- Gold remains supported by geopolitical uncertainty, concerns over Fed independence, and strong underlying demand, even as short-term volatility persists.

- Technically, momentum is still mildly bullish, but overbought conditions suggest the risk of a near-term pullback toward key support levels.

The CME Group changed the way it calculates margin requirements for gold, silver, platinum and palladium. It shifts from fixed dollar amounts to margins expressed as a percentage of the contract’s notional value. It take this step for a better reflect market volatility and price levels.

This change can make trading gold and other metals more expensive when prices rise which could reduce short-term speculative trading so price would face dipping. For example, the recent drop in gold prices was just a quick, emotional reaction by traders to new margin rules which is effective after the close of business on January 13.

This change affect how much money you must post as collateral to hold positions, and it imposed by the exchange itself as part its risk-management framework. While this step affects gold pricing in the short term, other fundamental factors such as Trump–Fed uncertainty and broader geopolitical tensions remain intact.

The Key Fundamental Factors Supporting Gold Outlook:

- The rising expectations for further rate cuts this year, boosting the gold prices. Anna Paulson, president of the Federal Reserve Bank of Philadelphia looks for further rate cuts later this year. She said that inflation should be around 2% by the year’s end. She is optimistic on inflation will move back to the target.

- The ongoing tensions in regions like Venezuela, Iran and other areas continue to boost demand for safe-haven assets like gold and silver.

- The structural demand from central banks is increasing as global central banks particularly across emerging markets have aggressively added to their gold reserves for three straight years. China, India, turkey and a lot of middle eastern nations have been consistent buyers.

- Threats to the Fed’s independence have weighed on the US dollar, supporting gains in the yellow metal.

Gold Price Technical Outlook:

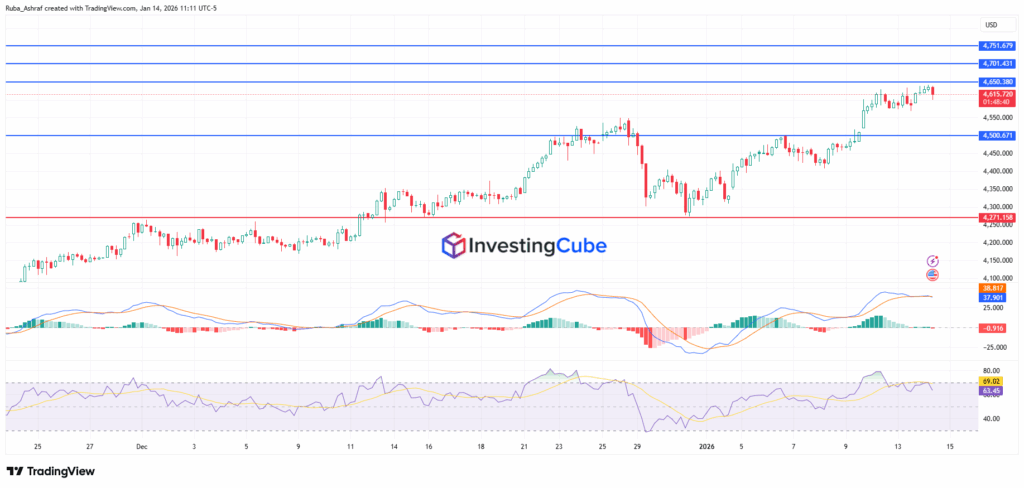

Gold prices remain in a well-defined bullish trend. It posts higher highs and higher lows as price consolidate near the 4620 area. The strong rebound from the 4270 support, highlights sustained buying interest. On the other hand, the break above the 4500 level has reinforced bullish momentum.

The immediate resistance is seen near to 4650, followed by the higher resistance at 4700 and then 4750. The MACD remains in positive territory, indicating that bullish momentum is still intact. The RSI is hovering near the 65–70 region, indicating strong momentum but approaching overbought conditions.