPEC+ agreed in November to cut daily production by 2.2 million barrels. However, demand-side concerns have seen the oil prices struggle for consistent gains. This has been compounded by rising US inventory figures. This week, Energy Information Administration (EIA) announced on Wednesday that stockpiles had risen beyond the projected 3.10 million to register 4.19 million barrels. In addition, there has been an existential risk factor from China’s slowing economy. The world’s second-largest economy reported on Thursday a decline in its industrial activity for the fifth consecutive month in February.

Nonetheless, February was a good month for oil bulls. WTI rose by 1.8%, while Brent gained 2%, to record the third consecutive month of gains by the commodity. The OPEC+ nations will announce last week whether or not they will carry the current production cuts into the second quarter of the year. The market sentiment currently leans towards production cut extension. This is attributed to underlying concerns over demand outlook and increased production by non-OPEC+ members led by the United States, Brazil and Canada.

Meanwhile, the US dollar could also come under renewed pressure next week after the US economy printed a series of below-forecast figures this week. A weak dollar typically spurs upside momentum by crude oil prices. Also, uncertainty surrounding the ceasefire talks between Israel and Hamas could add to the upward propulsion.

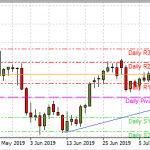

Technical analysis

WTI crude oil price pivot is at 78.60, and a break above that level will put the buyers in strong control. Extended control by the buyers will break the 79.60 resistance, and possibly test the 80.00 psychological resistance mark. However, the momentum could favour the sellers if the price breaks below the pivot. This will see them attempt to breaching the 78.20 support, beyond which the next support will be at 77.80.