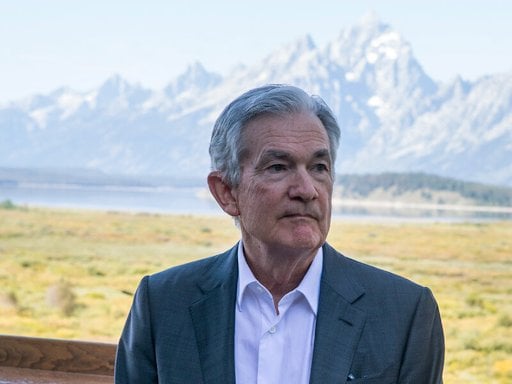

- Investors eye Jackson Hole as Fed Chair Powell signals the outlook for interest rates. Markets brace for volatility in stocks, gold, and oil amid rising rate cut bets.

This week, the market trend from the Federal Reserve has occupied the attention of almost all markets. After the Federal Reserve releases its meeting minutes early Thursday morning, the annual global central bank conference in Jackson Hole, Wyoming will kick off.

Federal Reserve Chairman Powell will deliver a speech on “Economic Outlook and Framework Assessment” on Friday. The market will directly verify the prospect of a September interest rate cut through the speech.

What is the Jackson Hole Symposium?

The Jackson Hole Symposium, hosted by the Kansas City Federal Reserve, is held each August in the mountain resort of Jackson Hole, Wyoming, USA. Central bank governors, economists, and financial leaders from around the world participate in discussions on the global economy and monetary policy framework. This year’s symposium took place from August 21 to 23.

Federal Reserve officials have kept interest rates steady so far this year as they wait to see the impact of the Trump administration’s tariffs on the economy, further dividing policymakers over when to resume cutting rates as inflation remains above the Fed’s 2% target and the labor market shows signs of slowing.

Powell’s stance so far this year has been primarily one of cautious wait-and-see action. The Jackson Hole symposium is often seen as a crucial window for signaling shifts in the Fed’s stance, so this speech, likely his final, is drawing even more attention. The market currently places the probability of a September Fed rate cut at over 80%, and whether that rises to over 90% depends largely on Powell’s stance this time.

How Past Jackson Hole Meetings Shaped Markets

In recent years, Powell has used his Jackson Hole speeches to signal significant changes in monetary policy. In 2022, Powell issued a hawkish message emphasizing the “fight against inflation” and continued rate hikes, which led to a 4% weekly drop in the S&P 500.

In 2024, he confirmed that the Federal Reserve would begin its first rate cut in over a year, after maintaining high federal fund rates to control the post-pandemic inflation wave. This time, Powell may use the meeting to indicate whether the Fed is ready to restart its first rate cut since December of last year.

Fed’s Current Dilemma: Inflation vs. Growth

However, some institutions believe Powell may elaborate on how he views the Federal Reserve’s current dilemma, particularly after the mixed inflation data released recently. In July, the core Consumer Price Index (CPI), excluding food and energy, saw its largest increase of the year.

However, the cost increases for tariff-affected goods did not meet expectations. Meanwhile, another report on wholesale inflation revealed rising price pressures on businesses. Recent retail sales data shows a slight increase in consumer spending over the past two months, but declining consumer confidence suggests concerns about inflation and the job market.

Impact on the Market

According to Bespoke Investment Group, “Jackson Hole Week” typically provides positive returns for U.S. stock investors, with the median S&P 500 index gain during this week historically at 0.8%. Since 2009, the S&P 500 has only experienced five declines during Jackson Hole Week.

Declines greater than 1% have only occurred twice: in 2019 and 2022. This time, however, with Powell potentially signaling a rate cut, there could be greater volatility in the market. If a dovish stance is communicated, U.S. stocks could hit record highs once again.

Gold’s Narrow Range: Breakout or Breakdown Ahead?

Historically, gold prices tend to break out of their range if a meeting sends a dovish signal (such as hinting at a rate cut); a hawkish stance puts pressure on prices. Currently, gold is trading in a relatively narrow range, so if Powell signals a clear stance this time, it could signal a breakout and confirm its short-term direction.

Regardless of the trajectory, it’s important to note that historical experience shows a high degree of implementation of policy paths following the Jackson Hole symposium, but the market often buys on expectations and sells on the facts. Currently, caution is warranted against the risk of a reversal given that dovish expectations are already overpriced, especially in the already highly valued US stock market.

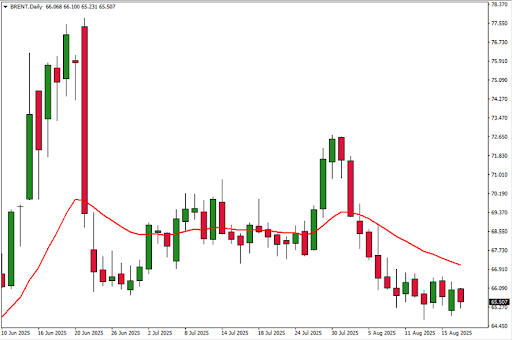

Oil Prices Under Pressure Amid Geopolitical Developments and Potential Diplomatic Breakthrough

Oil closed the session in negative territory, reflecting investors’ cautious stance amid signs that diplomatic progress could ease geopolitical tensions and potentially soften sanctions on Russia.

This move was anchored by news that US President Donald Trump was organizing a tripartite meeting with Vladimir Putin and Volodymyr Zelenskiy to discuss alternatives for resolving the conflict in Ukraine.

The mere signaling of a possible de-escalation reduced the perceived risk of new restrictions, increasing expectations that Russian oil flows to the international market could be gradually restored, a factor that is pushing prices toward lower levels.

However, for there to be a structural impact on price dynamics, it would be necessary not only to announce negotiations but also to effectively and lastingly implement measures that relax the current barriers. Until then, any relief, even temporary, tends to provoke only specific movements in volatility, keeping oil confined to a narrow trading range, with no clear indication of a short-term trend.