- What is the outlook of the Cineworld share price? We explain whether to expect now that the firm is eying Regal Entertainment IPO.

The Cineworld share price has continued underperforming the broader market as concerns about the company grow. The CINE stock is trading at 31.66p, which is about 75% lower than where it was last year. Its market value has crashed to just 436p, which is lower than the $3.6 billion it paid to acquire Regal Entertainment.

Cineworld is facing tough challenges as demand for its services continues to struggle. While several high-profile movies are scheduled this year, there are concerns about demand because of Covid. Also, companies like Disney and Warner Bros are expected to keep pushing their blockbuster movies to streaming devices.

Cineworld is also battling the ongoing lawsuit that was brought by Cineplex, a Canadian company. The plaintiff accuses Cineworld of failing to complete its takeover. As a result, it is seeking over $900 million in damages. If CINE loses, it could be subjected to bankruptcy proceedings. Further, Cineworld has also expressed challenges about its large debt, signaling that dilution is in play.

One strategy for Cineworld is to list or sell its Regal Entertainment stake in the US. Still, it is hard to see the amount the firm would raise. Most likely, the amount would be sharply lower than what Cineworld paid for a few years ago.

One way is to compare it with Cinemark, one of the leading companies in the industry. Cinemark has 514 theatres and 6,885 screens, while Cinemark has 321 theatres and 4,400 screens in the US. In total, it has 522 theatres and 5,868 screens. Therefore, since Cinemark is valued at $2 billion, there is a likelihood that Regal could receive an equal or slightly smaller valuation.

Cineworld share price forecast

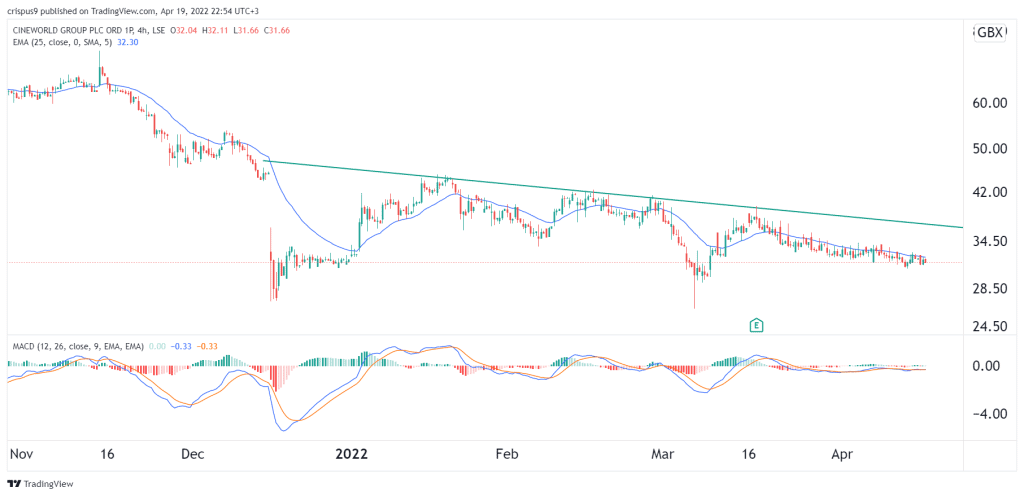

The four-hour chart shows that the CINE share price has been in a downward trend in the past few weeks. The stock managed to move below the descending trendline shown in green. It has also moved to the 25-day and 50-day moving averages. It has also formed an inverted head and shoulders pattern. Therefore, there is a likelihood that the stock will have a bullish breakout in the coming weeks. If this happens, the next key point will be at 35p.