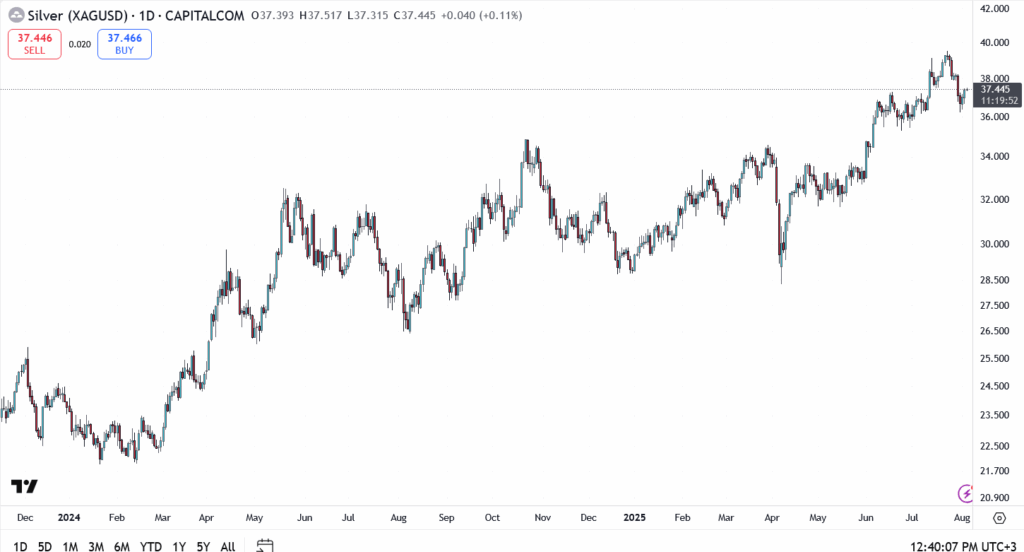

Silver prices are holding firm above $37.40 on Tuesday, extending their bounce from last week’s lows as traders grow more confident that the Federal Reserve could begin cutting rates as early as September. XAG/USD is trading near $37.45, up 0.11% on the day, with safe haven flows and inflation hedging demand lending support.

The metal has retraced modestly from its recent swing high near $40, but buyers have returned quickly on dips. Monday’s session showed signs of strength as silver bounced off the $37 level with strong buying into the close.

Market bets on a Fed pivot have resurfaced following a string of soft economic data and dovish commentary from policymakers. If those expectations continue to build, silver may regain its bullish momentum heading into Jackson Hole later this month.

Silver Price Technical Outlook

- Current price: $37.45

- Resistance: $38.20 and $40.00

- Support: $36.00, then $34.70

Silver is consolidating just below the psychological $38.00 barrier, having printed two higher lows in a row. On the downside, $36.00 remains key; a failure to hold there could drag the metal back toward $34.70, a former breakout zone from early July.

Conclusion

Silver is sitting at a critical zone, where macro expectations and technical structure are beginning to align. With rate cut bets gaining traction and global risk sentiment still shaky, the path of least resistance may remain to the upside, especially if the Fed confirms a policy shift later this quarter.

The bulls are holding their ground for now. A clean break above $38 could reignite momentum toward $40 and beyond.