- Silver surges toward $50 for the first time in 40 years, fueled by Fed rate cut hopes, global tensions, and rising industrial demand.

A Rally with Deep Roots

This week’s surge in silver isn’t just another headline bounce—it carries weight. For the first time in four decades, XAG/USD is within striking distance of the $50 mark, a level etched into trading folklore. Unlike the speculative mania of the 1980s, this time the rally has a sturdier backbone.

What’s driving it? A mix of policy shifts, political strain, and industrial strength. The U.S. government shutdown, now stretching beyond a week, has reminded investors how fragile confidence can be when Washington stalls. Add to that the constant noise from tariffs and geopolitics, and it’s no surprise that money is flowing into tangible assets. As the Silver Institute’s Michael DiRienzo remarked: “When there’s concern about the global economy, people turn to hard assets like silver.”

At the same time, traders are leaning heavily on the Fed story. Markets are all but convinced of a 25-bps cut in October, with talk of more to follow. Lower yields make silver less costly to hold. And unlike gold, silver enjoys a dual advantage: it’s both a safe haven and a vital industrial metal—think solar panels, electronics, and EVs. That blend of fear hedge and real demand makes the rally harder to dismiss.

A Market Looking Over Its Shoulder

But even strong rallies live under the shadow of doubt. Later today, investors will parse the University of Michigan’s Consumer Sentiment numbers. A robust reading could revive the dollar and take some shine off silver, at least temporarily. Fed officials are also on deck, and a single line that sounds less dovish could spark a sharp intraday shakeout.

Beyond the U.S., Europe continues to wrestle with political disunity, while the Middle East ceasefire remains fragile at best. Markets know that headlines can flip sentiment in seconds. That’s why every dip has found buyers so far—few want to be caught short in a market this sensitive to surprise.

Technical Landscape – Respect the Levels

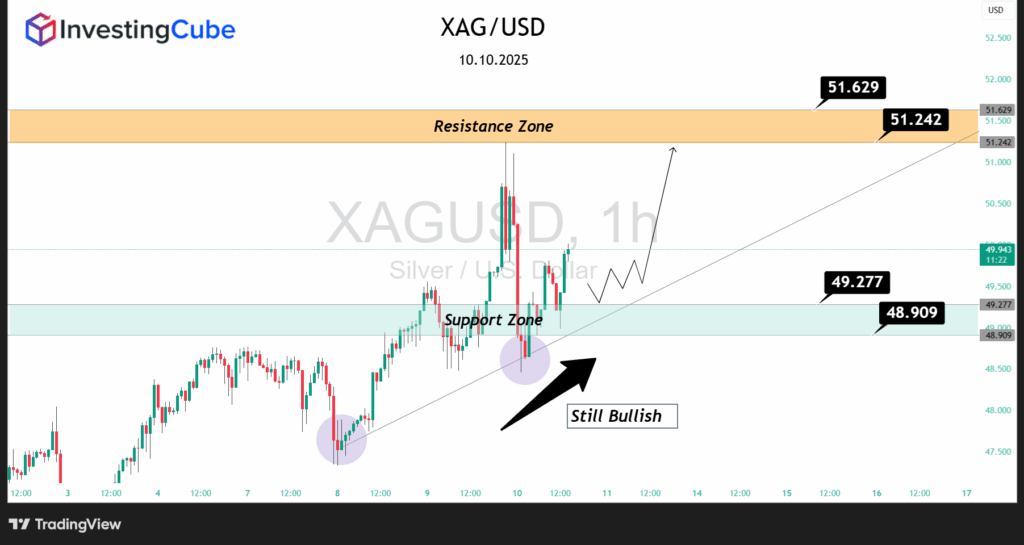

The chart tells its own story.

- Support: The $48.90–$49.27 band has become a magnet for dip-buyers. Lose it, and the market could quickly slide toward $48, or even test $47.50.

- Resistance: The real ceiling is $51.24–$51.62. Traders know this is the barrier between a healthy run and a euphoric breakout. Clear it decisively, and silver could stretch toward $52.50 in short order.

- Trend: Higher lows are still intact. Momentum has cooled, but that looks more like consolidation than reversal. The market has shifted into a waiting game.

In simple terms: $50 is no longer just symbolic—it’s the battleground where conviction is tested.

Positioning and Sentiment

CFTC positioning data shows speculative longs at elevated levels. ETF flows remain strong, with September inflows among the highest on record. That’s both a blessing and a warning. On one hand, strong positioning underlines belief in the rally; on the other, it means crowded trades and sharper volatility if sentiment turns.

For medium-term investors, such pullbacks could be chances to add exposure. For short-term players, the message is clearer: discipline matters. Don’t chase every spike, respect the levels, and remember that in metals, the market often punishes impatience.

Balancing Near-Term Noise with Long-Term Drivers

The XAG/USD Price Forecast rests on whether silver can navigate short-term noise without losing its longer-term drivers.

- If Fed dovishness deepens, silver likely pushes through resistance.

- If sentiment data surprises on the upside, the dollar may claw back ground, forcing a cooling-off period.

- If geopolitics flare again, safe-haven demand could propel silver into new territory almost overnight.

For now, the bias tilts higher, but the path is uneven. The $51 handle is not just another number—it’s where psychology meets price action.

Bottom Line

Silver’s advance to the edge of $50 is about more than just charts—it’s about trust, fear, and demand colliding in one market. The structure remains bullish, but the real test is ahead. Until the ceiling gives way, traders should stay nimble: respect support, be cautious near resistance, and remember that in metals, the crowd is often wrong at the extremes.

Q&A

The inability to break $51 could reflect heavy profit-taking after a historic rally, hinting at short-term distribution. However, as long as $48.90–$49.27 support holds, it looks more like consolidation before another attempt higher.

A sharp rebound after flushing stops often signals strong dip-buying interest, suggesting the broader trend remains intact. Only if the rebound fails to regain momentum should it be treated as a warning of weakening demand.

In the short term, monetary easing usually outweighs softer demand, as liquidity attracts capital into precious metals. Over the medium term, however, sustained weakness in industrial activity would cap silver’s upside.