- Silver price break below $50 has resulted in a weaker sentiment recently, but the metal's core fundamentals tell a different story.

Investors were on the edge of their seats as silver price swung significantly in late October. Prices fell sharply in the middle of the month, going from more over $50 an ounce to a low of $46.32 by October 28. But last week, the grey metal made a strong recovery.

Spot silver rose more than 3% to $48.97 per ounce on Friday, thanks to strong industrial demand from solar panels and electronics, as well as a weaker U.S. dollar.

As of November 3, the metal has gained an incredible 50.29% year-to-date, but it dropped slightly to $48.69. But is a reversal coming?

What Silver Needs for A Reversal

It’s been a wild ride for silver price this year, and many market analysts agree that there is a high risk of a reversal in the near future, even though the long-term outlook is very good. The recent increases were partly due to a short-term liquidity squeeze and increased demand for safe haven assets.

But this kind of abrupt rise often makes the market very overbought on daily and weekly charts, which makes it easy for traders to take profits fast.

For a real turnaround to happen, there would need to be a reason, like U.S. jobs data that was hotter than expected or a surprise hawkish move by the Federal Reserve. But because of geopolitical uncertainty across the world, from elections to trade conflicts, silver’s appeal as a “monetary metal” could win out over any short-term problems.

Silver Price Risks

Silver sits in a strong position because it serves two purposes: as an industrial workhorse and an inflation hedge. According to the World Silver Survey, green tech sectors used up 60% of the metal’s last year’s supply. If the U.S. economy slows down, demand from these sectors could drop. Geopolitical tensions might make it go up, but a strong dollar could stop it from going up.

Silver Technical Analysis

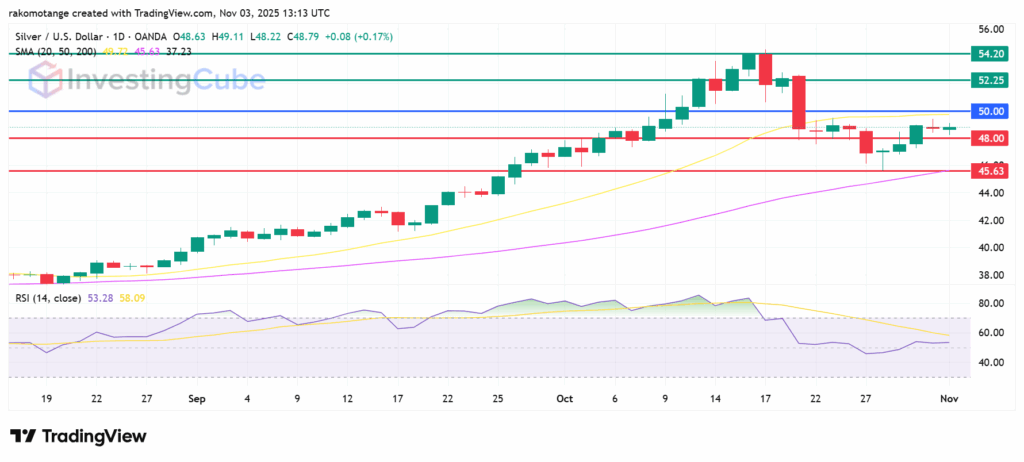

The metal is hovering around $48.70, which is above its 50-day EMA at $45.63. In addition, the previous bullish crossover is still in place, which means that the uptrend will likely continue.

Initial support will likely be at $48.00 and potentially lower at $45.63 (October low), where dip-buyers bought in last week. Resistance will likely be at the psychological $50.00 initially, and potentially higher at $52.25 psychological level if the momentum strengthens with rising buying volumes. A break above that level could extend gains and potentially test $54.20 while invalidating the downside narrative.

Silver price chart with key SMA, key support, and resistance levels. Source: TradingView

In Summary

We cannot rule out a resumption of a short-term correction, but the fundamental structural case for silver is still strong. Analysts say that things like supply shortages that could to last through 2025 and rising industrial demand from renewable energy are some of the main reasons for the long-term bull market.

Silver’s recent gains were mostly driven by a short-term liquidity squeeze and increased demand for the metal as a safe-haven asset, with a weaker US dollar and geopolitical risks providing fuel.

The silver market is facing a high risk of a near-term reversal. This is mostly because of increased profit taking after its strong gains in early October. However, its long-term outlook remains strong because of strong industrial demand.

Key risks include a potential slowdown by the global economy, slowdown hurting industrial demand, a stronger US dollar, and profit-taking by investors after over 50% YTD gains.