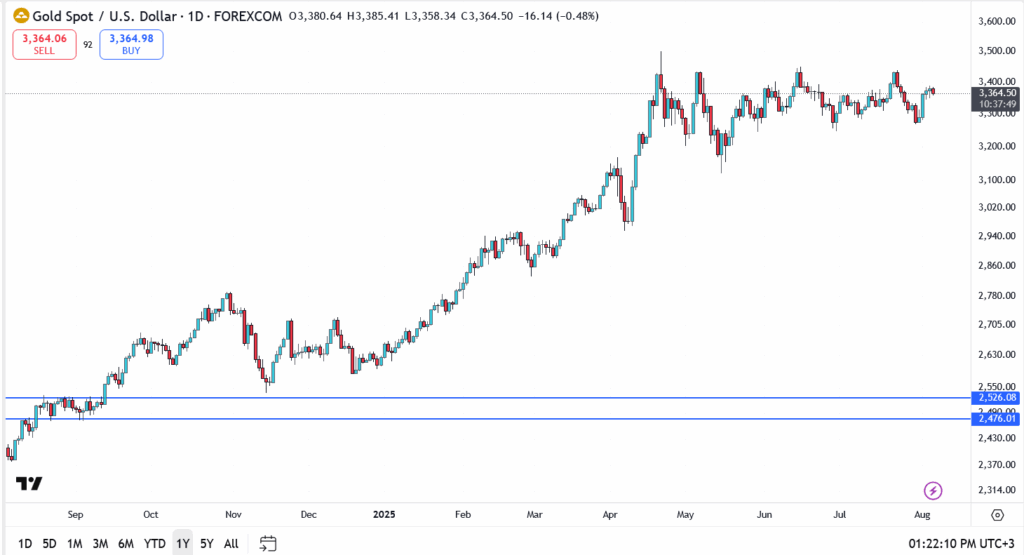

XAU/USD is holding near $3,365, just under the ceiling at $3,385, as market tension builds ahead of Thursday’s US CPI release, which could serve as the next big trigger for a breakout toward $3,400 and beyond.

After weeks of sideways grind, XAU/USD has started showing signs of buildup. And this time, macro conditions may finally be lining up in favor of the bulls.

What CPI Data, Fed Expectations Mean for Gold Prices

The US inflation print could set the tone for the rest of August. A cooler-than-expected CPI reading would fuel expectations of a Federal Reserve rate cut later this year, a scenario that’s historically bullish for gold.

Meanwhile, recent jobless claims data hinted at softening labor demand, and several Fed officials have begun to acknowledge the case for easing if inflation slows further. Add falling real yields and a wobbling dollar, and gold starts to look like it’s on the verge of something bigger.

Gold Price Technical Outlook

- Current price: $3,364

- Resistance: $3,385, then $3,420

- Support: $3,340, then $3,280

Gold is pressing up against the $3,385 ceiling, a level it has failed to breach on multiple attempts since mid-July. A clean move through this resistance could unlock momentum toward $3,400, followed by a potential retest of $3,420.

Support sits at $3,340, with the next key level lower at $3,280. So far, every dip has been bought, and the structure remains firmly in consolidation, but tilted bullish.

Outlook: All Eyes on CPI

If CPI data confirms cooling inflation, gold could finally snap out of its range and begin a new leg higher. But if the numbers come in hot, the rally may stall, at least temporarily.

For now, the setup favors the bulls. With central banks buying, macro pressure building, and the Fed potentially pivoting, the path toward a $3,400 breakout is within reach. It just needs the right spark, and Thursday’s inflation report might deliver exactly that.