- Discover insights on silver price predictions, key factors influencing market trends, and technical analysis with key levels to watch.

The silver price attracts some buyers around $41.00 level due to the rising bets that the Federal Reserve will cut interest rates at its next meeting. The escalating tensions in the Middle East boost the XAG/USD pricing, especially amid the weaker US Dollar. Additionally, traders are waiting for the US producer price index data later today.

This article covers the key factors influencing XAG/USD prices, along with the technical analysis for silver price prediction, highlighting the key levels to watch. Finally, we’ll address some of the most frequently asked questions by traders and beginners.

Silver Price Prediction | Why Is Silver Price Rising? Key Factors Below:

- According to the CME Fed Watch tool, market participants are pricing a 91.8% probability of a 25-basis-point rate cut and an 8.2% probability of a 50-basis-point rate cut.

- The higher the bets on Fed rate cuts, the greater the focus on safe-haven assets, such as silver and gold. The liquidity absorbed from the riskier investments, like U.S.Dollar and stocks, and directed to safe-haven assets for hedging.

- The U.S. dollar weakens in response to the softer economic data of the Nonfarm Payroll report, which adds concerns about the health of the US economy.

- The escalating geopolitical tensions in the Middle East could boost the safe-haven asset pricing. Yesterday, Israel launched a strike on Doha, Qatar, and said that it was targeting the senior leadership of Hamas.

- This strike increases uncertainty in the Middle East, with Qatar officials stating that the attack by Israel violated international law and threatened to widen the conflict in the region.

- The upcoming US August PPI today could provide hints about the Fed’s decision path.

- The market forecast for the PPI figures shows an increase of 3.3% YoY in August, while the core PPI shows a rise of 3.5% YoY during the same period.

- If the figures show an increase in inflation, this would weigh on the US Dollar and strengthen safe-haven assets, with a higher probability of the US cutting rates.

- There is a great bullish momentum from the institutional investors. The net long positions in silver futures increased by 163% from the end of 2024 to June 2024. This is the highest level since 2021.

- In the first half of 2025, about 95 million ounces of silver flowed into Silver exchange-traded funds (ETFs) and exchange-traded products (ETPs). That is more than the total amount for all of 2024.

Silver Price Prediction | Technical Analysis :

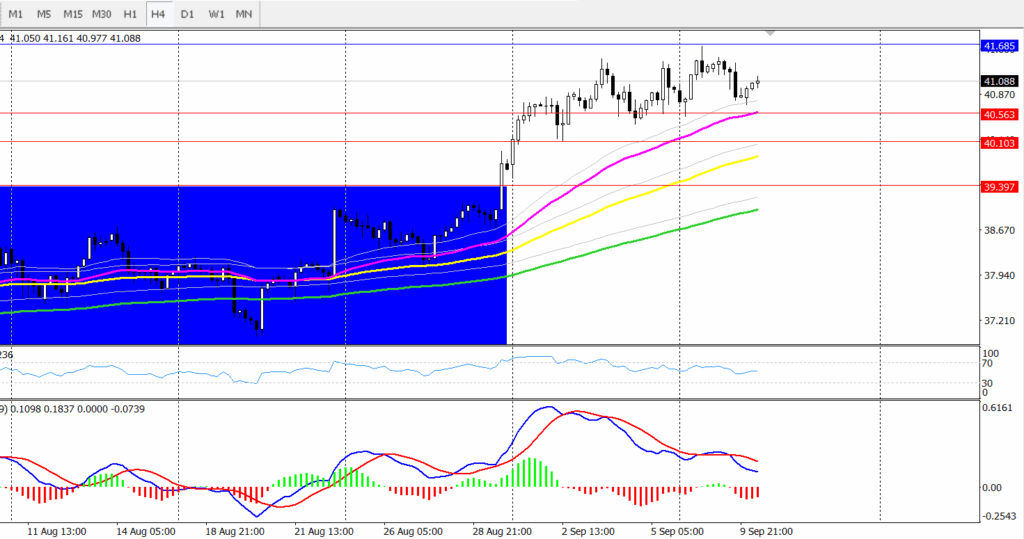

During the Asian trading session, the silver price edged higher to near $41.00. It’s still hovering between the key support level of $40.53 and the resistance level of $41.86.

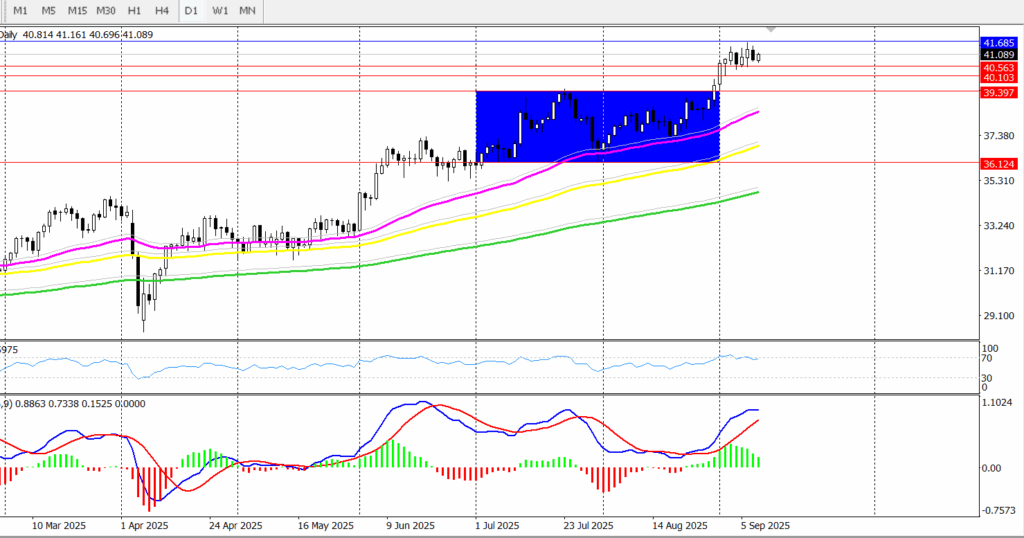

On the daily chart, silver has consolidated above the 50-day moving average since August 4, 2025, and broke above the rectangle shape on the 1st of September, which suggests a bullish continuation and a new uptrend is beginning. Moreover, the MACD signals a bullish momentum.

These bullish signs suggest that the silver price could reach higher levels toward $41.68 and then $42.00, if the XAG/USD can make a clear daily close above $41.64.

Looking at the 1-hour chart, the MACD signals bullish momentum, while on the 4-hour chart, it indicates bearish momentum. This suggests a possible price correction in the short term. A clear 4-hour close below $40.56 could pave the way toward $40.10, and then to the upper boundary of the rectangle at the $39.39 level. But the main trend remains bullish.

Silver prices tend to follow gold’s movements. As both fall under the umbrella of safe-haven assets, they share similar behavior. When gold prices rise, silver typically follows. Traders can also monitor the gold/silver ratio, which shows the number of ounces of silver needed to equal the value of one ounce of gold. This ratio can help determine whether silver is undervalued or overvalued compared to gold. A high ratio indicates that silver is undervalued, while a low ratio suggests that gold is undervalued relative to silver.

Silver prices are subject to change in response to several factors, such as Geopolitical instability, the strength of the US Dollar, the supply and demand dynamics, industrial usage, inflation and interest rates, and correlation with gold.