- Gold’s rally faltered after ceasefire news — is this just a pause, or the start of something deeper?

A Historic Break, Then a Sudden Pause

This week will be remembered as the one when gold finally crossed the $4,000 line. On October 8, spot prices broke decisively through that psychological barrier and ran to $4,059 per ounce, a level that only months ago seemed improbable. The speed of the move reflected a perfect storm: softer U.S. yields on dovish Fed expectations, a dollar under pressure, and heavy safe-haven flows tied to geopolitical risk.

Yet markets rarely move in one direction for long. By early Thursday, the story had changed. News broke that Hamas and Israel had agreed to a ceasefire, and suddenly the urgency behind safe-haven buying evaporated. Traders who had been sitting on large profits didn’t hesitate to lock them in, pulling XAU/USD back to the $4,020–$4,030 region.

The question now is not whether gold remains in a long-term uptrend—it clearly does—but whether the current pause is a healthy consolidation or the beginning of a deeper correction.

Why the Rally Happened – And Why It May Not Be Over

The climb to $4,000 was supported by three pillars:

Fed Policy Outlook

- The Fed minutes reinforced expectations of at least one rate cut before year-end. With October seen as almost certain and December still on the table, the path for lower U.S. yields was clear. Lower yields weaken the dollar’s carry appeal, making gold relatively more attractive.

U.S. Political Dysfunction

- The government shutdown, now stretching beyond a week, has frozen key economic data releases. Without payrolls or inflation data, markets are flying blind, and when clarity is absent, gold often benefits.

Institutional and Sovereign Flows

- September alone saw record ETF inflows into gold, while central banks continued their steady accumulation. This demand base created a self-reinforcing loop—momentum buying on top of structural flows.

These drivers haven’t disappeared. They remain in the background, supporting the view that the pullback may prove temporary.

The Ceasefire Shock

The ceasefire between Hamas and Israel was the spark for this week’s retracement. Markets had priced in a premium for ongoing conflict; once that risk eased, gold no longer carried the same urgency.

Still, ceasefires in the region are fragile. Traders know that peace agreements can unravel quickly. If violence resumes or negotiations stall, safe-haven demand could return overnight. For now, the ceasefire represents a reason to pause rather than a reversal of trend.

Technical Landscape – Where the Lines Are Drawn

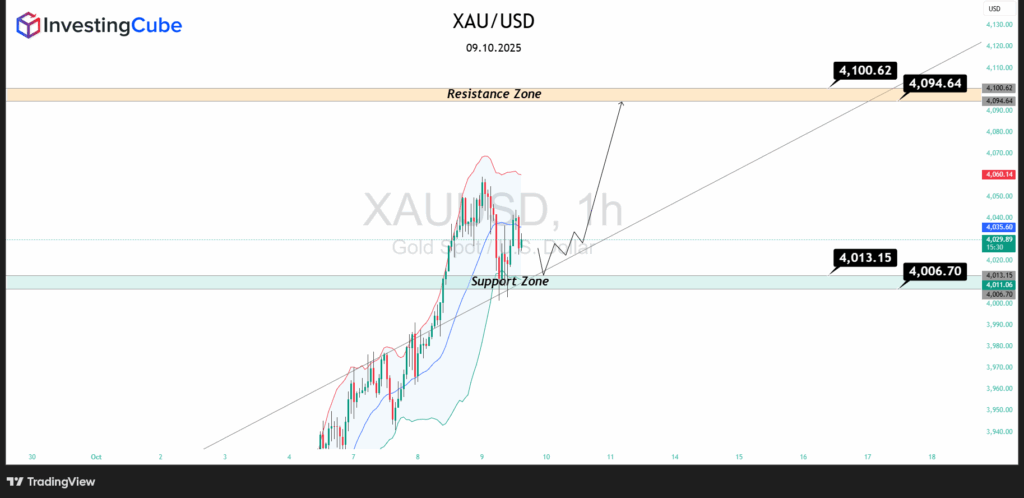

From a chart perspective, gold is balanced on key levels:

- Support: $4,006–$4,013 is the critical floor. If buyers defend this zone, the bullish structure holds. If it breaks, the next test is around $3,960.

- Resistance: $4,094–$4,100 capped the latest rally. A close above here would likely invite a retest of $4,050–$4,060 and possibly open the way toward $4,120.

- Bollinger Bands: The recent surge pushed XAU/USD above the upper Bollinger band, showing the market had entered overextended territory. The subsequent pullback has brought price back inside the bands, a classic sign of cooling momentum. As long as price trades near the mid-band around $4,020, consolidation is the base case. Holding above the mid-band keeps the bullish structure alive.

In short, $4,000 has turned from a dream target into a real-time battleground.

Balancing Near-Term Risks and Long-Term Tailwinds

Where does that leave the outlook? The XAUUSD Price Prediction in the near term is for consolidation between $4,013 and $4,059. The market needs to digest its historic rally before deciding on the next leg.

But medium-term risks and opportunities remain clear:

- If the ceasefire holds, risk appetite may rise, encouraging further profit-taking in gold.

- If U.S. data disappoints, especially with payrolls likely delayed by the shutdown, the case for Fed easing strengthens, reviving gold demand.

- If geopolitics flare up again, safe-haven flows will return quickly, and $4,100 could be left behind in short order.

Longer term, the bullish thesis remains intact. Rate cuts, structural central bank demand, and persistent uncertainty are powerful drivers. That’s why many analysts still talk about $5,000 as a realistic target for 2026.

Strategy – What Traders Should Focus On

For now, discipline is key. Chasing the rally after such a strong move is risky. A better approach is to respect the levels:

- Above $4,013: Buy dips cautiously, with $4,060–$4,100 as the upside target.

- Below $4,006: Stand aside or consider tactical shorts toward $3,960.

- If $3,960 breaks: Deeper correction toward $3,900 could unfold before buyers return.

Gold has a long history of shaking out impatient traders before resuming its trend. This is likely one of those moments.

Bottom Line

The XAUUSD Price Prediction now rests on the defense of the $4,000 line. It is both a technical pivot and a psychological anchor for the market. Hold above, and the uptrend continues; lose it, and the correction deepens.

Either way, the bigger picture hasn’t changed: in a world of policy easing, political dysfunction, and fragile geopolitics, gold remains one of the strongest assets in the market. The path may not be straight, but the bias remains upward.

Frequently Asked Questions

It depends on the backdrop. Rate cuts and central bank flows would favor dip-buying, but a calmer risk environment could see profit-taking dominate.

Not necessarily. Ceasefires can be fragile; any renewed tension could restore safe-haven flows almost instantly.

Not yet. Short-term momentum may be fading, but as long as key support holds, the broader uptrend is intact. A true reversal would need both macro and flow confirmation.