- EURUSD trading 0.05% higher after the United States Chicago Fed National Activity Index came in at 0.56, topping forecasts of -0.09

EURUSD trading 0.05% higher after the United States Chicago Fed National Activity Index came in at 0.56, topping forecasts of -0.09 in November. The Durable Goods Orders registered at -2%, below analysts forecasts of 1.5% for November, while the Durable Goods Orders ex Transportation came in at 0%, below expectations (0.2%) in November.

Earlier today, the Germany Import Price Index (month over month) came in at 0.5% beating forecasts of 0.4% in November, the yearly reading for Import Price Index increased to -2.1% from previous -3.5%.

Read our Best Trading Ideas for 2020.

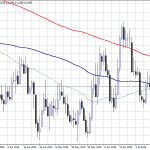

EURUSD Trapped Between the 50 and 100-Day MA

The rally in euro after phase one trade between USA and China stalled around the 200-day moving average while the correction that started the previous week tested the 100-day moving average. The pair hovers above and below the 50-day moving average in thin volumes ahead of the Christmas holidays. The outlook is neutral for the pair as it trapped between the 50 and 100-day moving average.

On the technical side the pair will face the intraday resistance at 1.1088 the daily top. Above that the next level to watch is the 1.11 round figure and then the 1.1124 the high from Friday’s session. A break above might question the next barrier at 1.1147 the 200-day moving average.

On the contrary, first support stands at 1.1069 the daily low. More bids will emerge at 1.1062 the 100-day moving average. The next strong support on the downside to watch is the low from December 2nd at 1.1002