Gold (XAU/USD) is edging toward the $3,386 resistance mark on Wednesday, climbing nearly 0.6% as traders hunker down ahead of a data-heavy week. After a sluggish start to June, the metal is regaining momentum, driven by a softening dollar and rising caution around U.S. macro signals.

With inflation still a concern and geopolitical tensions simmering under the surface, gold is back in favor. The move follows a strong bounce from the $3,246 zone last week, reinforcing market appetite for safe-haven assets ahead of upcoming payroll figures and inflation data.

What’s Driving the Rally?The macro backdrop continues to tilt in favor of safe-haven assets:

- Geopolitical risk remains high. Whether it’s Taiwan, Ukraine, or internal US political instability, the need to hold tangible value remains strong among institutional players.

- Tariff anxiety is back. With Trump’s second-term policies kicking in, global markets are once again grappling with aggressive US tariffs. The new 10% base tariff, plus sector-specific 25% levies, are sparking inflation concerns and threatening to reignite global trade wars.

- Dollar softens. The USD has shown weakness across the board, providing room for gold to inch higher without much pushback.

- Bond outflows. There’s growing chatter that countries like China and Japan are trimming their US Treasury holdings. That capital has to go somewhere, and gold is the natural hedge.

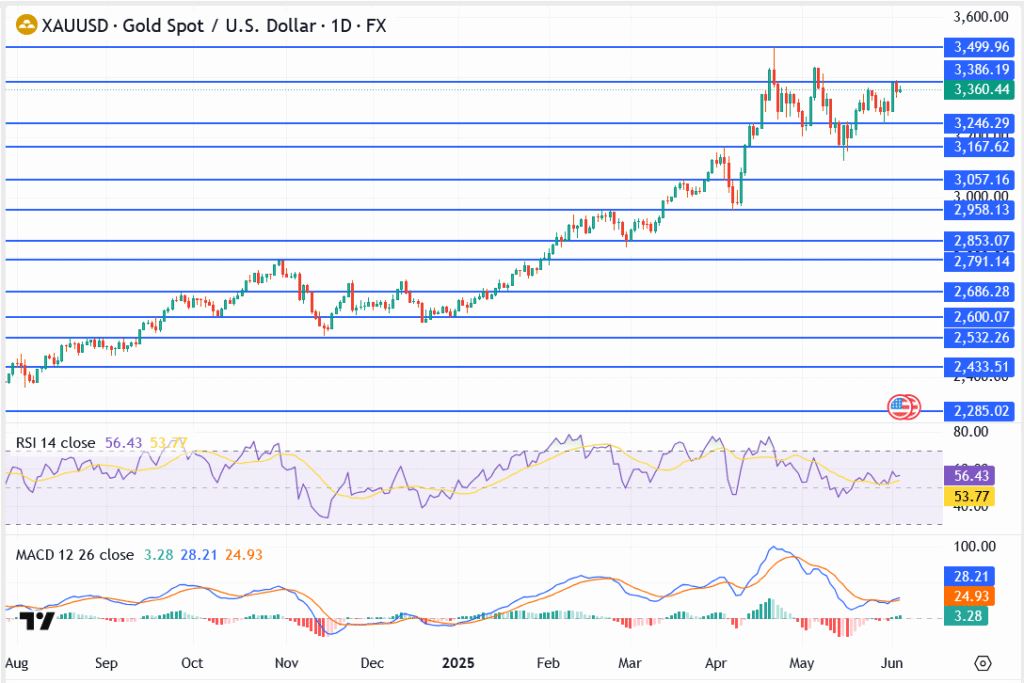

Gold Chart Structure: Gold Eyes Breakout Zone

- Resistance holding at $3,386.19 – price has tested this level multiple times

- Previous top near $3,499.96 remains the key upside magnet

- Strong demand zone at $3,246.29 and $3,167.62 – buyers defended these areas in May

- April low at $2,957.13 marks the trend invalidation point for bulls

Outlook: $3,600 Still on the Table?

As long as the price holds above $3,246, the structure remains bullish. A daily close above $3,386 would likely invite a new round of momentum buying, targeting the $3,499 zone and possibly the inflation-adjusted 1980 high of $3,600. Traders are also watching for a sentiment-driven push toward $4,000, especially if bond outflows accelerate or a new fiscal shock hits markets.

But caution is warranted. Gold is back in a parabolic zone, and anyone entering late risks getting caught in a sharp correction, just like in 1980.