- Discover the latest insights on silver price predictions and technical trends. Learn why silver is targeting the $58 milestone.

Silver gained almost 6.19% over the past 5 trading days. This positive performance is fueled by increased bets on additional Federal Reserve interest rate cuts this year.

Moreover, new industrial demand headlines are also driving the silver market. China’s carbon-cut pledge has boosted focus on solar panels, which rely heavily on silver. At the same time, supply concerns, such as the force majeure at Freeport’s Grasberg mine, have added to the rally.

In last week’s outlook, I expected silver to break above $45.00. That target has now been achieved, with prices trading near $46.60. Silver closed the week at $46.55, while futures are currently around $46.85.

Silver Price Prediction | Why Is Silver Rallying?

- The US Personal Consumption Expenditures (PCE) Price Index rose 2.7% year-over-year in August. Up from 2.6% in July, in line with expectations.

- Core PCE excluding food and energy was 2.9% YoY in August, also in line with expectations.

- With these figures, investors increased their bets on additional interest rate cuts during this year. They are shifting their investments toward precious metals such as gold and silver to gain better investment returns.

- According to the CME Fedwatch Tool, markets are now pricing an 89% probability of a Fed Cut in October and a 66% probability of another reduction in December.

- Silver prices surged in response to increasing demand for safe-haven assets.

- Investors remain focused on the risk of a U.S. government shutdown if Congress doesn’t approve a funding bill before the fiscal year ends on Tuesday.

U.S. Government Shutdown Risk Weighs on Dollar, Boosts Silver, 58$ in Sight

- President Donald Trump is set to meet congressional leaders on Monday to negotiate government funding.

- Failure to reach a deal could trigger a shutdown starting October 1, alongside new tariffs on trucks, Pharmaceuticals, and more.

- The impasse may also push back the release of September payroll data and other key reports, according to Reuters.

- This situation weighs on the US Dollar, which is losing ground and trading around 98 at the time of writing.

- Silver is gaining from the weaker dollar, making it more attractive for foreign buyers.

- Silver and gold remain at the center of investors’ attention amid the uncertainty over fiscal policy and dollar weakness.

Silver Price Prediction | Is $58 the Target?

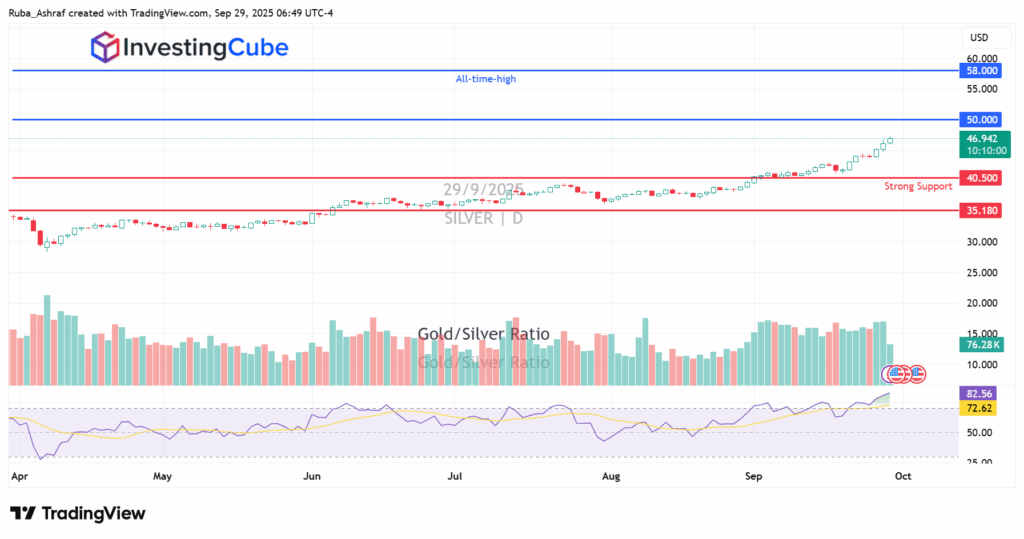

Technically, the XAG/USD has been consolidating above the 50-day, 100-day, and 200-day moving averages since June 2025. The MACD indicates strong bullish momentum on the daily chart. The RSI reached the 80 level, suggesting silver is overbought, and a correction could occur for profit-taking.

However, the main trend remains bullish; a clear 4-hour close above 47 could pave the way toward 48 and then the psychological level of 50.00. A successful break above the 50.00 level could open the way toward the all-time high level of 58$.

On the other hand, if silver fails to hold above $46.65, a pullback could occur toward strong support at $45.50.

Looking at the gold/silver ratio, it’s currently trading at 81, meaning that it takes 81 ounces of silver to purchase one ounce of gold. This high ratio suggests silver is relatively undervalued compared to gold.

Investors interpret this high ratio as a signal to buy silver, expecting that its price will rise relative to gold. The 81 ratio suggests that the bullish momentum will continue.

Silver is definitely a good investment opportunity for 5 years or more. Its price tends to increase over time because it is a precious metal like gold. Investors can hedge against inflation and currency devaluation by including silver and gold in their investment portfolios.

The gold-silver ratio measures how many ounces of silver are needed to purchase one ounce of gold. It is calculated by dividing the price of gold by the price of silver. A higher ratio suggests gold is expensive relative to silver, potentially indicating silver is undervalued. Conversely, a lower ratio suggests silver is relatively expensive.

It is calculated by dividing the price of gold by the price of silver to obtain the ratio. If you divide the price of gold ($3,810 per ounce) by the price of silver ($46.80 per ounce), the ratio will be 81.2. This means it takes approximately 81.2 ounces of silver to purchase one ounce of gold