- Discover the latest insights on Brent Crude oil price predictions, OPEC+ updates along with the technical outlook.

Brent Crude oil prices on Thursday extended a decline of 1.02% to $66.91. It closed yesterday $67.155 and opens today in the same range, $66.67-67.41.

The expectations of a higher output by OPEC+ will support the bearish trend for oil prices. According to eight members of the Organization of the Petroleum Exporting Countries (OPEC+), considering a further increase to production in October at the Sunday meeting, as they are seeking to regain market share, according to Reuters.

In this article, we will review OPEC+’s previous decisions and the expectations for the upcoming Sunday meeting, along with the technical outlook for the Brent Crude oil price prediction on a broader time frame.

How OPEC+ Decisions Impact Brent Crude Oil Price Predictions?

- After Reuters reported yesterday that OPEC+ is planning to increase production in October, Brent Crude oil is down 0.9% to $66.96 a barrel, and WTI trades lower 0.63% to $62.84 a barrel.

- As OPEC+ seeks to regain its market share. It is expected to pause 1,65 million barrels per day of output cuts, which accounts for about 1.6% of global demand.

- They had already agreed that they would lift output targets by roughly 2.2 million barrels per day from April and September. And adding a 300,000 barrels per day quota for the UAE.

- If OPEC+ increases supply as expected, this could put pressure on Brent crude oil prices, causing them to decline further.

- According to the American Petroleum Institute API, US weekly crude oil stocks rose by 0.6 million barrels, instead of the expected 3.4 million-barrel drop. It signals weaker demand.

- ISM Manufacturing PMI for August came in at 48.7, below the expected 49.0. It indicates contraction in the manufacturing sector.

- For today, traders are waiting for the upcoming data, seeking fresh signals on the Fed’s policy outlook in September:

- U.S weekly Initial Jobless Claims.

- The ADP Employment Change.

- The ISM Services Purchasing Manager Index.

- EIA Crude Oil stocks Change.

- And then the focus will shift toward the US Nonfarm Payrolls on Friday.

Brend Crude Oil Price Prediction | Technical Outlook:

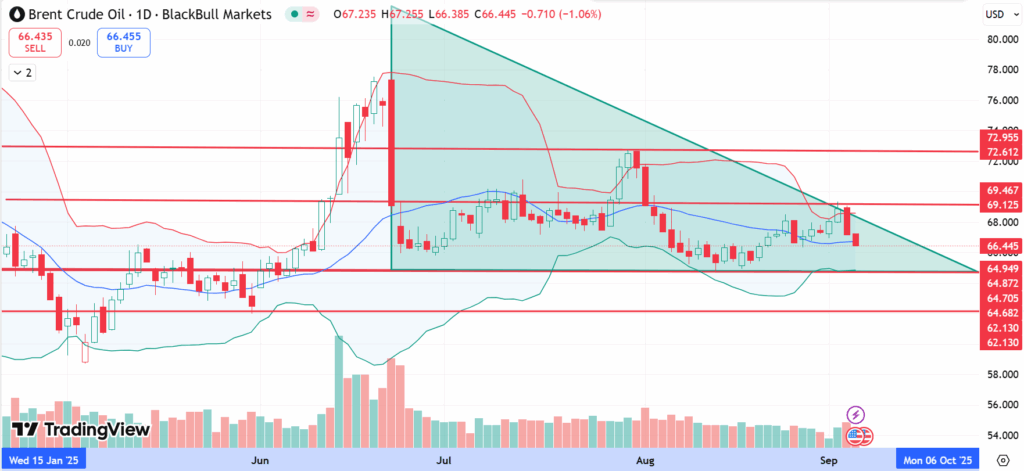

From the technical perspective, the Brent crude oil price action forms an ascending triangle on the daily chart. The price attempted to break out of the upper boundary six times without success.

These repeated failure suggests weakening bullish momentum. I anticipate a sharp correction in the long term, which could drag prices down to around $40, with a potential 37% decline from the current level of $66.66.

In the near short-term, Brent crude oil is under pressure at the resistance level of $69.46. The price is ranging between $69.46 and the support level of $64.94. A clear 4-hour close below $64.94 could pave the way toward $64.68, and then the key support at $58.00.

The best time to trade crude oil is during the overlap between the US trading session and the European session. From 9:00 AM to 11:00 AM EST. At this time, the liquidity and volatility are high, providing good investment opportunities with tight spreads.

JP Morgan earlier this year anticipated that oil prices could stay in the low-to-mid $60s during 2025 and $60 in 2026. Added certain worst-case scenarios that prices could surge to double those levels, amid escalating geopolitical tensions, which could negatively affect the oil supply.

While President Trump has made energy a key part of his agenda. The white house has announced a strong preference to reduce crude prices to $50/bbl or lower. That’s why we anticipate the same in the long run, based on the technical chart, and amid the output hike by OPEC+.