- Investors brace for weak U.S. payrolls: gold holds near record highs as Fed easing bets dominate, but risks of volatility remain.

Investors brace for weak U.S. payrolls: gold holds near record highs as Fed easing bets dominate, but risks of volatility remain. The U.S. economy is showing clearer signs of fatigue. In mid-September, the Federal delivered its first cut of 2025, lowering the federal funds rate to 4.00% – 4.25%.

Powell underlined that labor weakness is now the key concern: job creation has fallen below the “break-even” pace needed to stabilize unemployment, which has already risen to 4.3%, the highest in nearly four years. Hiring freezes are widespread, and even modest layoffs could accelerate joblessness.

Inflation is moderating but not yet tamed. August CPI eased to 2.9.% YoY, while core inflation hovered around 3%. Treasury yields have retreated after the Fed’s policy shifts, with the 10-year note backing away from its highs. For this September NFP Report Preview, the macro context is one of slowing but not collapsing growth — a backdrop that primes markets for muted payrolls gains.

Institutional Forecasts: “Stall Speed” Hiring

Economists expect September payrolls to come in painfully weak. Forecasts cluster in the range of few tens of thousands, with some fearing a near zero-print.

- Reuters survey: +39k jobs, jobless rate steady at 4.3%

- Bloomberg median: +50k with leisure and hospitality as the main driver

- Goldman Sachs: trend hiring closer to +30k, far below the ~90k needed to keep unemployment stable

- Citi: warns downward revisions may show actual growth “close to zero”

Wage growth is expected to soften further. Average hourly earnings are seen rising 3.7% – 3.8% YoY, a slowdown from over 4% earlier this year. The consensus for the September NFP Report Preview is small payroll gains, elevated unemployment, and contained pay pressures — a profile consistent with continued Fed easing.

Gold Price Forecasts: Rally Faces Key Resistance Zones

Gold has been the clearest beneficiary of the dovish macro backdrop. Prices surged to an all-time high near $3,790/oz in late September, powered by a combination of safe haven demand, sliding real yields, and Fed easing bets. ETF inflows have reached record levels, reflecting broad-based conviction among investors.

Still, some analyst caution that gold looks tactically overbought after such a steep climb, The short-term risk is that if U.S. data — particularly the upcoming NFP report — surprises strongly to the upside, it could trigger profit-taking. Yet the medium-term narrative remains supportive: political uncertainty, geopolitical tensions, and a Fed committed to easing keep the longer-term trajectory tilted higher.

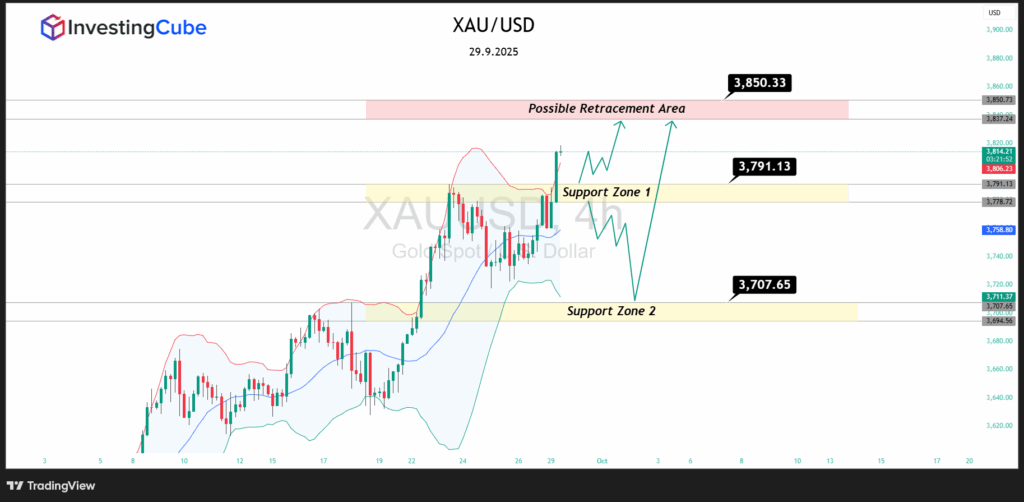

Technical Outlook Based on Chart

The chart shows immediate resistance at $3,837 – $3,850, highlighted as the Possible Retracement Area. A clear breakout above this zone could open the way toward new highs closer to $3,880 – $3,900. On the downside, the first support lies around $3,778 – $3,791 (Support Zone 1), while deeper demand is visible near $3,694 – $3,707 (Support Zone 2). These zones define the likely trading corridors as the market digests macro events.

NFP-Driven Scenarios

- Weak NFP: Gold likely extends its rally and challenges the $3,850 barrier, with possible extension toward $3,880.

- Strong NFP: Profit-taking could drag prices back to Support Zone 1 ($3,378 – $3,791) or even retest Support Zone 2 ( $3,694 – $3,707).

- Medium-term: The easing cycle provides a firmer floor, dips into support zones are expected to attract buyers rather than signal a structural reversal.

Overall, the Gold Price Forecasts remain skewed toward further strength, but the path higher is becoming more selective. The market’s reaction to NFP will be pivotal in determining whether gold breaks through resistance or pauses for consolidation.

Q&A – Reader Checkpoints

With job growth near stall speed, large downward revisions can redefine the trend, turning a modest gain into evidence of outright deterioration.

A strong beat could lift yields, strengthen the dollar, and weigh on gold. A miss would reinforce rate-cut bets, boosting gold further.