- Copper prices could drop as low as $7500 per ton, according to market strategists from Societe Generale bank in their latest outlook.

Copper price continues the correction to the south, as rising cases of the coronavirus delta variant continue to depress demand for commodities linked to risky sentiment such as copper.

To buttress this point, market strategists at Société Générale bank have projected that copper prices will continue in the corrective move, touching as low as $7500 per ton ($3.75 per pound) in the first quarter of 2022, before a slight recovery in Q2 2022. The bank says it expects the risk-off sentiment created by COVID-19 Delta and other problematic variants such as the Mu variant to “send the medium-term outlook for copper strongly to the downside”.

The bank sees upside potential only if there are more strike actions in the copper-producing belts of Latin America. Copper price on the day is trading lower, down by 0.74%.

Copper Price Outlook

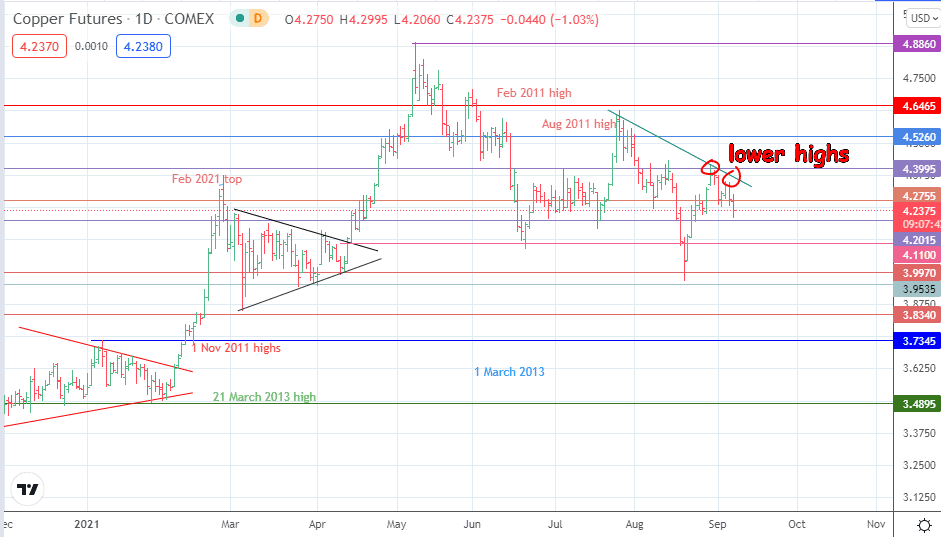

Copper price continues to form lower highs on the daily chart. The most recent highs (red circles) form a double top, completed by the breakdown of the 4.2755 neckline support. Price is now aiming for 4.2015 as the initial downside target, with 4.1100 and 3.9970 forming potential targets to the south if the 4.2015 support target gives way.

Conversely, bulls need a price reversal from a bounce off 4.2015, which takes out 4.3995 to restore the potential for a push towards 4.5260. 4.6465 (Feb 2011 high) remains a price barrier to beat, as will 4.7500 and 4.8860 if the uptrend on copper prices is to be restored.

Copper Price (Daily) Chart