- Discover silver price predictions, key fundamental factors, and technical analysis for XAG/USD to make informed investment decisions.

Silver prices have scaled to their highest level since 2011. Silver futures have gained around 44% this year. In response to escalating geopolitical tensions, the precious metals are receiving a strong boost.

On the other hand, the higher the bets on more Fed rate cuts this year, the more the precious metals like Silver and gold are gaining. Looking at silver’s performance, it has gained 2.18% over the last 5 days. However, it closed 0.22% lower yesterday, mainly due to profit-taking. The bullish momentum for silver prices remains intact.

The Key Fundamental & Geopolitical Factors Boost Silver Prices:

- Europe-Middle East tensions. On Monday, NATO members told the UN that Russia violated the airspace of Estonia and Poland. Britain warned that such actions could risk starting a conflict.

- Many world leaders within the UN supported Palestinian statehood after Britain, Canada, Australia, and Portugal officially recognized it on Sunday.

- This marks a big diplomatic shift during the Gaza war, though Israel and the U.S. remain strongly opposed.

- Despite efforts to improve relations, economic tensions persist between the US and China. China has increased exports to countries outside the US. Flooding the global market with cheap goods in response to U.S. tariffs.

- Trump’s decision to increase the H-1B visa cost to $100k has created more confusion in people’s minds regarding trade tensions around the world.

- H-1B visa fee hike will affect the U.S. companies that usually hire workers holding this visa from various countries outside the U.S. This will negatively impact this segment of the U.S. labor market.

- All of these factors, in turn, are forcing central banks to intensify their buying of Gold.

- These factors also raise risk-averse sentiment and push silver prices to their highest levels.

- The dovish US Federal Reserve suggests two additional rate cuts, most likely by the end of 2025. This will limit US Dollar gains and boost silver prices.

- Traders have to watch the preliminary US S&P Global PMI report for September.

- Attention will be on US Federal Reserve Chair Jerome Powell.

- The latest Personal Consumption Expenditures PCE Price Index will be in focus.

- The PCE is the Fed’s preferred inflation measure. It’s expected to be released with low price pressures.

Key Economic Indicators to Watch This Week for Silver Price Predictions:

- Tuesday, September 23, S&P Global Services PMI (Sep) will be released at 4:45 PM GMT.

- Tuesday, September 23, Fed’s Chair Powell speech will be at 5:00 PM GMT.

- Thursday, September 25, the US Gross Domestic Product Annualized (Q2) will be released at 3:30 PM GMT.

- Friday, September 26, Core Personal Consumption Expenditures – Price Index (MoM) (Aug) will be released at 3:30 PM GMT.

Silver Price Predictions & Technical Analysis for XAG/USD :

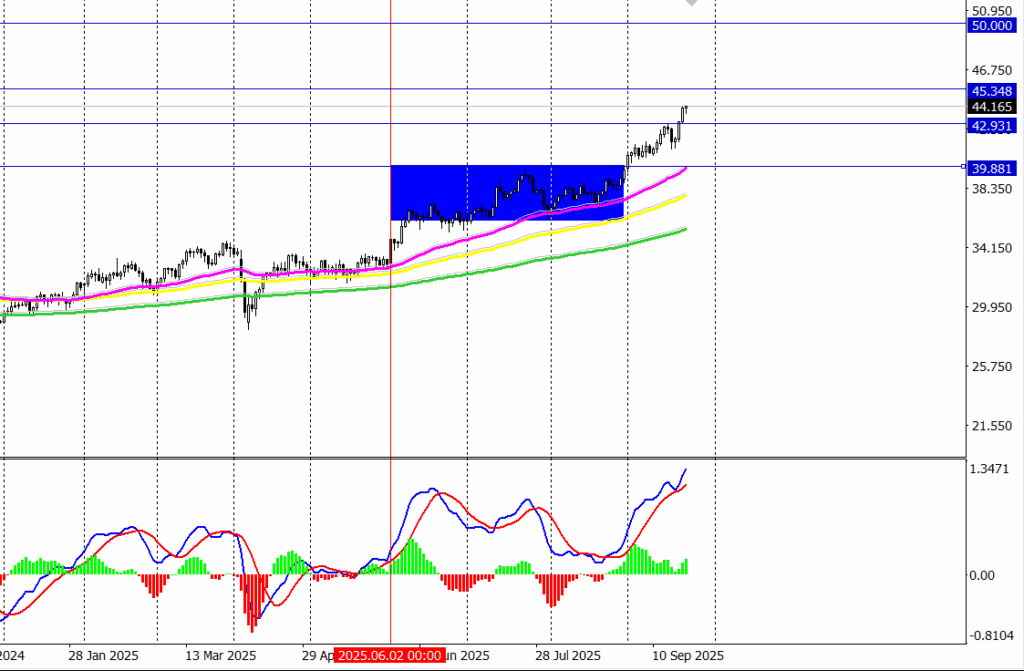

Technically, on the daily chart, the Silver price has been consolidated above the 50-day, 100-day, and 200-day moving averages since June 2025.

XAG/USD successfully broke above the rectangle pattern at 39.91 at the beginning of September and has since consolidated above this level with steady bullish momentum. This breakout suggests a continuation of the uptrend.

Silver has broken above the resistance level of 42.00 and is now testing 44.10. The MACD shows a bullish momentum on both the daily chart and the 4-hour chart.

Silver is eyeing $50 mark. A clear daily close above $45 could pave the way toward $50 and eventually challenge the all-time high of $58.

Silver is expected to go up with strong momentum. This is driven by increasing industrial demand in tech and green energy, and an increase in investors’ interest. The macroeconomic environment, such as the dovish Federal Reserve, also supports silver prices. The escalating geopolitical tensions also raise risk-averse sentiment, which boosts precious metal prices like gold and silver.

Silver is definitely a good investment opportunity for 5 years or more. Its price tends to increase over time because it is a precious metal like gold. Investors can hedge against inflation and currency devaluation by including silver and gold in their investment portfolios.