- Gold price has risen by more than 40% YTD and there are indications that profit-taking may not exert enough pressure to slow down gains.

Gold price has been rising steadily, reaching new records as the world continues to experience rising political and economic uncertainty. The yellow metal is up by 42% year-to-date and trades at $3,743 per ounce as of this writing.

The prevailing market conditions suggest that the rise in the price of gold is not just a short-term spike. Rather, it is a complex rally fueled by a strong combination of macroeconomic and geopolitical factors that could stay on for long. Determining the potential duration of this rally requires an understanding of these drivers.

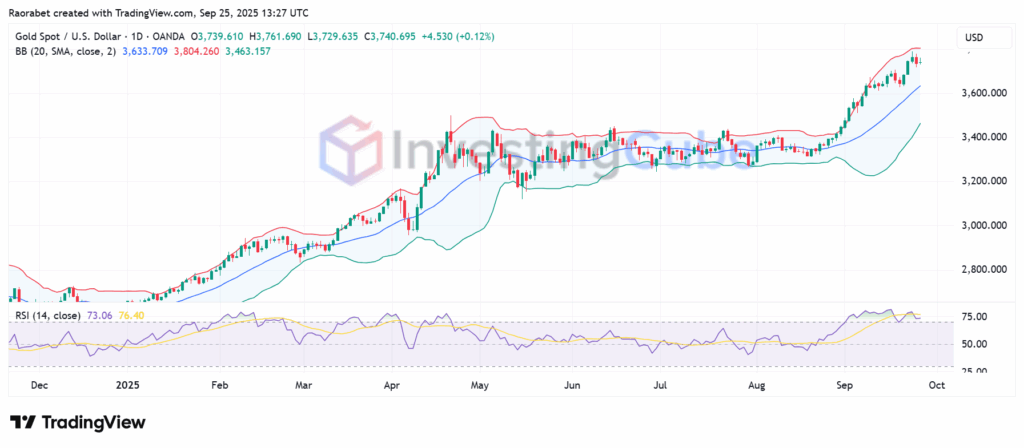

Gold price has its daily RSI at 73 and trades just below the upper Bollinger Band on the daily chart, underlining bullish control. Source: TradingView

Why is gold price rising?

US Monetary Policy and Real Yields

The key factor at play currently is the belief that the US Federal Reserve will reduce interest rates in the fourth quarter of the year. Gold is a non-yielding asset and it does well when the cost of holding it goes down. When the Fed takes a more conservative or “dovish” approach, the yield on assets like US Treasury bonds goes down.

Consequently, the other investments become less attractive, which makes gold a better asset to store value. Also, the dovish change in US monetary policy generally makes the US dollar weaker, which makes gold cheaper for people who buy it abroad and increases demand around the world.

Global Geopolitical Uncertainty

Gold has built a reputation of being a safe haven asset, and the current global geopolitical situation makes the case even stronger. Ongoing wars, trade barriers that won’t go away, and increased competition between major powers all make conditions extremely uncertain. Both institutional and ordinary investors buy gold as a way to protect themselves from uncertain political and economic events. This adds a “risk premium” to gold price and could help it stay on the ascent.

Strong Central Bank and Institutional Demand

The record-breaking speed at which global central banks are buying gold is a major propulsion for gold price. In an effort to become economically independent, these institutions have been steadily shifting their foreign reserve holdings away from the US dollar and other traditional assets.

Notably, nations are adding gold to their reserves at the quickest rate in decades. China and Russia, for example, have been at the forefront of moving reserves away from the dollar. In addition, strong trading volumes averaging $329 billion per day in the first half of 2025 and robust investment flows into exchange-traded funds (ETFs) and over-the-counter marketplaces highlight the ongoing momentum.

How Long Will Gold Price Rally Last?

Most analysts believe that the ongoing gold price bull market has a few more years to go. The rise is being driven by long-term structural and systemic challenges, not by temporary cyclical occurrences. Goldman Sachs forecasts the price will reach $5,000 by the end of 2026 if current trends continue. Some analysts estimate that it will reach $3,800 to $4,200 by 2026 and up to $5,155 by 2030.

In Summary

In conclusion, gold’s rise is due to a combination of monetary easing, inflation hedges, and demand for safe havens assets amid sour geopolitical and economic outlook. There may be short-term drops, like the recent rise in the value of the dollar, but the rising trend is likely to last until 2026, making gold a strong investment.

The current gold price rally is primarily driven by expectations of continued US interest rate cuts, global geopolitical instability, and record central bank gold purchases.

The ongoing rally is structural, and analysts are forecasting a multi-year upward trajectory that could go well past 2026.

Lower rates reduce the opportunity cost of holding non-yielding gold, making it a more attractive investment than yielding assets like bonds or savings.