- Discover the technical analysis for the gold and its price prediction mentioning the factors affecting the XAUUSD price trend.

The gold price went down a bit in response to the hope that the US and China would get along better on the trade deal, making the gold less interesting to investors right now.

The release of the US (CPI) on Tuesday, increasing the potential of cutting interest rates by the Federal Reserve, and affected the US dollar relatively negatively.

On the other hand, the world tensions could prevent gold prices from going down too much, so investors who are betting that gold will keep going down should be careful.

Main Gold Price Movers:

- On Monday, President Donald Trump said that he doesn’t expect tariffs on Chinese imports to return to 145% after the 90-day pause, adding that Washington and Beijing will reach a deal.

- The US Producer Price Index data will be released on Thursday, which is another indicator for the Federal interest rate decision. While markets are still pricing in the possibility of interest rate cuts by 53 points by the Federal Reserve this year, starting from September.

- On the geopolitical side, Russia and Ukraine will have their first big meeting since 2022, this week in Istanbul, aiming for a ceasefire for a month. The U.S. Secretary of State, Marco Rubio, is expected to attend this meeting.

- The Israeli army announced that there was are interception of a hypersonic ballistic missile launched by Iran from Yemen towards Ben Gurion Airport near Tel Aviv on Tuesday evening. This raises the geopolitical risks, which may prevent traders from keeping bearish bets on the gold. Gold Price Forecast for 2025, 2027, 2030

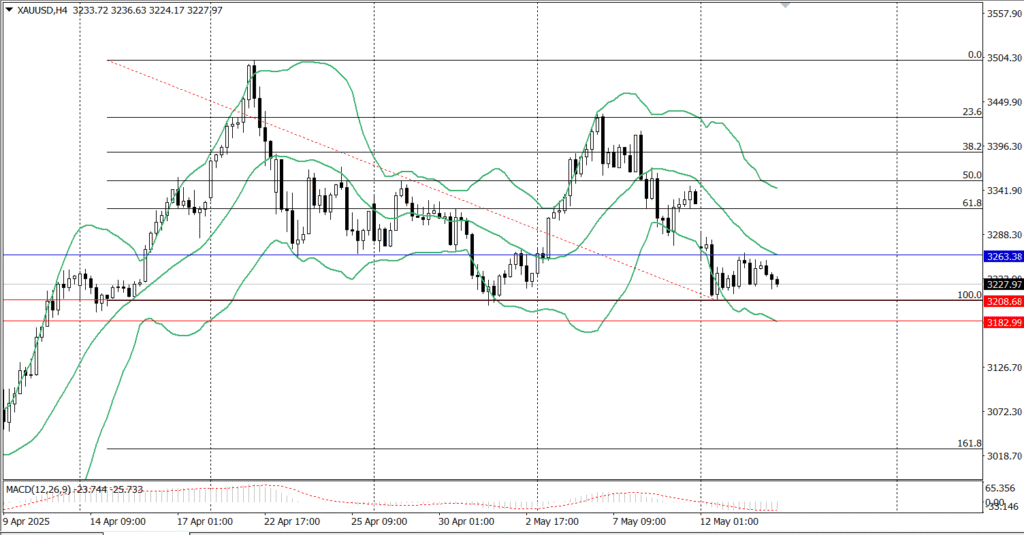

Gold Price Prediction: Technical Analysis for the XAUUSD

From the technical perspective, the gold prices are now trading under pressure due to the mentioned market events happening, but it holds comfortably above $3200, which is a strong support. A subsequent breakdown below $3200 will confirm a bearish trend and make the gold price vulnerable, then it may test the support level of $3182.

On the flip side, the area between $3263 -3266 is the critical region; above this area, the gold price could reach $3300, starting with breaking above $3288, and placing a clear daily close above it will confirm the bullish trend.