- At its current level, Coinbase appears to be a good buy. This is the foundation for Coinbase stock price prediction 2023 and beyond.

Coinbase (NASDAQ: COIN) stock price has started the year well. It jumped to a high of $87.63, the highest level since November 1 last year. The shares have been in a strong comeback, helped by the strong comeback of cryptocurrencies, with Bitcoin prices recovering. As a result, the company’s stock soared by more than 97% from its lowest point in 2022.

Coibase Global is currently the largest digital assets exchange in the US and 2nd largest in the world in terms of the trading volume. According to the most recent stats, the exchange has 32.7 million monthly users, which is second to only Binance, with 64.7 million monthly users. Coinbase currently supports $2 billion in daily trading volume.

Coinbase stock price history

Coinbase Global, Inc became a publicly-traded company in mid-April 2021. At that point, its share price was at a record high of $429.12 as demand for cryptocurrencies was soaring.

Between mid-May and mid-October 2021, it was range-bound between $260.93 and $208.62. Granted, it momentarily rose above the range’s upper border to a three-month high in mid-August.

The subsequent breakout had Coinbase stock price rally to a seven-month high in November 2021 before recording a trend reversal that has continued this year. The stock plunged to an all-time low of $40 in May. After attempting to recover, the stock crashed again and retested the lowest point as the crypto sell-off intensified.

Was Coinbase IPO Price Overvalued?

After establishing itself as one of the major crypto hubs in the world, Coinbase finally listed itself publicly in 2021. Coinbase IPO was one of the most hyped IPOs of 2021 as it occurred at a time when both traditional and crypto markets were in a bull market.

Just within a few days after the launch, Coinbase stock price went from its listing price of $250 to $429. The fear of missing out (FOMO) caused many new investors to jump to those insanely high levels. Nonetheless, the following sell-off proved that the company’s stock was overvalued. As of March 20, the stock of the top US Exchange is trading 86% below its 2021 all-time high.

As Bitcoin peaked at $69,000 in November 2022, Coinbase shares (NASDAQ: COIN) also tumbled. Since the start of 2023, Coinbase stock has shown a massive rebound due to a corresponding recovery in BTC price. However, the price is tumbling once again as Bitcoin price failed to break above $25,000.

Coinbase (NASDAQ: COIN) & The Banking Crisis

The crypto industry is still not recovered from the FTX collapse, and another major institution has collapsed. Silvergate was one of the few banks that had partnered with crypto exchanges for fiat payments. Recently it was announced by the bank that it might not be able to conduct business as usual.

Following this announcement, many exchanges, including Coinbase Exchange, distanced themselves from the troubled bank. More recently, Silvergate Capital Corporation has announced its plans to liquidate its banking unit.

Following the announcement, crypto prices started to tumble. The collapse of the Silicon Valley Bank further added fuel to the fire, and BTC slid below $20,000. However, the prices reversed to make new yearly highs as soon as the US government announced protection for all depositors.

Coinbase Gets Wells Notice By SEC

According to the most recent Coinbase stock news, the company has been served a ‘Wells Notice’ by the Securities & Exchange Commission of the US. The move came just weeks after the SEC’s strict actions against Kraken exchange and the stablecoin issuer Paxos. As per Coinbase CEO Biran Armstrong, the company is prepared for the legal battle and would be happy to go to court.

Brian also said that a Wells notice is usually followed by an enforcement action. The founder of the biggest US cryptocurrency exchange also appeared to be surprised as the SEC had received the business in detail before approving it for a 2021 IPO.

Data from a recent Coinbase survey showed that 20% of Americans hold digital assets. Despite a crypto bear market, the number of holders hasn’t decreased from its 2022 peak. 80% of the participants were not satisfied with the current financial system. These people called for either a complete overhauling or major changes to be made in traditional finance. Most American adults also consider crypto to play a part in the development of a modern financial system.

Coinbase has just announced its own layer-2 network, which will act as a gateway to Ethereum and any other blockchains. It will be known as BASE. The testnet of the Optimism base layer-2 platform was launched on February 23. This Coinbase news was taken well by the industry as it meant more credibility for smart contract platforms.

The announcement was made via a series of tweets by Coinbase. The Coinbase layer-2 will leverage the open-sourced OP Stack of Optimism Network. It was also mentioned by the company that there wouldn’t be a new token for the new smart contract platform.

