- Gold steadies near $4,000 as central bank demand stays strong but hawkish Fed keeps upside limited.

Fundamentals & Market Sentiment

The structural backdrop for gold remains favorable. According to WGC, central banks added nearly 220 tonnes of gold in Q3 of 2025, 28% more than when compared with Q2 of 2025.

Moreover, the need for investment demand (via ETF’s or others) jumped around 47% on the year, reinforcing further key role of gold as a diversifier and hedge from inflation or risk to portfolios in an environment of de-dollarization and geopolitical uncertainty.

However, the picture as far as sentiment is concerned in the near term is not one of support. The U.S. dollar has strengthened, and the recent economic data trends point to employment and activity being resilient – lessening the market’s view that cuts from the Fed are imminent. So, for example, on 4th of November, spot gold fell to nearly US$3,940 as a result of the upbeat signals coming through.

Consumer demand in areas like India particularly because of the high prices leads to lower demand for jewelry and the comment that the price of gold and demand for gold may be “range-bound” for the time being. A round of risk-off sentiment (with weakness in the equity market) in the meantime constitutes a contrarian and episodic support for gold at this time.

In short, structural destiny is intact but near-term catalysts are uncertain – market in wait and see mode.

Technical Outlook & Analysis

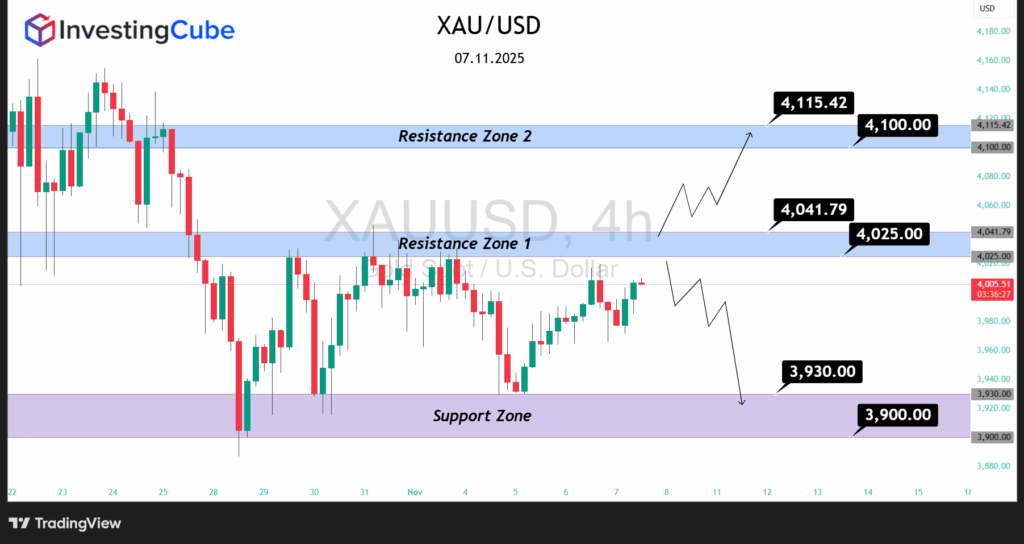

- Resistance Zone 1: US$4,025.00 – 4,041.79 — this zone has been noted as the first barrier that need to wait for a breakout for further gains.

- Resistance Zone 2: US$4,100.00 – 4,115.42 — surpassing this level may results a bullish continuation scenario.

- Support Zone: US$3,930 – 3,900 — some reports highlight that this support zone is an important zone for the coming downside move.

At present, gold is trading at about US$3,990 level, after a recent pullback from tops near US$4,000. The consolidation between about US$3,900 and about US$4,041 indicates the market is digesting recent gains and is waiting for a sequel catalyst.

Outlook & Forecast

Short term (given 4 to 6 weeks): If US micro data disappoints or the dollar backs off, gold may rally toward US$4,025 – 4,041. On the other hand, if the data is better than expected or if the Fed remains very hawkish, we could see goal test support around US$ 3,930 – 3,900 are possible lower.

Given the current situation, however, the most likely situation is some type of range trading from US$3,900 to US$4,041 unless we see a very strong stimulus emerge.

Medium term (given 3 to 6 months): If the structural attractions remain undimmed (central bank accumulation, inflation risk, geopolitical fears) bullish momentum could develop again, giving gold US$4,100+, possibility approaching US$4,300. However, on the other hand, if the risk appetite returns strongly and the dollar rallies, this cannot rule out the option of a more severe correction toward US$3,900 or less. Therefore, the means case will be to say that the market was a sideways to modestly bullish still with the warning of being prepared for a breakout or breakdown.

Frequently Asked Questions

Because the near term macro factors which is the strong dollar and lower interest rate cut expectations are negatives. Demand structure is intact by the technical momentum is not there.

The support area US$3,900 to 3,930. A defeat of that level would cut the bullish outlook significantly. Likewise, the clearance of the resistance us$4,025 to 4,041.79 would be required to establish a bullish continuity.

It can be far weaker than expected US economic data leading to a change in Fed expectations, a new geopolitical shock of stress in the financial system, or large scale, unexpected gold purchases by the central banks or some statement altering the perception of the markets on structural demand.