Silver (XAG/USD) is clawing back losses on Friday, bouncing from the day’s low near $31.80 to trade above $32.23 in late European hours.

The earlier slump in silver was short-lived. Traders initially pulled back after news broke that the US and China had agreed to slash tariffs by 115% for 90 days — a move seen as a step toward cooling long-simmering tensions. That kind of geopolitical calm often dents demand for traditional safe-havens like silver.

What’s Moving Silver Today?

Silver’s rebound today is being driven by a mix of calmer headlines and improving demand outlook. With the US and China stepping back from the edge and agreeing to fresh negotiations, markets are breathing easier, which means less panic-driven buying of safe havens.

At the same time, US 10-year Treasury yields have dipped to 4.40%, helping boost interest in non-yielding assets like silver. But what’s really turning heads is the industrial side of the story: as Chinese factories gear up again, demand for silver in electric vehicles, electronics, and solar components is expected to ramp up sharply.

Silver Chart Setup

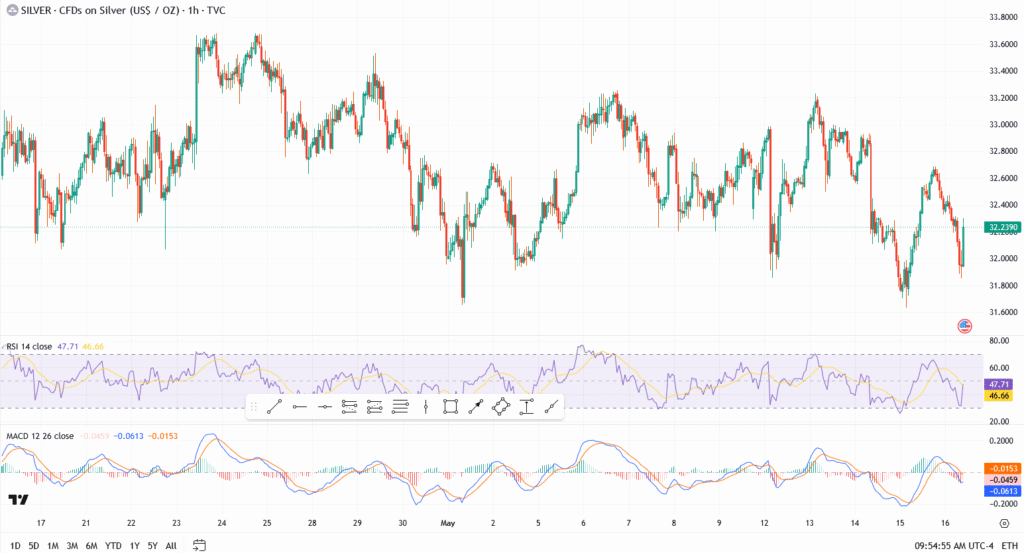

- Price is holding above $32.20 after rebounding off $31.80 earlier today

- Short-term resistance: $32.44, then $33.00

- If bulls break that zone, they may target $34.60 — last seen in late March

- Support to watch: $31.80, and deeper at $30.90

- RSI is balanced near 47, not overbought or oversold

- MACD is turning upward, hinting at a shift in short-term momentum

While silver is still trading within a broader descending triangle, the way it’s responding today suggests that bears are losing their grip and if buyers push it past $33.00, we could be looking at a full-blown breakout attempt.

Final Take

Silver’s bounce today suggests that the market may be rethinking its earlier reaction. While geopolitical calm typically dents safe-haven appetite, the industrial use case, especially with China in the mix, is giving the white metal a second wind.

With soft US data pressuring yields and the dollar, XAG/USD could be positioning for a run toward the $33.00 level, especially if next week’s Fed commentary leans dovish.