Coinbase Exchange Faces Financial Issues

Recently, Coinbae has been forced to implement layoffs in a bid to conserve cash. In June, the firm said that it was cutting 1,100 jobs. It then followed these layoffs with another 60 job cuts in November. In January, the company announced that it would lay off 10% of its staff.

The exchange was also recently fined 3.3 million euros by the Dutch Central Bank for failing to register in the country. Further, the Coin was downgraded by analysts at Mizuho, who warned that retail traders were still afraid of investing in cryptocurrencies.

What is Coinbase market capitalization?

Coinbase was listed on the Nasdaq stock exchange after an insanely hyped Coinbase IPO in 2021. Since then, the price has been making new lows every month and dropped to its lowest level of $31.55 in 2022. The price has shown a significant recovery in 2023, and the Coinbase market cap currently stands at $15.35 billion.

Is Coinbase a good investment?

Considering the long-term potential of Coinbase, it appears to be a good investment. However, the fair valuation of the company is still a challenge for many investors. Currently, Coinbase stock price is 84% down from its all-time high. Another factor affecting the Coinbase valuation is the Bitcoin price. Therefore, if crypto market keeps growing at a steady pace, Coinbase as a company is expected to grow with the increase in adoption.

Coinbase market share

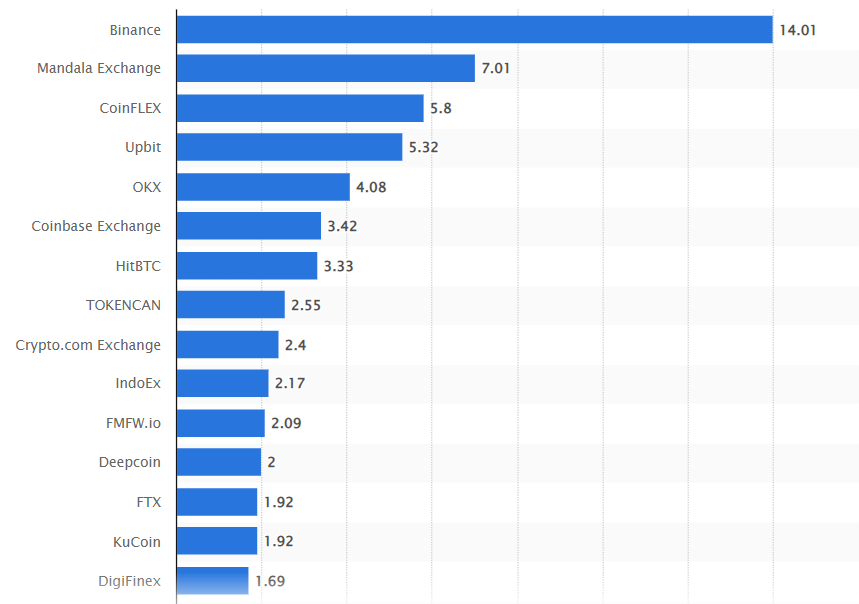

To begin with, the firm is still one of the leading cryptocurrency exchanges in the world. As shown in the chart below, it ranks sixth in terms of daily trading volumes. While other firms may enter the scene in the coming years, Coinbase will likely remain one of the popular entities, both in the US and worldwide.

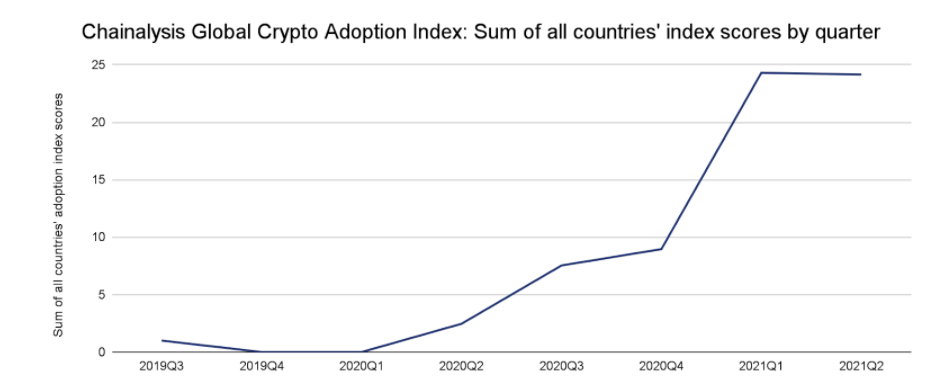

Cryptocurrency adoption rate

The crypto adoption rate has sky-rocketed in the recent past. According to the Chainalysis Global Crypto Adoption Index for 2021, the score was at 24 by the end of the year’s second quarter. In comparison, it was at 2.4 a year earlier. In 2020, the adoption rate surged by 881% and 2300% between Q3’19 and Q2’21.

Is Coinbase profitable?

In Q3’21, Coinbase Global, Inc. missed earnings and revenue estimates. Besides, amid the recent market sell-off, its share price has declined significantly in recent months. After seeing robust profitability in 2021, the company moved into a loss this year.

Coinbase lost $429 million in the first quarter of the year, followed by $1 billion in the second quarter. This loss then narrowed to $544 million in Q3 as the situation improved. However, this improvement will not last for long as the situation has worsened in the past few weeks.

Coinbase stock price forecast 2023

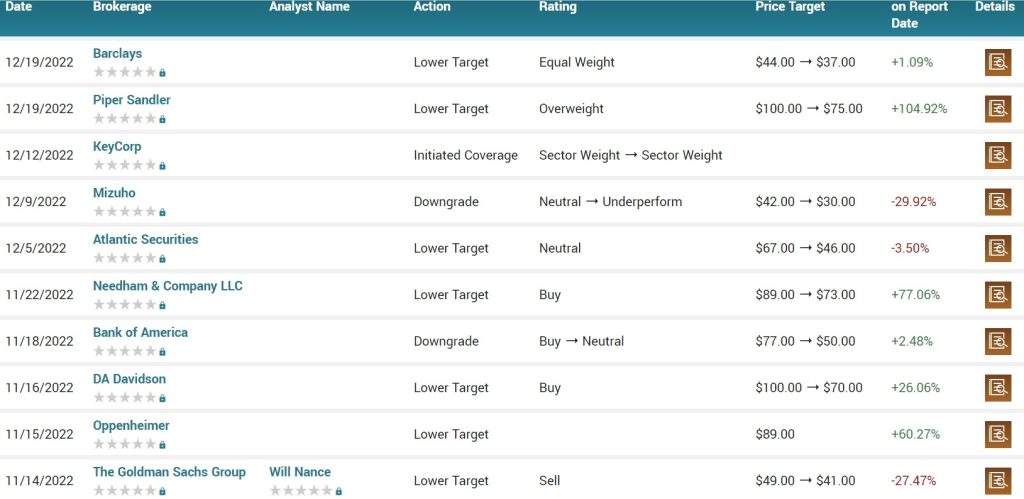

Analysts have been relatively bearish on the Coinbase share price for a while. Those at Atlantic Securities expect that the shares will be between $67 and $46. However, the price already surged to $87 in February and then retraced. Despite the bearishness in crypto markets, Ark Invest’s Cathie Wood still remains bullish on Coinbase. Her firm bought around $16 million worth of Coinbase stock in February 2023.

Similarly, analysts at Barclays, Needham, Bank of America, DA Davidson, and Oppenheimer have all lowered their estimates. The most accurate analysts were Goldman Sachs, who predicted that it will drop to $41. As shown below, most analysts have downgraded the stock.

NASDAQ: COIN Technical Analysis

Due to the recent notice from SEC, Coinbase stock price has tanked very hard. It lost more than 27% of its value in just two days. The following chart also shows that the price has faced rejection from the range mids once again. The upcoming retest of 200-day MA will be very critical.

After a very strong bounce at the start of the year, NASDAQ: COIN is retesting the 200-day moving average. This indicator acts as a line in the sand for many traders. If the price closes below 200-day MA, then a retest of range lows will be very likely. This will be a 32% drop from the current price.

Coinbase stock price prediction 2025

According to Wallet Investor, Coinbase stock price prediction for 2025 is rather bearish. The firm expects the crypto exchange’s share price will have collapsed by 2025. They believe that the company’s shares will be trading at about $0.00001, meaning that they expect that it will have gone bankrupt by then.

We believe that Wallet Investor’s Coinbase stock price forecast for 2025 is not accurate since it assumes that the company will be bankrupt by then. It also expects that Bitcoin and other cryptocurrencies will be worth nothing. While the stock could be much lower by then, we believe that it will be between $5 and $20.